Create your best tax strategy with Bloomberg Tax Research

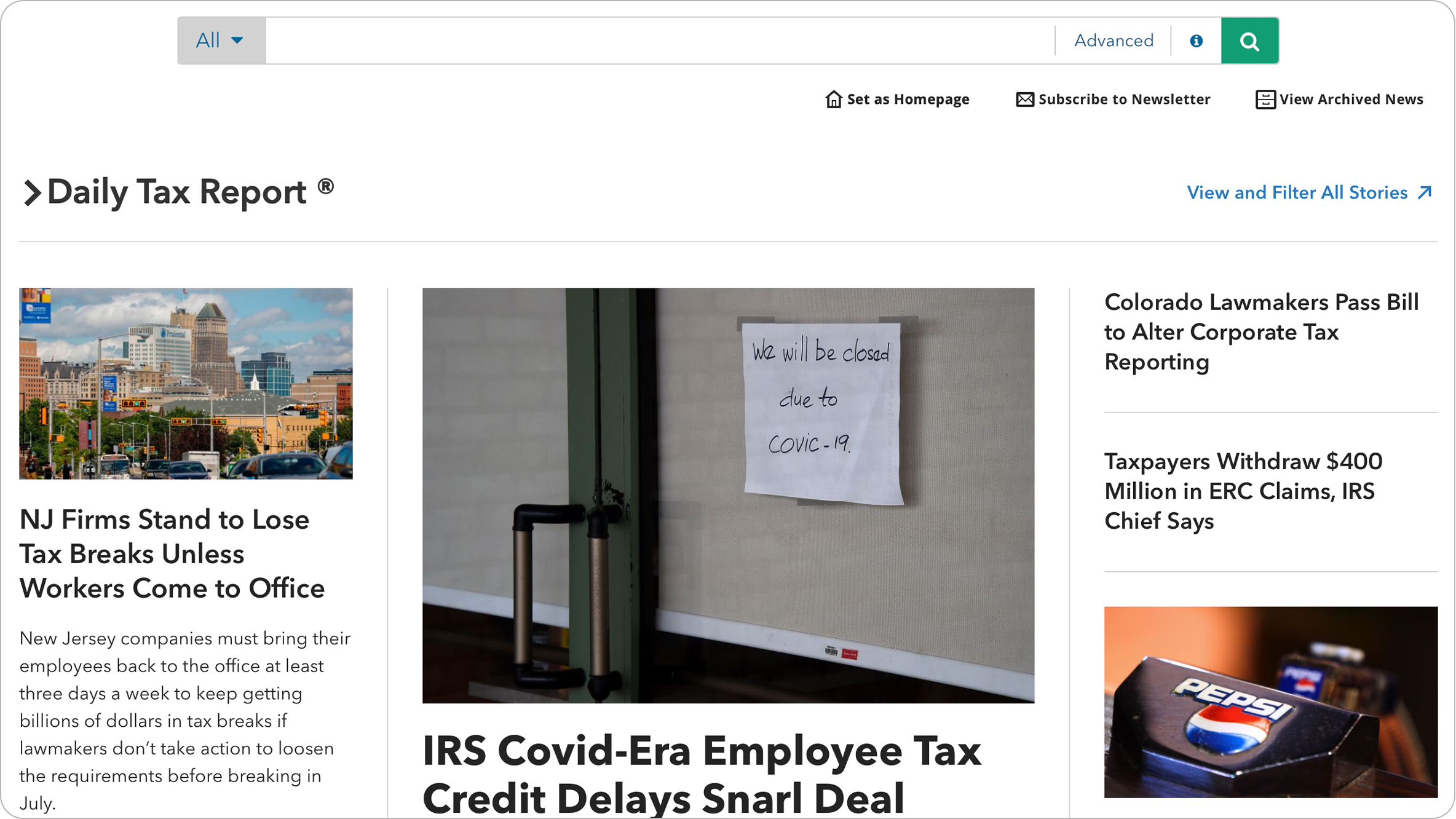

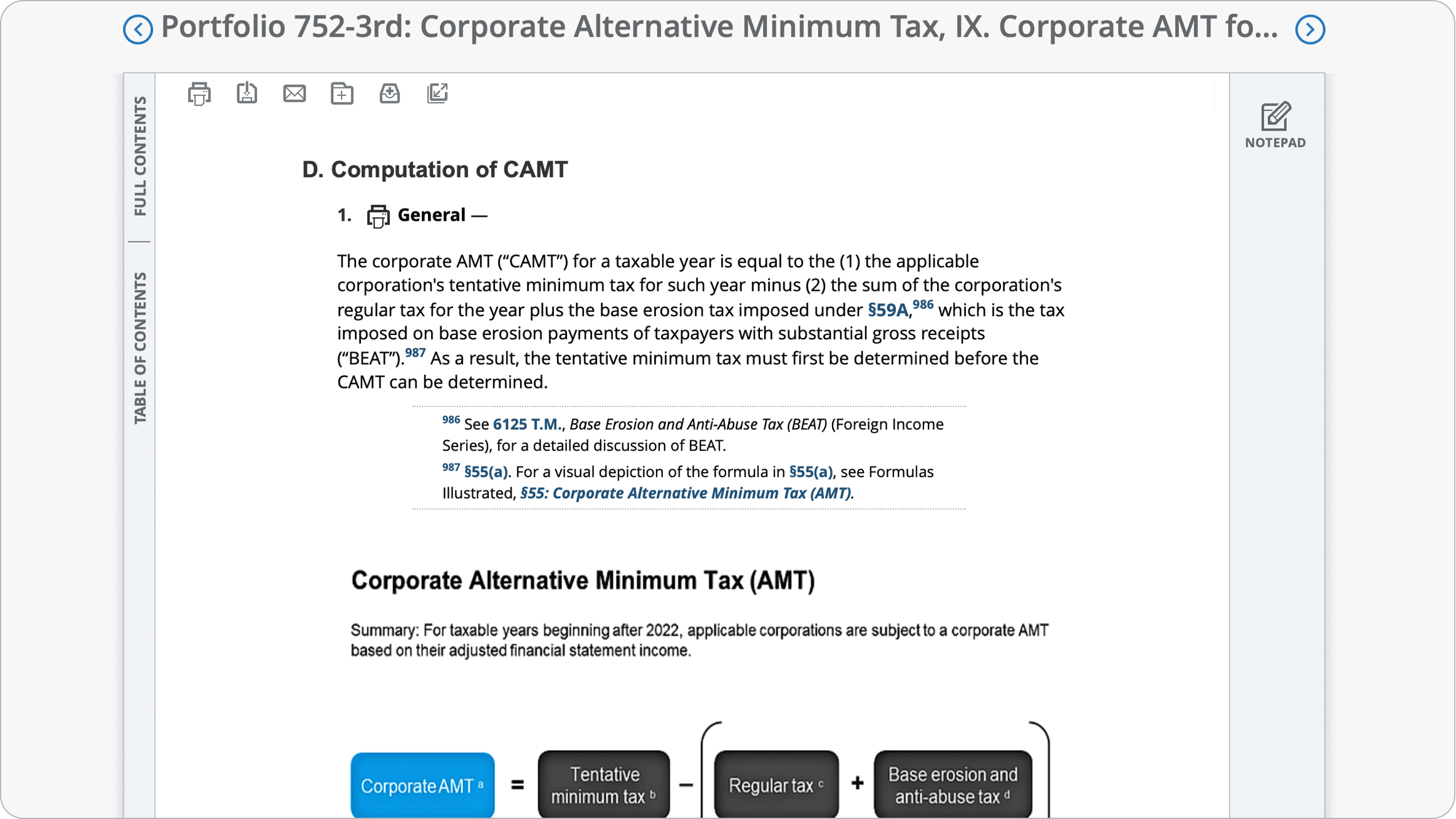

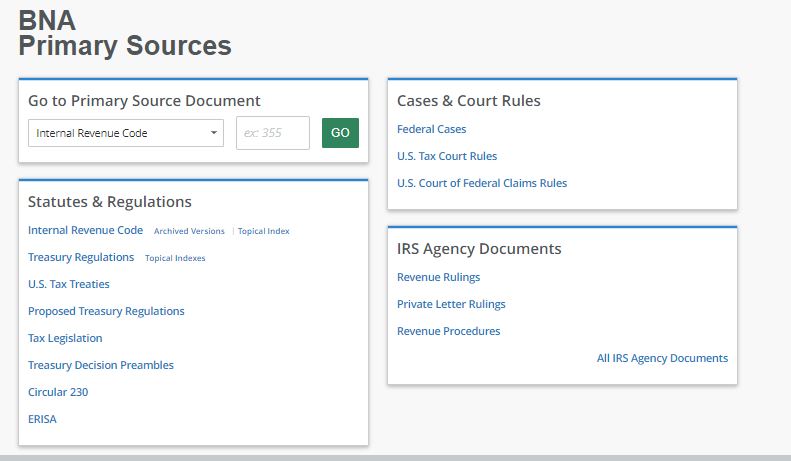

Bloomberg Tax Research delivers expert news, analysis, and AI-powered practice tools that link directly to primary source materials — all in one convenient place, so you can spend less time searching and more time strategizing.