Explore how Bloomberg Tax Provision’s new rate rec automatically adapts to ASU 2023-09 to simplify reporting compliance.

ASC 740 Valuation Allowances for Deferred Tax Assets

Determine if a valuation allowance is required for a deferred tax asset – including tax planning strategies, evaluating positive and negative evidence, and its effect on income statements

Like most tax provision subjects, correctly handling valuation allowances requires tax and accounting expertise. Thankfully, practitioners no longer need to maintain cumbersome spreadsheets to document their assessment of whether a valuation allowance is required or calculate the allowance. Bloomberg Tax Provision offers a complete ASC 740 tax provision solution, allowing companies to easily handle valuation allowances

In-depth guidance and industry perspectives on ASC 740 tax provision

Bloomberg Tax Provision offers unmatched expert analysis to help financial accounting professionals develop and implement complex accounting strategies to navigate the nuances of U.S. GAAP with confidence.

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. This applies only to taxes based on income – not sales, payroll, or property taxes – per ASC 740-10. Valuation allowances impact the ASC 740 provision for income tax required by U.S. GAAP.

What is a valuation allowance for deferred tax assets?

A valuation allowance is a mechanism that offsets a deferred tax asset (DTA) account.

DTAs – whether resulting from deductible temporary differences, operating loss carryforwards, or tax credits – must be evaluated for realizability.

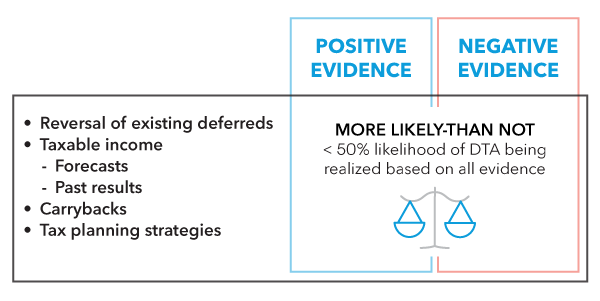

A company should perform the analysis after considering the two-step recognition standard regarding uncertain tax positions. All available evidence – both positive and negative – should be considered to determine whether, based on the weight of that evidence, a valuation allowance for DTAs is needed.

This realizability test doesn’t result in a measure of expected value for DTAs. Instead, a valuation allowance is established for any DTA that is more likely than not (at least 50%) to NOT be realized. This is not a question of tax law, but a question of judgment regarding the company’s future.

A company may reach different conclusions in different tax jurisdictions concerning the need for a valuation allowance for the same entity or entities.

[Bloomberg Tax Provision offers a complete ASC 740 tax provision solution, allowing companies to easily handle valuation allowances.]

How do you determine when to recognize a valuation allowance for deferred tax assets?

ASC 740-10-30-18 states that future realization of the tax benefit of an existing deductible temporary difference or carryforward ultimately depends on whether the company has sufficient taxable income of the appropriate character (for example, ordinary income or capital gain) within the carryback/carryforward period available under the tax law.

The following four possible sources of taxable income may be available under the tax law to realize a tax benefit for deductible temporary differences and carryforwards:

- Future reversals of existing temporary differences

- Future taxable income exclusive of reversing temporary differences and carryforwards

- Taxable income in prior carryback year(s) if tax law permits carryback

- Tax planning strategies (see paragraph 740-10-30-19) that would, if necessary, be implemented to, for example:

- Accelerate taxable amounts to utilize expiring carryforwards

- Change the character of taxable or deductible amounts from ordinary income or loss to capital gain or loss

- Switch from tax-exempt to taxable investments

Deferred tax liabilities

In assessing the need for a valuation allowance, a company that can’t forecast future income may be required to schedule the reversal of temporary differences to determine the amount of deferred tax liabilities (DTLs) expected to offset the deferred tax assets. The company should use a systematic and logical methodology to schedule the reversals. If no other sources of taxable income are available, the company should record a valuation allowance against the residual amount of DTAs that are not offset by DTLs in the scheduling exercise.

