Reduce Risk and Simplify Reporting with Tax Provision Software

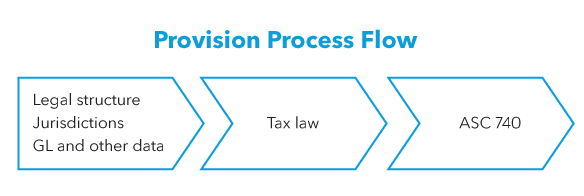

Calculating your company’s provision for income taxes under ASC 740 is a formidable undertaking. Under Generally Accepted Accounting Principles (GAAP), companies must recognize the effects of income taxes on their financial statements, which is a time-consuming process that requires a nuanced understanding of reporting, accounting standards, and legislation.

With changing laws and business footprints, items that were once immaterial can suddenly become material to the financial statements. As a result, inaccurate entries can lead to expensive financial restatements, scrutiny from auditors and regulators, and reputational damage.

Many companies rely upon Excel for calculating their provision for income taxes. However, many limitations exist when trying to use Excel to accurately calculate income taxes under ASC 740. Tax provision software is designed specifically to handle complex tax provision calculations and comply with the most up-to-date laws and regulations.

Even if you think your company’s current tax provision processes are manageable, tax provision software might be a better fit to achieve accuracy and efficiency, especially as your business grows and changes.

[Download our Buyer’s Guide to Tax Provision Software for a helpful step-by-step process for evaluating tax software.]

Myth: Excel is sufficient to calculate tax provision

Excel is great for organizing and manipulating data sets. That’s why it’s one of the most-used software tools in the world – not just in finance and accounting but in marketing, sales, human resources, operations, and other areas of the business world.

Many companies start out by calculating their tax provision in Excel: it’s familiar, and it’s easy to build out the basic calculations. But as a business grows and changes, it becomes increasingly difficult and time-consuming to maintain accurate and efficient ASC 740 calculations in Excel. Reliance on intricate Excel workbooks – where maybe one or two key individuals know how they work – results in significant manual effort to verify results, backtrack through calculations, consolidate data across entities and schedules, and prepare rate recs.

Reality: ASC 740 calculations in Excel are time-consuming and error-prone

Several situations can complicate calculating the ASC 740 tax provision, including:

- expanding operations into a new jurisdiction

- beginning new business activities with new book-to-tax differences or tax credits

- new tax legislation passing at the state, federal, or international level

- taking an uncertain tax position

- recognizing and measuring the tax benefits arising from uncertain tax positions

Challenges with control and efficiency

As tax professionals travel from facts to footnotes when preparing their financial statements, one of the major challenges lies with internal controls. Excel lacks the functionality to support audit trails showing the date and time of each change made. It also doesn’t allow for locking and signing off on a provision. This opens the company to the risk that changes to the provision could be missed, or that a prior provision file will be altered and not tie to what was originally calculated.

