Bloomberg Tax Workpapers

There’s a better way to work(paper)

Preparing workpapers in Excel leaves you decoding calculations, manually gathering data, and worrying you’re not in line with the latest tax laws. Bloomberg Tax Workpapers changes all of that by giving you the control of spreadsheets with automatic data transformation and time-saving tax-specific functions, all in one solution.

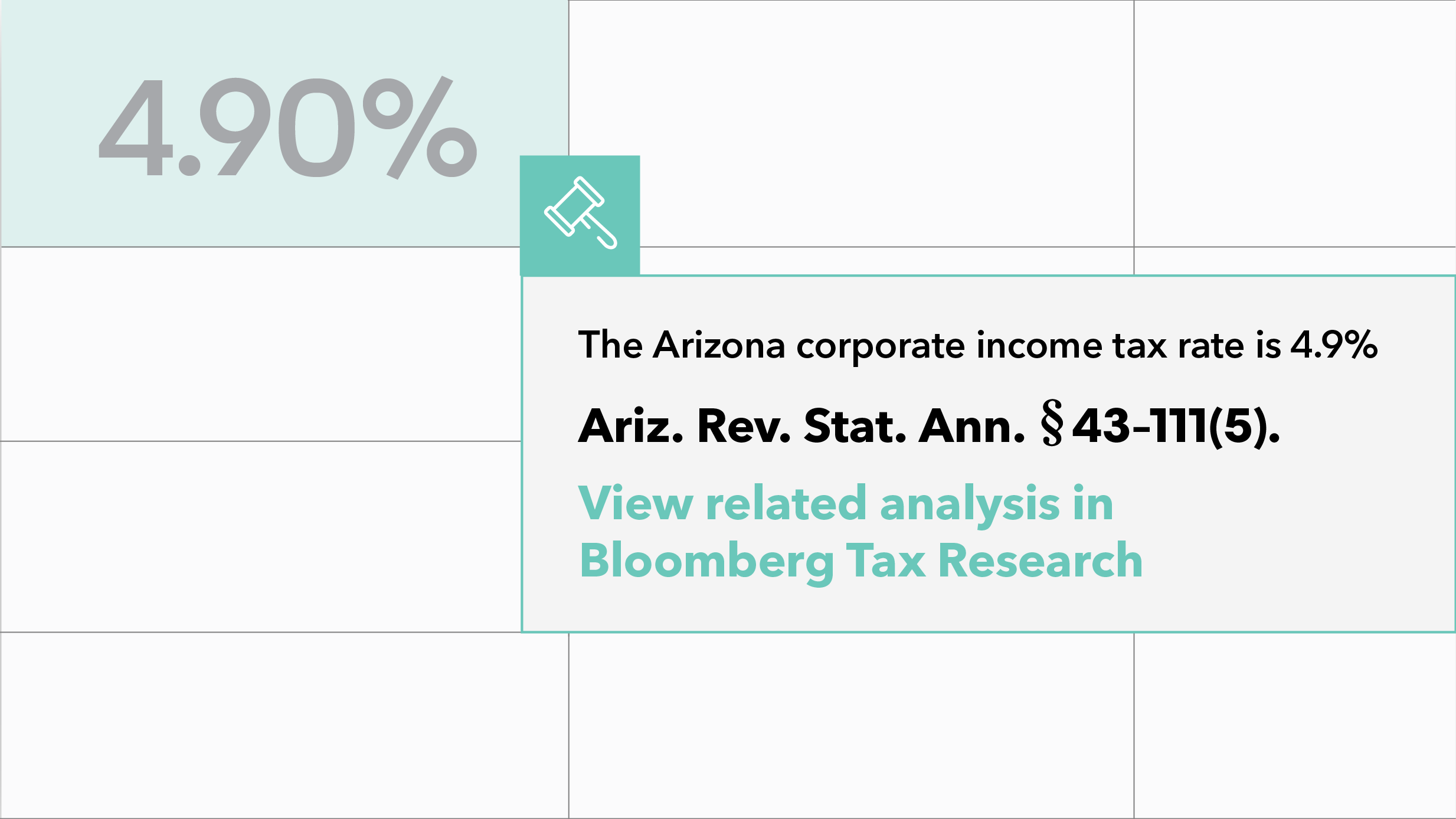

Trust your calculations are up-to-the-minute

Relying on someone to manually keep your tax calculations up to date is dangerous. Our workpapers solution automatically updates your calculations with the latest tax laws and includes explanations to give you confidence and clarity on any changes.

