ASC 740: Uncertain Tax Positions

How to recognize and measure uncertain tax positions under ASC 740

ASC 740 includes rules for accounting for uncertain tax positions (UTPs). These rules clarify the accounting for uncertainty in income taxes recognized in a company’s financial statements and establish rules for recognizing and measuring tax positions taken on the company’s income tax return.

Navigate the ASC 740 tax provision with confidence

Bloomberg Tax Provision offers unmatched expert insights and analysis to help financial accounting professionals develop and implement complex accounting strategies to navigate the nuances of U.S. GAAP with confidence.

What is an uncertain tax position?

Applying tax law to a company’s facts is often subject to uncertainty. That uncertainty can arise from ambiguity in the law, case law, or regulations, how the company applies the law to its facts, or even a lack of guidance regarding certain types of transactions.

As such, ASC 740 prescribes a framework for dealing with uncertain tax positions and any related uncertain tax benefits (UTBs) arising from a UTP where the company has not recognized the full benefit of the position when calculating the ASC 740 provision for income tax.

Tax positions

For the purposes of ASC 740, a tax position is any position in a previously filed tax return or a position the company expects to take on a future tax return. The term tax position also encompasses, but is not limited to:

- A decision not to file a tax return

- An allocation or a shift of income between jurisdictions

- The characterization of income or a decision to exclude reporting income in a tax return

- A decision to classify a transaction, entity, or other position in a tax return as tax-exempt

- The characterization of an entity’s status, including its status as a pass-through entity or a tax-exempt not-for-profit entity

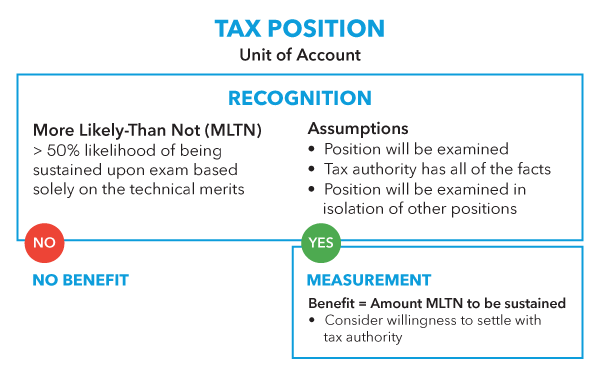

An overview of the accounting for uncertain tax positions, including the two-step (recognition and measurement) more-likely-than-not process.

What are the criteria for recognizing the benefits of an uncertain tax position under ASC 740?

For each tax position, the company must identify the unit of account for determining what constitutes an individual tax position and the rationale for the conclusion. The determination is a matter of judgment based on all available evidence, including how the entity prepares and supports its income tax return and the approach the entity anticipates the taxing authority will take during an examination.

Recognition test

The first step is to evaluate whether it is more likely than not (greater than a 50% chance) that the taxing authority would sustain the position solely on its technical merits.

The recognition test assumes that the tax authority will examine the uncertain tax position and has full knowledge of all relevant facts. No consideration is given to offsetting or aggregating tax positions in negotiations with the tax authority.

In evaluating the technical merits of a particular tax position, a company may consider past examination activity only to the extent that the taxing authority explicitly agreed to the item.

If the recognition test is not satisfied, the company cannot recognize a benefit for the uncertain tax position.

Measurement test

To the extent the more-likely-than-not recognition threshold is met, the amount of benefit recognized is the amount that is more likely than not (greater than 50% chance) to be sustained upon examination, including all appeals or negotiations.

This analysis for the measurement test often depends on whether the position is an “all-or-nothing position. An all-or-nothing position is where success on the technical merits (i.e., satisfying the recognition test) essentially means the entire benefit will be realized at the appropriate measurement amount.

A position that is not all-or-nothing allows for many possible resolutions to the underlying technical issue. For these positions, professional judgment is necessary for determining the measurement amount.

In applying the recognition and measurement tests, all information available on the reporting date should be considered, including the company’s willingness to settle or litigate a position with the taxing authority.

When can an entity recognize the benefit of an uncertain tax position?

To recognize an uncertain tax benefit, an entity must meet the more-likely-than-not recognition threshold in the period for which a tax position is taken or expected to be taken.

If the recognition threshold is not met, the entity can recognize the benefit of the tax position in the first interim period that meets any one of the following conditions:

- The more-likely-than-not recognition is met by the reporting date.

- The tax position is effectively settled through examination, negotiation, or litigation.