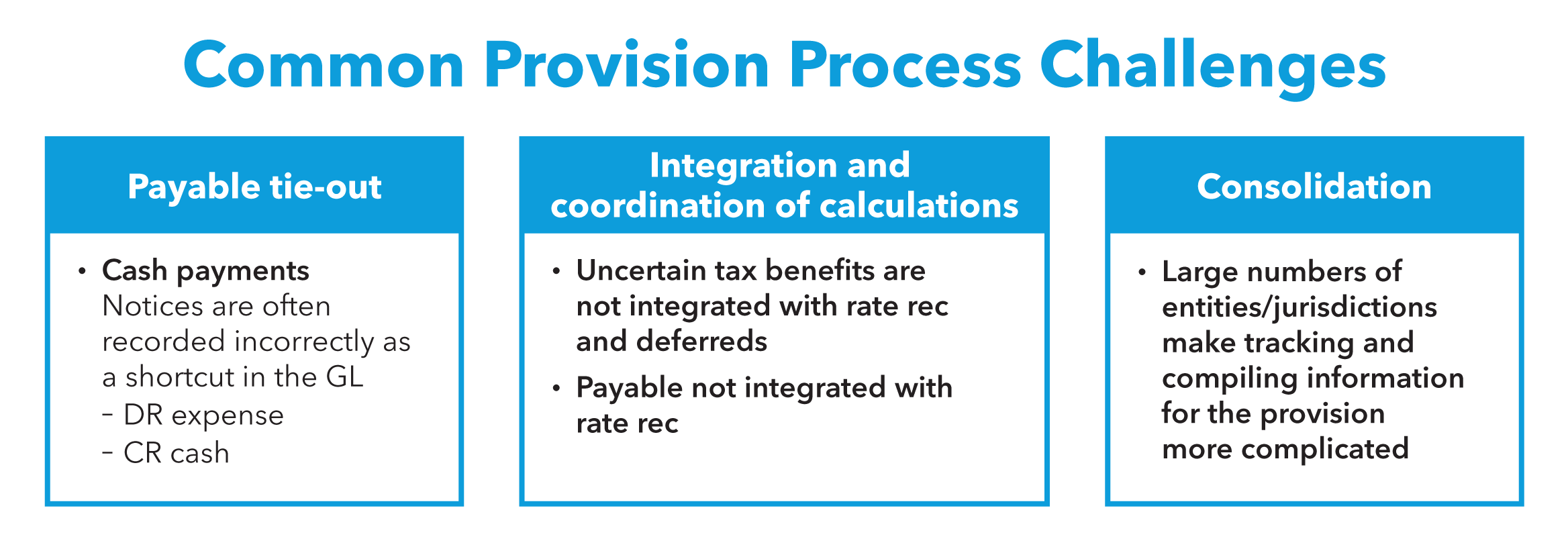

Companies using Excel also find it challenging to have, or often lack, a standardized way of managing current payables, tracking deferred balances, integrating uncertain tax benefits or other complexities, and tying out a rate rec and preparing necessary reports. Unlike software that guides users through a standardized provision process, Excel allows data to be entered in random order at any time, making it difficult for teams to work efficiently and replicate the process.

Changes and updates must be manually entered, introducing the risk for errors

Another major challenge is the amount of time and effort it takes to manage the provision process, perform analysis on key rate drivers, or produce traceable audit-ready reports. Excel requires a significant amount of manual work to verify results, backtrack through calculations, consolidate data across entities and schedules, and prepare rate recs.

The tax department often receives last-minute changes from their financial counterparts, which can add additional pressure on the timeliness of completing the tax provision process. It’s rarely simple to update calculations in a spreadsheet in these circumstances because the changes need to be manually updated in multiple places.

When using Excel to calculate and prepare your tax provision, you need to consider all the workbooks, tabs, and cells that these changes will impact. You may need to update apportionment calculations, which will then impact the rate used for state deferred tax calculations, and therefore the federal benefit of state taxes. And if the spreadsheets aren’t dynamic, changing a calculation on one spreadsheet or tab will require a corresponding change to the other provision calculations that are impacted, such as the rate reconciliation – a step many professionals overlook.

All of this requires an in-depth knowledge of technical rules under ASC 740. But even with that technical knowledge, entering these changes manually often results in broken formulas, increasing the margin of error and exposing the organization to more risk.

This not only wastes resources, but also keeps tax professionals from doing other important strategic work.

Excel relies on institutional knowledge, limiting contingencies and replicability

Further complicating the issue, tax departments that use Excel often rely on one or two key people who know the company’s spreadsheets and models well.

This makes it difficult to review the preparer’s work if the reviewer doesn’t understand how the spreadsheets are built, resulting in a more time-consuming process and increasing the risk of missing errors.

Furthermore, when employees leave, transfer, or are reassigned, it creates a knowledge gap that can slow the process or result in errors.