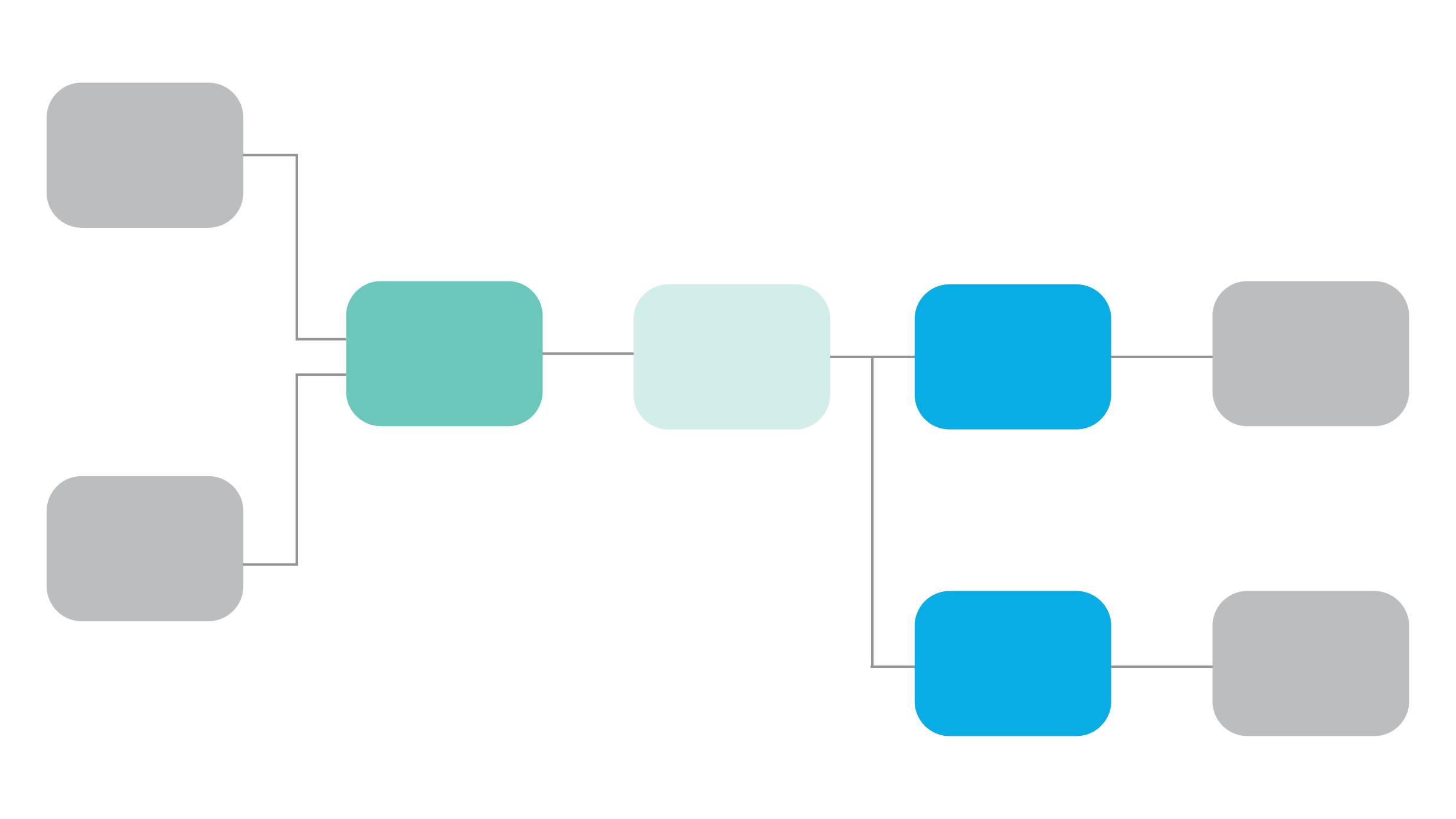

Watch your data prep itself

You’ve had to spend so much time and energy manually gathering, organizing, and transferring data — until now. Our robust data transformation technology automates data prep to remove manual risks and give you valuable time back.

Gain total control of workpapers

No more interpreting workpapers prepared by someone else. No more accidental changes to calculations, no more chaos. Our spreadsheets include features that enable you to take control over every workpaper.

Tax-specific, time-saving tools designed just for you

We’re constantly thinking of ways to make life better for tax professionals. As the latest addition to Bloomberg Tax, Bloomberg Tax Workpapers automates calculations to remove manual errors and offers a whole new world of spreadsheets loaded with custom tax features.

Use spreadsheets made just for tax

On top of all the functionality you’re used to in Excel, get exclusive features uniquely designed to improve your entire tax process, including automatic tax law updates with explanations to give you confidence and clarity on any changes.

Let tax-centric data transformation do the heavy lifting for you

Unlike generic data transformation tools, Bloomberg Tax Workpapers automates data processes unique to tax professionals, including trial balance cleansing, M-1 flux analysis, and period-over-period roll forwards.

