Income Tax Planner

Handle any income tax challenge

When you can’t confidently guide clients through complex tax issues, they lose trust, and you lose business. Be prepared for anything with our Income Tax Planner — the industry’s most powerful planning and projection tool that helps you give clients a clear view of strategies to minimize their taxes.

Know you’re accurate

Calculations, analytics, and the application of the most up-to-date regulations are handled automatically, ensuring your data is always reliable.

Deliver with certainty

Side-by-side comparisons of different scenarios give clients a clear view of their options and make it easy for you to lead them to the best tax-saving strategies.

Build trust quickly

Complex income tax situations can overwhelm clients fast. Knowing they can always come to you for the optimal solution earns you a reputation of expertise — and that spreads quickly.

Don’t let subpar software limit your potential

Bloomberg Tax’s Income Tax Planner offers the most valuable tax projection and planning tools for financial professionals that want to grow their business.

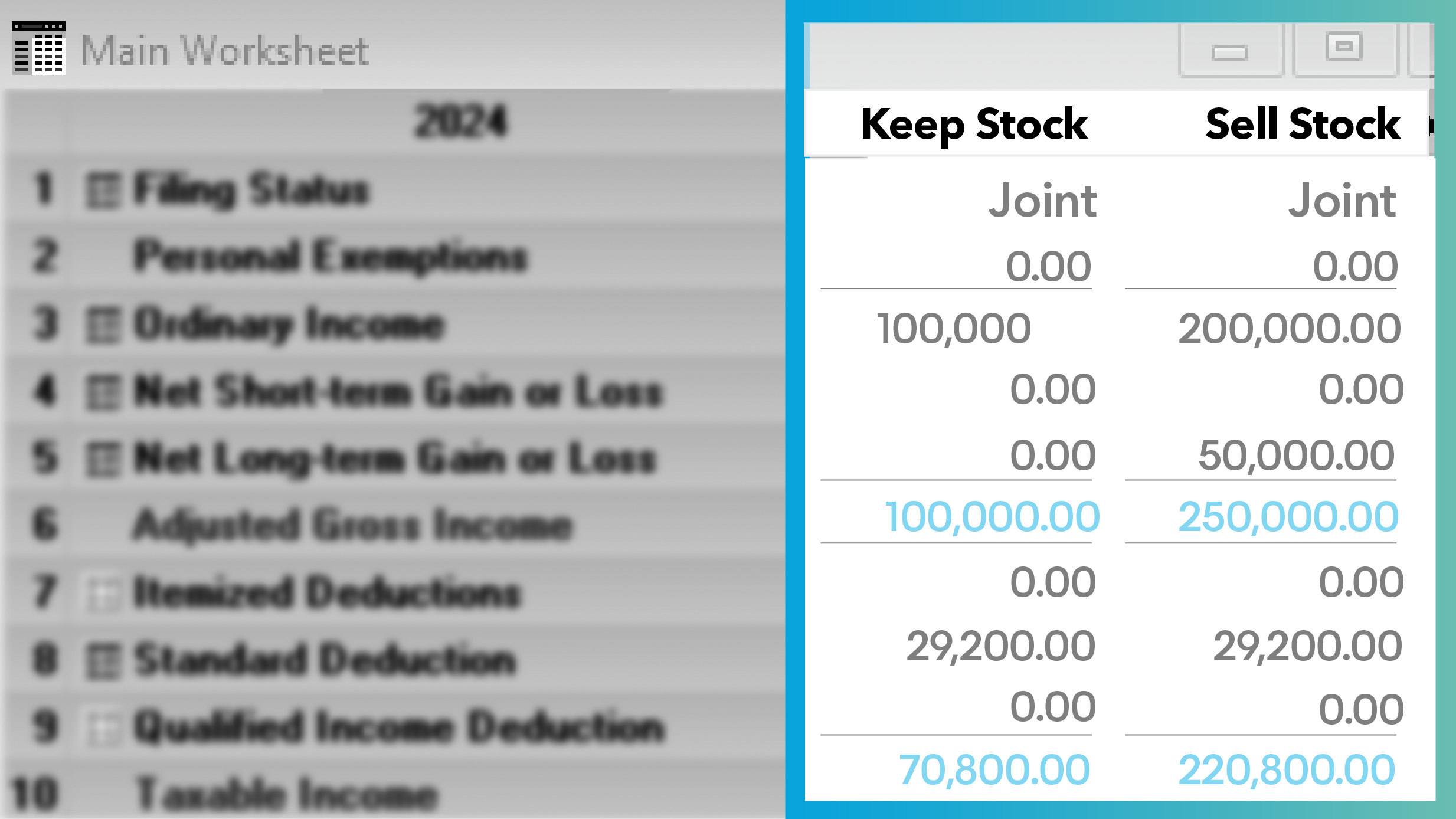

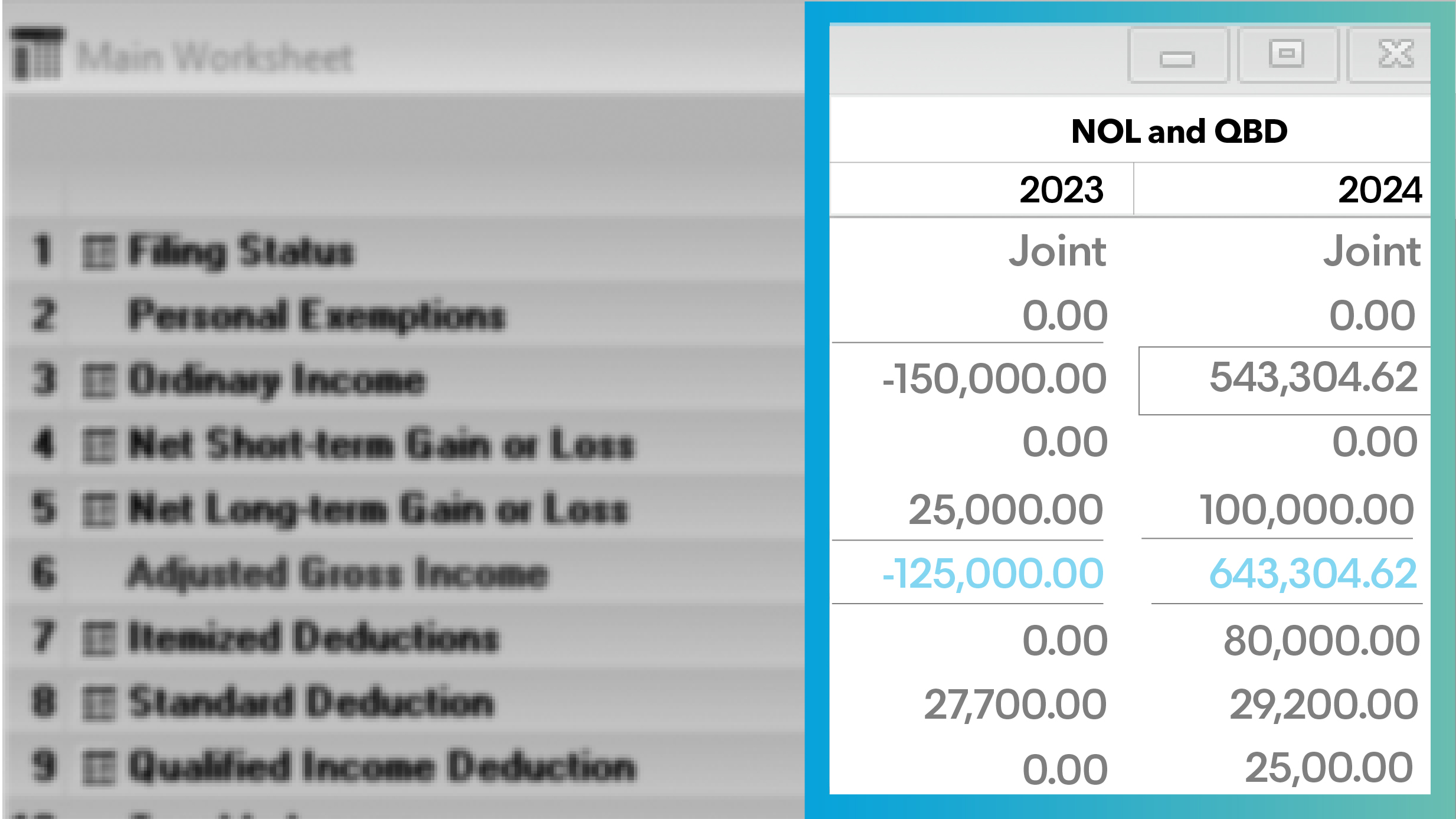

Compare multiple scenarios side-by-side

Run year-end, quarterly, and multiyear tax projections for up to twenty years and account for different ‘what-if’ scenarios to advise the best long- and short-term tax-saving strategies.

Automate complex calculations

Automatically calculate federal, state, and nonresident income taxes for alternative minimum tax, capital gains, phase-outs, carry-overs and more with the most up-to-date calculations available.

Easily import data to reduce errors

Our integrations make transferring client data from commonly used tax preparation software fast and simple, saving you time and reducing data-entry errors.

Have trusted intel at every turn

Expert analysis and the latest tax law updates are automatically applied to help minimize your clients’ tax liabilities.

Present with clarity and confidence

Ready-to-use letters, graphs, and reports make it simple to show clients their income tax options and guide them toward the best strategy.

Getting started is easy

And so is everything else.

See income tax planner in action

Request a demo and a representative will schedule a meeting.

See the benefits

Get a firsthand look at how to streamline your processes and stay ahead of regulatory changes throughout the year.

Deliver the best tax strategy

Start offering a more complex, value-added tax planning service to attract and retain clients.

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.