Fact: Provision software drives better outcomes

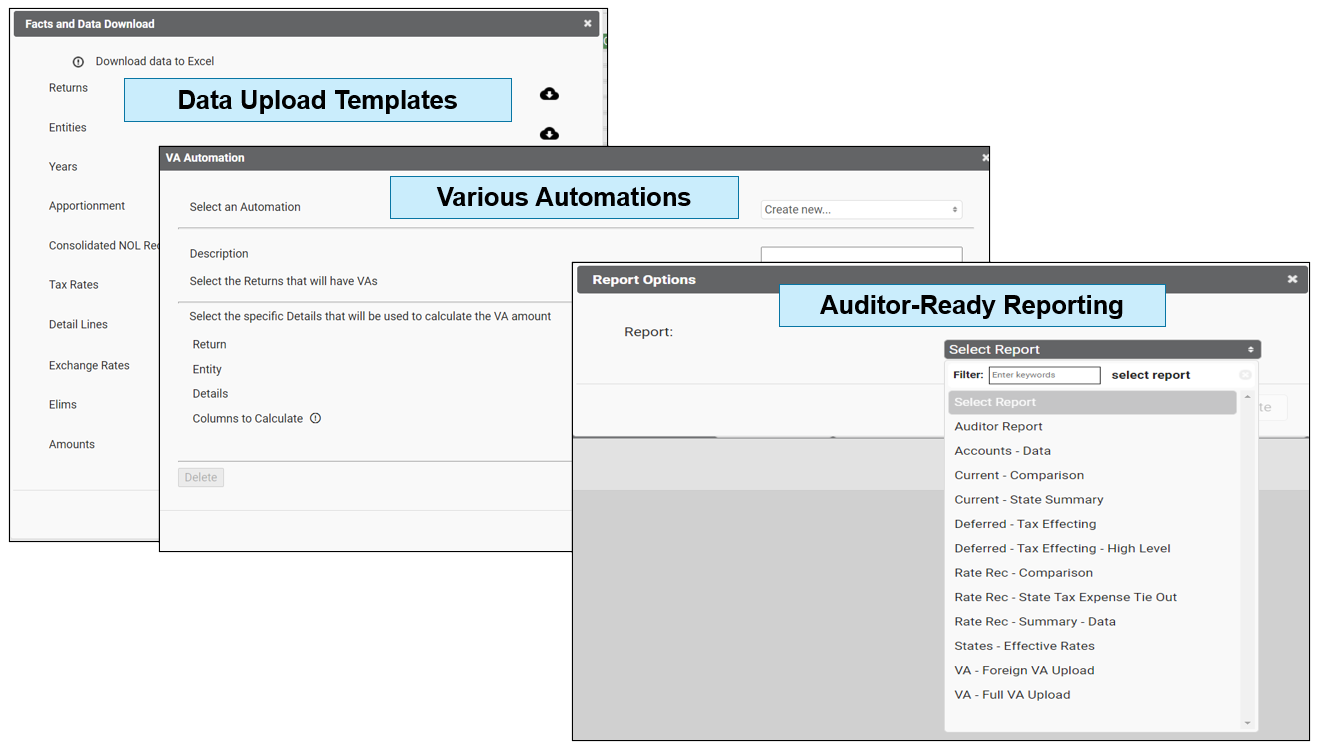

Tax provision software allows your organization to carry out fast, accurate, and controlled audit-ready outputs using cloud-based security features. It simplifies annual and interim provision work by creating a step-by-step flow that allows you to prepare and review an income tax provision using a balance sheet approach as required by GAAP under ASC 740.

Software solves common technical challenges with the tax provision process by:

- reducing time spent in the provision process with a streamlined, fast, and efficient model that moves seamlessly from facts to the footnotes

- providing strong review and audit support

- allowing professionals to spend more time reviewing the provision itself and assessing tax positions instead of laboring in Excel

- centralizing and controlling the tax provision process even for multinational companies with globally distributed tax functions

- generating robust and accurate automated rate reconciliations that always tie

[Download our Buyer’s Guide to Tax Provision Software for a helpful step-by-step process for evaluating tax software.]

Save time preparing deliverables and streamline the review process

Tax provision software delivers audit-ready tax reporting within the tight timelines tax professionals are facing. In addition to enabling a full understanding of your company’s tax rate drivers, software improves tax-related internal controls (SOX), and reduces the risk of control deficiencies or weaknesses.