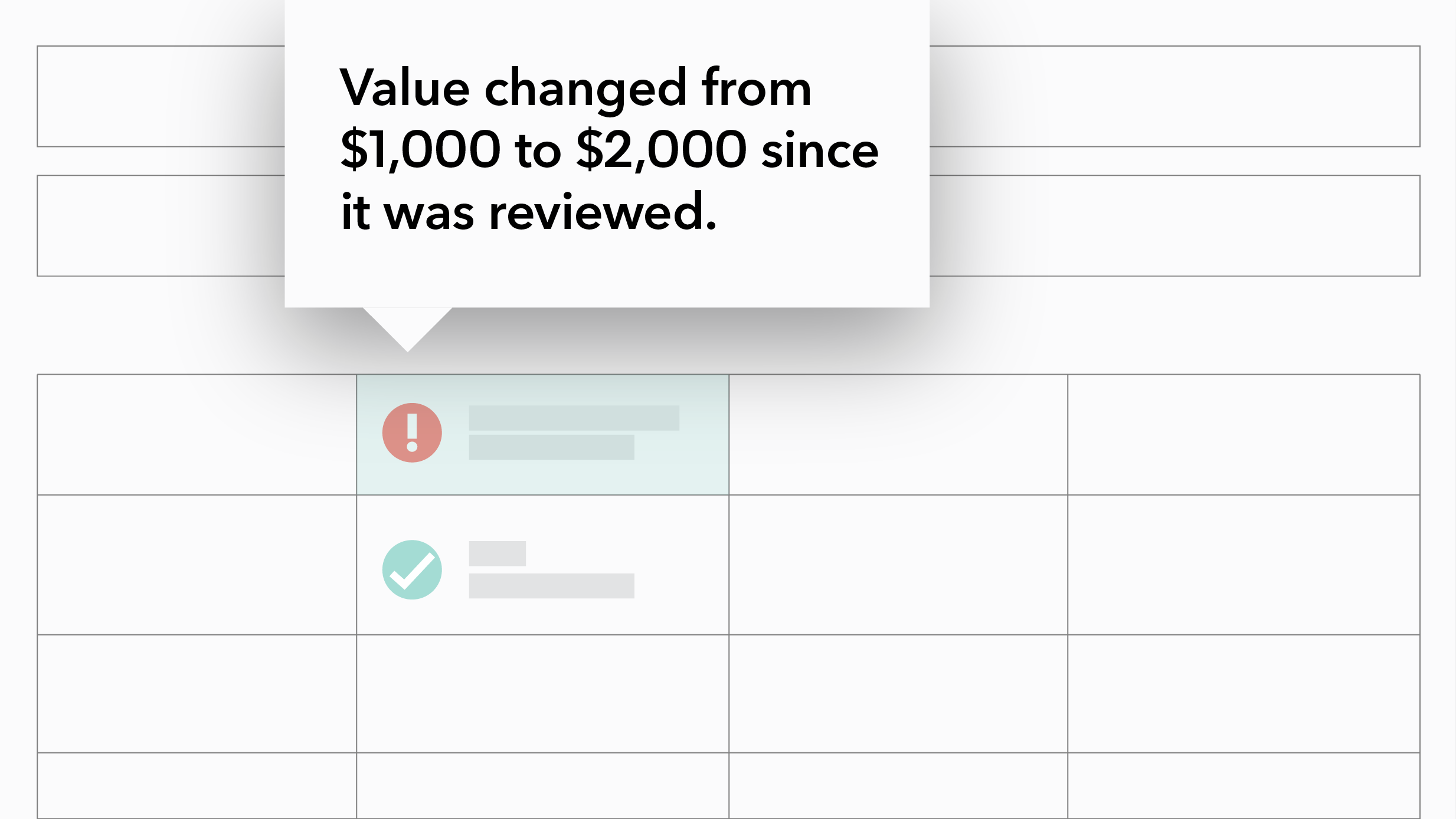

Know everything happening on every spreadsheet

Stop worrying about late entries or last-minute changes to workpapers. With cell-level review tracking, you know whenever a value changes and who reviewed it. Automatic saving, workbook-level signoffs, and a workpaper status tracking and progress dashboard give you ultimate control.

