When Should You Disclose an Uncertain Tax Position?

At the end of each annual reporting period, a corporate entity must make disclosures in the notes of its financial statements that assist with evaluating the entity’s uncertain tax positions. Public entities are required to make additional incremental disclosures. Below, we summarize the key aspects of the ASC 740 reporting and disclosure requirements related to uncertain tax positions when calculating your income tax provision.

Uncertain tax position annual disclosures required for all entities

Interest and penalties

ASC 740-10-50-15(c) requires all entities to disclose the total amounts of interest and penalties recognized in the statement of operations and the statement of financial position, including increases and decreases in such amounts.

Unrecognized tax benefits

For tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly increase or decrease within 12 months of the reporting date, entities must disclose:

- The nature of the uncertainty

- The nature of the event that could occur in the next 12 months to cause the change

- An estimate of the range of the reasonably possible change or a statement that the company cannot estimate the range

Entities must also disclose the tax years that remain subject to examination by major tax jurisdictions.

Interim disclosures required for public entities

In their annual reports, public companies must make disclosures related to the estimation uncertainty in their income tax accounts, if such estimates are designated as critical accounting estimates.

In their interim reports, public companies must discuss both:

- Material changes in the critical accounting estimates of their income tax since year-end and the events or changes in assumptions that led to such material changes

- Events and changes in assumptions that are reasonably likely to lead to a material change in the critical accounting estimates of their income tax, results of operations, and financial condition of the company

A public company’s condensed interim financial information must include sufficient disclosures to avoid presenting misleading information. Companies can omit footnote disclosures that would substantially duplicate the disclosures in the most recent annual report from the condensed interim financial statements. For example:

- A summary of significant accounting policies

- Account balances that have not changed significantly in amount or composition since the most recently completed fiscal year

- Other disclosures required by Rule 4-08 of Regulation S-X

However, registrants must disclose events that occurred after the most recent fiscal year that have had a material impact on the registrant. This requirement includes any significant changes in ASC 740 disclosures related to uncertainty in income taxes.

Tabular rollforward

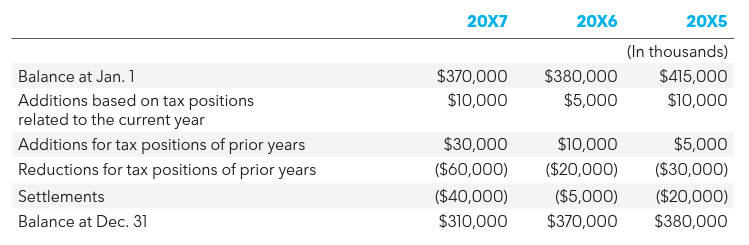

The following are the captions in the tabular rollforward public companies must provide and the information to be included within each category. Interest and penalties should not be included in the tabular rollforward.

Gross increases and decreases in unrecognized tax benefits because of tax positions taken during a prior period

This disclosure is intended to address changes (increases and decreases) in the amount of unrecognized tax benefits related to prior annual periods. It includes changes in the recognition or measurement of prior year tax positions because of new information, excluding cash payments, use of an existing deferred tax asset, or a lapse in the statute of limitations. Entities are required to disclose both the gross increases and gross decreases in prior year tax positions.

Gross increases and decreases in unrecognized tax benefits because of tax positions taken during the current period

This disclosure is intended to address changes in the amount of current period unrecognized tax benefits. Because this disclosure is an annual rollforward of unrecognized tax benefits, there cannot be “decreases” in this category. That is, this disclosure addresses current year increases in unrecognized tax benefits. However, material changes in unrecognized tax benefits (including decreases), which occur in an interim period, should be disclosed in interim financial statements.

Decreases in the unrecognized tax benefits relating to settlements with taxing authorities

This disclosure addresses decreases due to cash payments made to the taxing authority or the use of a related deferred tax asset. It does not include changes in an estimate or changes related to other means of resolution of tax positions – like negotiation, litigation, or lapse of the statute of limitations. An entity that makes an advance deposit with taxing authorities to stop the accrual of penalty interest on tax uncertainties or as a condition for appealing a tax position in court would disclose these amounts once they are applied to a particular position in settlement.

Reductions to unrecognized tax benefits because of a lapse of the applicable statute of limitations

This disclosure addresses tax positions ultimately settled through the expiration of the statute of limitations.