Software enables more granular reporting across jurisdictions, so you don’t need a lot of manual effort, such as organizing hundreds of spreadsheet rows or creating multiple PDFs from Excel for review.

This allows tax professionals to reduce the amount of time spent preparing deliverables – they just input their work and the deliverables flow out of the systems. Plus, you can easily overcome the “same as last year” mentality and provide the detail auditors need.

When it comes to the review process, Bloomberg Tax Provision software in particular saves users time. The software can automatically generate comparative reports that would otherwise require a significant amount of manual work in Excel to create.

Changes and updates are automated, improving internal controls

Provision software saves time when dealing with business or tax law changes by ensuring that calculations automatically flow through all components of the provision.

When the organization has a change, users simply add the new adjustments, filings, or entities in one area in the software, and they flow to where they need to go.

Last-minute changes during reporting are also common for departments with heavy workloads and time crunches. You can make edits and rest easy knowing the software cascades the changes for the entire provision. Instead of checking and rechecking Excel formulas, updates in the software flow to other impacted areas automatically.

Bloomberg Tax Provision software is especially powerful when considering uncertain tax positions (UTPs). Because ASC 740 prescribes a framework for dealing with UTPs and any related uncertain tax benefits (UTBs), tax professionals who have questions about UTBs will find the program easily uploads and integrates all data throughout the tax provision. It tracks UTBs issue by issue, resulting in more accurate tracking as issues are settled and statutes expire.

It also improves accuracy in state calculations because it allows the user to get away from using a blended rate for state deferred taxes without the laborious undertaking that would come from calculating and tracking this in Excel. Instead, users can simply add a new state, and the software will automatically update applicable apportionment rates and state tax rates and recalculate deferred balances precisely and quickly.

Simple, user-friendly interface allows for collaboration and efficiencies

With provision software, tax departments do not need to depend on team members with an intricate knowledge of existing spreadsheets to manage the ASC 740 provision process. Bloomberg Tax Provision software standardizes provision workflows and reduces risk by allowing tax departments to divide duties via granular permission access controls at the provision, return, and entity levels. It also enables multiple users to work on tax provision concurrently.

Additionally, your tax workpapers become the application’s provision data model, so you don’t need to memorize another department’s nomenclature or structures. Every schedule uses the same entity and description labels, which will all tie and agree.

[Learn more about how Bloomberg Tax Provision software saves time and reduces risk while accurately calculating income taxes under ASC 740.]

Trust Bloomberg Tax Provision for fast, accurate calculations

Companies might be hesitant to switch from Excel to tax software since there are a lot of tech solutions on the market that overpromise but underdeliver. Download our Buyer’s Guide to Tax Provision Software for a step-by-step process to help tax leaders successfully evaluate provision software.

Bloomberg Tax Provision will help you manage risk, save time, and ensure accuracy. Our software is a complete ASC 740 solution, providing strong review and audit support with Excel reports that include formulas, something our competitors don’t do. It’s intuitive, robust, and the rate rec always ties. In addition, Bloomberg Tax’s software supports companies with existing reporting needs and those with additional calculations due to business changes, such as expansion into new jurisdictions. Most importantly, it’s built by tax practitioners for tax practitioners.

Unlike other tax provision solutions, Bloomberg Tax Provision is extremely fast to implement, learn and use.

National hybrid IT provider Flexential ran Bloomberg Tax Provision and Excel side-by-side for a year. During that period, Flexential experienced significant business growth, in which only Bloomberg Tax Provision could satisfy their tax needs.

“Bloomberg Tax Provision was faster, easier, more precise, and much more flexible [compared to Excel],” said Flexential’s tax manager. “When you can create your provision in Excel, there are so many manual steps and processes in place that it leaves a good amount of risk in an environment where it is critical to get everything correct. With Bloomberg Tax Provision, you enter data once, and it knows how to flow through.”

To learn more, schedule a free demo.