RELATED ARTICLES

Complying With EU’s DAC7 Reporting Directive

Foreign Tax Credit Limitations and Rules for U.S. Corporations

How to Calculate GILTI on Foreign Earnings

Transfer Pricing and Cross-Border Transactions

What Is Permanent Establishment?

What Is the DAC6 Mandatory Disclosure Regime?

What’s the Difference Between FDII and GILTI?

Value-added tax (VAT) is imposed by most countries – not including the U.S. – on the value added to goods or services at each stage of the supply or import chain. As governments around the world expand their tax nets, proactively monitoring and responding to shifting VAT rules, rates, and complex reporting requirements will be a necessary part of international tax planning for U.S. corporations.

What is value-added tax?

VAT is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges and imports. In some countries it’s referred to as the “goods and services tax” (GST) and the two terms are broadly interchangeable.

VAT is imposed at every stage in the supply chain at rates of up to 27%.

Mismatches in VAT rules between countries can lead to incorrect or double taxation. Tax professionals will need to adopt corporate tax planning strategies to optimize their tax position in each country in which they operate.

Place of supply rules for cross-border transactions

VAT is imposed by the country in which the transaction is deemed to occur, referred to as the “place of supply.” Different countries have different rules on whether cross-border transactions are treated as taking place in the country of the supplier, the country of the recipient, or elsewhere (e.g., place of use).

Many countries have amended or are amending their place of supply rules so that more cross-border transactions are taxed in the country of the customer, including digital supplies, consumer e-commerce purchases, and live virtual events. These more robust rules to capture e-commerce transactions mean more suppliers must register and comply with VAT practices in their market jurisdictions and prepare for heightened scrutiny of their business activities.

VAT rates and exemptions

Rates and exemptions shift as governments respond to economic and political pressures. Countries often impose a combination of standard and reduced VAT rates, and the supplies eligible for reduced rates change frequently.

In addition, some activities, such as education and many types of financial services and insurance, are exempt in most countries. This means that enterprises don’t charge VAT to customers in connection with these supplies but generally can’t recover related input VAT expenses.

Some countries are overhauling their indirect tax system altogether. For example, Brazil amended its constitution to replace its complex system of five indirect taxes with a simpler system consisting of the tax on goods and services (IBS) and the contribution on goods and services (CBS).

Who pays VAT?

Most businesses and individual traders are “taxable persons” responsible for registering, collecting, and remitting VAT, regardless of whether they’re resident or nonresident in the taxing country. In many countries, resident taxable persons are subject to these obligations only if their taxable turnover exceeds a specified registration threshold.

In some countries and for certain types of transactions, intermediaries such as credit card companies and digital platforms are liable for VAT, rather than the underlying suppliers.

Foreign suppliers may be able to avoid VAT obligations on transactions with local business purchasers who are required to account for the VAT under “reverse charge” rules. These rules often apply to inbound business-to-business services.

Value-added tax calculation

Registered taxable persons pay input VAT on goods and services purchased in connection with their business. Businesses then levy and collect “output VAT” on their own sales of goods or services to registered and unregistered customers.

In general, the business credits or deducts its input VAT against its output VAT to calculate a final VAT liability, which it remits to the tax authority.

Value-added tax example

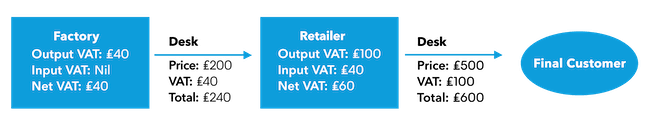

This is an example of how VAT is applied to a domestic sale with a simple supply chain:

Factory and Retailer are both established and registered for VAT in Country A, which imposes VAT at a rate of 20%. Factory manufactures a desk, which it sells to Retailer for a VAT-exclusive price of £200. Retailer sells the desk to Final Customer for a VAT-exclusive price of £500.

- Factory collects £40 of Country A output VAT from Retailer and remits it to the Country A Tax Authority.

- Retailer takes a £40 input VAT credit for the VAT it remits to Factory and collects £100 of output VAT from Final Customer.