- The statute of limitations for the relevant taxing authority to examine and challenge the tax position has expired (ASC 740-10-25-8).

Recognizing a tax position as effectively settled

An entity can recognize the benefit of a tax position when it is effectively settled (740-10-25-8(b)). A tax position can be effectively settled upon examination by a taxing authority.

Assessing whether a tax position is effectively settled is a matter of judgement because examinations occur in a variety of ways. In determining whether a tax position is effectively settled, an entity shall make the assessment on a position-by-position basis, but an entity could conclude that all positions in a particular tax year are effectively settled (ASC-740-10-25-9).

A position that has not met the recognition test may become effectively settled if it meets the following requirements (ASC-740-10-25-10):

- The taxing authority has completed its examination procedures, including all appeals and administrative reviews that the taxing authority is required and expected to perform for the tax position.

- The entity does not intend to appeal or litigate any aspect of the tax position included in the completed examination.

- The possibility of the taxing authority examining or reexamining any aspect of the tax position is remote. In making this assessment, management shall consider the taxing authority’s policy on reopening closed examinations and the specific facts and circumstances of the tax position. Management shall presume the relevant taxing authority has full knowledge of all relevant information while assessing whether the taxing authority would reopen a previously closed examination.

In the tax years under examination, a tax position does not need to be specifically reviewed or examined by the taxing authority to be considered effectively settled through examination. However, effective settlement of a position subject to an examination does not result in effective settlement of similar or identical tax positions in periods that have not been examined (ASC 740-10-25-11).

Changes to corporate facts may impact the recognition of an uncertain tax position

All new information – including changes in tax laws, regulations, court cases, and examination activity – should be evaluated for any impact on the more-likely-than-not recognition or measurement of tax positions. When evaluating new information, companies must consider all the facts and circumstances that occur after the reporting date but before the release of the financial statement. A previously recognized tax position that subsequently fails to meet the more-likely-than-not recognition standard is derecognized in the first interim period in which the recognition threshold is no longer met.

An entity may obtain information during the examination process that enables it to change its assessment of the technical merits of a tax position or of similar tax positions taken in other periods. However, the effectively settled conditions in paragraph 740-10-25-10 do not provide any basis for the entity to change its assessment of the technical merits of any tax position in other periods (ASC 740-10-25-12).

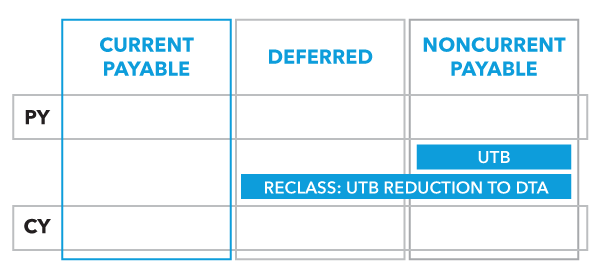

Accounting for unrecognized tax benefits on a balance sheet

Typically, for each uncertain tax position that is not fully recognized:

- Record the UTB as a noncurrent liability with an offsetting debit to noncurrent income tax expense.

- Record a gross state liability associated with a U.S. federal position as a noncurrent liability with an offsetting debit to noncurrent income tax expense.

- If the uncertainty relates to the timing of the deduction rather than the deductibility itself, record a deferred tax asset related to the position with an offsetting credit to deferred income tax expense. The company should record the deferred tax asset at the tax rate expected to be in effect in the period in which the item will reverse rather than the rate at which the noncurrent liability is recorded.

- Record a deferred tax asset related to the federal benefit associated with any state noncurrent liability.

How unrecognized tax benefits interact with carryforwards

ASC 740-10-25-16 states:

“A liability is created (or the amount of a net operating loss carryforward or amount refundable is reduced) for an unrecognized tax benefit because it represents an entity’s potential future obligation to the taxing authority for a position that was not recognized.”

A company with an uncertain tax benefit that would either reduce a net operating loss (NOL) or tax credit carryforward if it was resolved in the taxing authority’s favor would not record a noncurrent liability. Instead, it would reduce the deferred tax asset associated with the carryforward for the uncertain tax benefit.

In this situation, a company would record a noncurrent liability only in the case where there would be an economic liability after losing the position. The deferred tax asset related to a particular carryforward represents the amount estimated to be sustained upon examination.

If a company utilizes the deferred tax asset related to the carryforward before the resolution of the uncertain position, it records the uncertain tax benefit as a noncurrent liability.