Effective tax rate

The term “effective tax rate” in ASC 740-10-50-15A(b) should be interpreted as the percentage derived by dividing (1) income tax expense allocated to continuing operations by (2) pretax income from continuing operations.

The resolution of some tax uncertainties will not affect the effective tax rate as discussed in ASC 740 (e.g., resolutions related to business combinations that occurred during the measurement period, additional paid-in capital). However, supplemental disclosure should be encouraged for resolution of tax uncertainties that do not affect the effective tax rate.

Effect of full valuation allowance on disclosures

Public entities must disclose, in a tabular reconciliation, the total amounts of unrecognized tax benefits at the beginning and end of the period (ASC 740-10-50-15A(a)). Some have questioned whether this requirement applies to unrecognized tax benefits that result in a deferred tax asset that, if recognized, would require a full valuation allowance. Bloomberg Tax experts believe that the tabular rollforward requirement is independent of the need for a valuation allowance. As a result, the rollforward should be presented with the gross amounts of unrecognized tax benefits, regardless of the presentation in the balance sheet (i.e., valuation allowance).

ASC 740-10-50-15A(b) requires companies to disclose the total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate. In the case of an unrecognized tax benefit that, if recognized, would result in a deferred tax asset and corresponding increase in the entity’s valuation allowance, such unrecognized tax benefit would not affect the effective rate if recognized. As a result, because an increase in the valuation allowance would offset the benefit, there would be no effect on the effective tax rate.

Federal benefits and other indirect effects of uncertain tax positions

Many tax positions have an indirect effect on other tax positions in different tax jurisdictions. For example, state taxes often indirectly affect federal taxes because state taxes are deductible in the federal return.

The tabular rollforward described in ASC 740-10-50-15A(a) is intended to address only the unrecognized tax position. That is, the unrecognized position (the state tax deduction) would be included in the tabular rollforward of unrecognized tax benefits, and the amount disclosed would not reflect the indirect benefits it would trigger if disallowed. In other words, the federal benefit would be considered “recognized” because ASC 740 is applied by jurisdiction, and that benefit should not be included in the tabular rollforward of unrecognized tax benefits. However, the indirect effects should be included in describing the effect on the effective tax rate as provided for in ASC 740-10-50-15A(b).

Uncertain tax position disclosure example

The following example provides guidance for ASC 740 disclosures about uncertainty in income tax positions:

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. With few exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations by tax authorities for years before 20X1.

The Internal Revenue Service (IRS) commenced an examination of the Company’s U.S. income tax returns for 20X2 through 20X4 in the first quarter of 20X7. It anticipates completing the examination by the end of 20X8. As of Dec. 31, 20X7, the IRS has proposed certain significant adjustments to the Company’s transfer pricing and research credits tax positions. Management is currently evaluating those proposed adjustments to determine if it agrees. If accepted, the Company does not anticipate the adjustments would result in a material change to its financial position. However, the Company anticipates that it is reasonably possible that an additional payment in the range of $80 to $100 million will be made by the end of 20X8.

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows.

On Dec. 31, 20X7, 20X6, and 20X5, there are $60, $55, and $40 million of unrecognized tax benefits that, if recognized, would affect the annual effective tax rate.

The Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses. During the years ended Dec. 31, 20X7, 20X6, and 20X5, the Company recognized approximately $10, $11, and $12 million in interest and penalties. The Company had approximately $60 and $50 million for the payment of interest and penalties accrued by Dec. 31, 20X7, and 20X6, respectively.

Authoritative analysis on ASC 740 income tax provision

From recognizing uncertain tax positions to accounting for net operating losses and tax credits, calculating your company’s provision for income taxes under ASC 740 requires a nuanced understanding of a multitude of factors. Download a complimentary copy of our Essential Guide to ASC 740 for key insights to help you navigate the income tax provision process.

Tax professionals can use ASC 740 tax provision software to manage controls and efficiencies better than in Excel. Save valuable time when you trust Bloomberg Tax Provision software to tackle complex provision calculation and reporting tasks with ease. Request a demo to see how this easy-to-use software helps you manage risk and reduce time spent in your ASC 740 process by providing a streamlined, controlled environment that leverages a balance sheet approach to comply with U.S. GAAP.