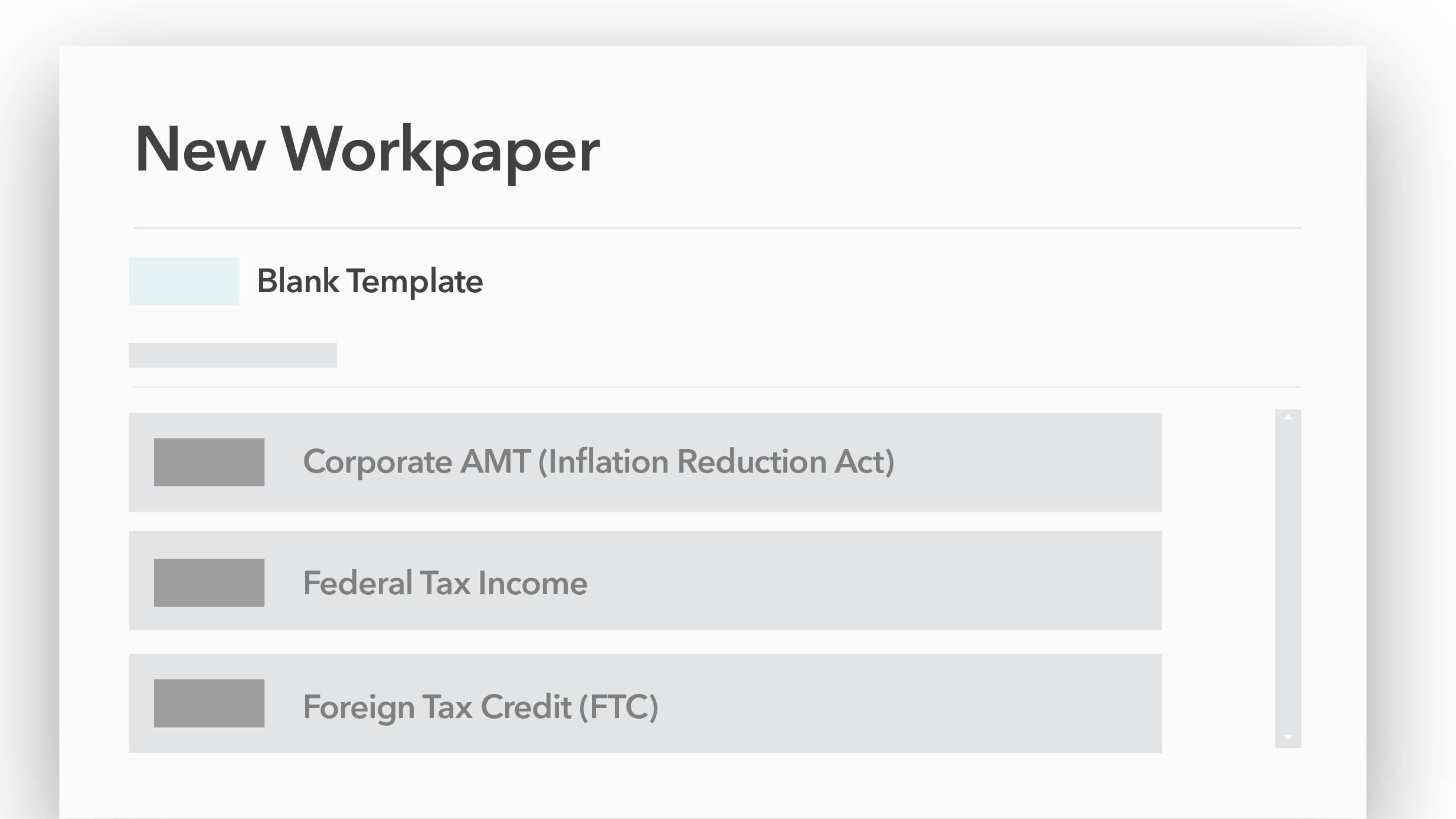

Zoom through tax prep with our tax templates

Bloomberg Tax Workpapers provides templates with the latest tax laws that give you a strong foundation for new legislation and simplify complex calculations such as GILTI, corporate AMT, and GloBE Pillar 2.

Like the spreadsheets you know, but better

We intentionally designed Bloomberg Tax Workpapers to mimic the spreadsheet experience you’re used to, so there’s little to no learning curve.

Upload

Simply add your existing workpapers as they are — no need to change the format.

Automate

Easily automate your data transformation with a system already built for the tax process.

Simplify

Manage your entire workpaper process with a single solution that removes risk, gives you more control, and saves time.

Tax tested. Tax approved.

“Using Bloomberg Tax Workpapers, I know where the data is coming from and I know that it’s correct. That gives me assurance that the output is correct and I can explain it.”

Christine Kennedy

Associate Tax Director

Hyland Software

“Bloomberg Tax Workpapers gives clients the ability to use data in multiple ways, getting rid of duplicative work that occurs over the course of a year.”

Becky Hawkins

Associate Tax Director

Riveron

“Having a starting point is going to save us a lot of time compared to opening up a blank Excel that has nothing on it and saying ‘build me a roll forward for this complex calculation’. This is going to save hours and hours of work.”

Matthew Russell

Domestic Tax Manager

Hyland Software

Insights

Discover the new generation Bloomberg Tax suite

Our innovative Bloomberg Tax Workpapers product is only one of our innovative tax solutions that change the game for tax department productivity and intelligence. Our suite of integrated tax solutions automates tedious work, minimizes risk, and frees up more of your time to do more strategic work.

Request a demo

Bloomberg Tax simplifies the entire tax process with technology that automates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and we’ll be in touch to schedule a demo so you can see how our solutions transform your work and meet your unique needs.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.