Accounting for carryforwards: previous year (PY) and current year (CY)

Interest and penalties from uncertain tax positions

A company must accrue the appropriate interest and penalties associated with its uncertain tax benefits. The company makes a policy election to either include interest and penalties related to uncertain tax positions as part of its pretax income or as a component of income tax expense.

Interest and penalties are expensed on a gross basis in the period in which they accrue. The company includes them in its noncurrent liability unless it expects to pay the interest and penalties within 12 months of the balance sheet date, in which case they are reported in income taxes currently payable.

Record a deferred tax asset related to any federal, state, or foreign deductibility of the accrued interest. A company’s net income will be the same under each policy. If it includes interest and penalties in pretax income, the company will add back the penalties as a permanent item and add back the interest as a temporary item, resulting in a deferred tax asset but no impact on the tax rate.

If the company includes interest and penalties in income tax expense, they are included as an additional expense on a gross basis (not tax effected). The company should record a deferred tax asset for the federal and state benefit of the interest. Each item impacts the tax rate.

How do foreign uncertain tax positions affect the ASC 740 tax provision?

Foreign uncertain tax positions are accounted for in the same manner as U.S. positions but can add additional complications.

Changes in the value of foreign UTBs arising solely due to foreign exchange rate changes are accounted for as currency translation adjustments (CTAs), a component of other comprehensive income (OCI), rather than as a component of operating income.

Certain jurisdictions require taxpayers to make deposits to contest or appeal a position. The deposits reduce the noncurrent payable but do not necessarily change the amount of the UTB recognized or disclosed.

There are often U.S. or other jurisdictional implications related to foreign UTBs. For example, transfer pricing UTBs may result in offsetting benefits in the tax jurisdiction of the trading partner.

Similarly, the foreign taxes arising from a foreign UTB may result in U.S. foreign tax credits (FTCs) that need to be accounted for. These FTCs will need to be analyzed for the appropriate translation rules, foreign sourcing baskets, and realizability from a valuation allowance perspective.

Required disclosures for uncertain tax positions

A company is required to make several disclosures with respect to uncertain tax positions.

Tabular roll-forward of uncertain tax positions

Annually, a company must disclose a roll-forward of the change in the amount of uncertain tax benefits in the following categories:

- Increases related to current year positions

- Increases and decreases related to prior year positions

- Settlements of positions with a taxing authority

- Reductions to unrecognized tax benefits as a result of the lapse of the applicable statute of limitations

The tabular roll-forward should include only the tax amounts associated with uncertain tax positions. Consequently, the disclosed amount will not necessarily correspond with the noncurrent payable in the financial statements for several reasons:

- Interest and penalties that have been accrued to the noncurrent payable will not be disclosed in the tabular roll-forward.

- Some UTBs are recorded as reductions to NOL and tax credit-deferred tax assets rather than noncurrent payable amounts. These UTBs are included in the tabular roll-forward.

- Deposits made to a tax authority for a contested UTP will reduce the noncurrent payable but will not be disclosed in the tabular roll-forward.

Furthermore, the tabular roll-forward should not include any benefits that may arise in a jurisdiction due to an uncertain tax position in another jurisdiction.

Current tax assets associated with uncertain tax positions may also be included in the reconciliation if necessary.

In all reporting periods, the company must disclose the total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate.

Recognized interest and penalties

A company must disclose the total amount of interest and penalties recognized in the income statement and the total amounts of interest and penalties recognized in the statement of financial position.

Policy with respect to interest

A company must disclose its policy election to either include interest and penalties associated with uncertain tax benefits as part of pretax income or as a component of income tax expense.

Years subject to examination

A company must disclose the years that are open to examination for its major jurisdictions.

Expected change in the gross uncertain tax positions

For uncertain tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly increase or decrease within 12 months of the reporting date, the company must disclose the following:

- The nature of the uncertainty

- The nature of the event that could occur in the next 12 months that would cause the change

- An estimate of the range of the reasonably possible change or a statement that the company cannot estimate the range

Untangle ASC 740’s complexity with Bloomberg Tax

Trade complicated spreadsheets for simplicity and accuracy. Tax professionals can use ASC 740 tax provision software to manage controls and efficiencies better than in Excel. Take control of your ASC 740 tax provision process and navigate the biggest hurdles with the most powerful ASC 740 calculation software on the market. Bloomberg Tax Provision solves the technical and process issues involved in calculating your income tax provision.

See for yourself. Get tax tools and expertise with our provision software and research platform. Request a demo today.