- Retailer remits £60 net VAT to the Country A Tax Authority (£100 – £40 = £60).

- The tax burden ultimately falls on Final Customer, who pays £100 in VAT and is not eligible for an input VAT credit.

- Country A Tax Authority receives £100 in total: £40 from Factory + £60 from Retailer.

Input VAT credits and refunds

VAT is intended to be “neutral,” or costless for businesses, and imposed only on final customers. Businesses are generally responsible for collecting and remitting VAT on behalf of their customers. To make the value-added tax neutral, registered businesses can claim a credit, deduction, or refund for the “input VAT” they pay on goods or services purchased or imported for their taxable business activities.

In practice, however, VAT costs for businesses can be steep for several reasons, including:

- The VAT expenses are uncreditable (e.g., fuel or business entertainment expenses)

- Timing mismatches between payments and refunds disrupt cashflow

- Compliance costs and advisory fees

- Fines and penalties

Businesses can reduce VAT costs by:

- Developing robust in-house VAT capabilities to reduce advisor spend

- Establishing systems to monitor and comply with filing deadlines and invoicing requirements

- Recovering unclaimed credits and refunds

- Using VAT grouping to minimize intracompany VAT liabilities

- Structuring corporate groups to maximize VAT efficiency and secure the right to VAT deductions – for example, by ensuring holding companies can recover input VAT

- Taking advantage of import VAT deferral schemes to ease cash flow mismatches

How to get a VAT refund

Taxpayers must retain careful records of timely VAT invoices that conform to strict formal requirements. Most jurisdictions require businesses to support claims for an input VAT credit with an invoice or similar document showing key information, including:

- Amount of VAT due

- VAT identification numbers of the counterparties

More and more countries are using the “clearance model” of invoicing, which requires businesses to obtain government approval digitally before issuing electronic invoices. Other countries require continuous “real-time reporting” of invoicing data. Both electronic invoicing and real-time digital reporting can simplify recordkeeping and filing requirements. However, these practices also make it more difficult to correct transaction documentation retrospectively. Accordingly, businesses may have to tighten their compliance processes.

In some countries, invoicing and reporting requirements may be strict and failure to comply may result in credits being denied or penalties being imposed.

Does the U.S. have a value-added tax?

Unlike most other countries, the U.S. doesn’t impose VAT at either the national or state level. Instead, most U.S. states impose a retail sales tax.

Imposing VAT at each stage of the supply chain doesn’t increase the total amount of tax collected, relative to an equivalent retail-level sales tax. However, VAT is easier than sales tax for authorities to monitor and more difficult for taxpayers to evade because of compliance mechanisms that include an invoicing trail and detailed reporting requirements.

Key differences between VAT and sales tax

| Value Added Tax (VAT) | Sales Tax | |

| Single vs. Multi-Stage | Imposed at every stage in the supply chain | Imposed at the retail stage, only |

| Creditability | Creditable by businesses but not final customers | Generally, not creditable by businesses or final customers |

| Administrability | Invoicing, reporting, and crediting systems promote compliance | Greater opportunities for evasion |

| Rates | Often imposed at rates above 10%, and even 20% | Generally imposed at rates below 10% |

| Applicable Jurisdictions | Implemented in most countries outside the U.S. | Applies in most U.S. states, many U.S. localities and Puerto Rico. Outside the U.S., sales tax applies in a minority of countries, e.g., Malaysia, the BES Islands, and certain Canadian provinces |

VAT research and practice tools from Bloomberg Tax

Take your international tax strategies to the next level with Bloomberg Tax international tax solutions – analysis, VAT rates by country, practice tools, global news coverage, and more.

Download our report on the EU’s latest e-commerce programs for expert analysis and insights to help you understand the new VAT obligations and opportunities for global businesses.

Bloomberg Tax research brings expert context and unmatched content so that tax professionals can navigate the nuances of VAT requirements with confidence. Our practitioner-authored analysis and interpretations help you develop and implement complex corporate tax planning strategies. Save time when you trust our international tax research solutions to tackle complex compliance tasks with ease. Request a demo to get started.