The 80% limitation on federal NOL utilization and the Section 163(j) interest deduction limitation, combined with the indefinite carryforward nature of those attributes, impact the way DTAs are scheduled to reverse.

A valuation allowance is recorded solely against DTAs, not DTLs. To the extent that DTLs will reverse and allow the company to utilize all its DTAs, no valuation allowance is recorded. Consequently, it is common – in companies that have determined that a valuation allowance is necessary – to record a valuation allowance equal to the amount that DTAs exceed DTLs.

ASC 740 tax planning strategies for realizing a deferred tax asset

Under ASC 740, tax planning strategies are a source of taxable income to realize a deferred tax asset. The ASC 740 definition is different from what tax professionals typically consider to be corporate tax planning strategies. For example, a tax planning action that reduces the amount of tax a company is going to pay through the acceleration of depreciation deductions isn’t a tax planning strategy for the purposes of ASC 740; instead it would be a tax planning action.

Under ASC 740-10-55-39, a tax planning strategy has a very specific definition. A qualifying tax planning strategy is an action that:

- Is prudent and feasible. Management must have the ability to implement the strategy and expect to do so unless the need is eliminated in future years. For example, management would not have to apply the strategy if income earned in a later year uses the entire amount of carryforward from the current year.

- An entity ordinarily might not take, but would take to prevent an operating loss or tax credit carryforward from expiring unused. All the various strategies expected to be employed for business or tax purposes other than utilization of carryforwards that would otherwise expire unused are, for purposes of this subtopic, implicit in management’s estimate of future taxable income and, therefore, not tax planning strategies as that term is used in this topic.

- Would result in the realization of DTAs. The effect of qualifying tax planning strategies must be recognized when determining the amount of a valuation allowance.

When evaluating the need for a valuation allowance, tax planning strategies include:

- Elections for tax purposes

- Strategies that shift estimated future taxable income between years

- Strategies that shift the estimated pattern and timing of future reversals of temporary differences

A plan that involves the repatriation of earnings from an entity whose earnings meet the indefinite reversal criteria does not constitute a tax planning strategy.

[Bloomberg Tax Provision offers a fully integrated approach where changes in one area automatically flow to all relevant areas without additional effort. For example, temps on the current screen flow directly to the deferred screen.]

Evaluating positive and negative evidence for realizing valuation allowances

The determination of realizability of a valuation allowance is highly subjective. It requires an evaluation of all available evidence and goes to an assessment of the relative weight of the evidence.

Some evidence may be positive, and some may be negative. Positive evidence generally supports an opinion that a valuation allowance is not needed. Conversely, negative evidence suggests that a valuation allowance should be established.

Positive evidence

According to ASC 740-10-30-22, examples (not prerequisites) of positive evidence that might support a conclusion that a valuation allowance is not needed when there is negative evidence include, but are not limited to:

- Existing contracts or firm sales backlog that will produce more than enough taxable income to realize the deferred tax asset based on existing sales prices and cost structures

- An excess of appreciated asset value over the tax basis of the entity’s net assets in an amount sufficient to realize the deferred tax asset

- A strong earnings history exclusive of the loss that created the future deductible amount (tax loss carryforward or deductible temporary difference) coupled with evidence indicating that the loss (for example, an unusual, infrequent, or extraordinary item) is an aberration rather than a continuing condition

Negative evidence

Under ASC 740-10-30-21, forming a conclusion that a valuation allowance is not needed is difficult when there is negative evidence such as cumulative losses in recent years. Other examples of negative evidence include, but are not limited to, the following:

- A history of operating loss or tax credit carryforwards expiring unused

- Losses expected in early future years (by a presently profitable entity)

- Unsettled circumstances that, if unfavorably resolved, would adversely affect future operations and profit levels on a continuing basis in future years

- A carryback, carryforward period that is so brief it would limit the realization of tax benefits if a significant deductible temporary difference is expected to reverse in a single year or the entity operates in a traditionally cyclical business

Valuation allowances and share-based compensation

With respect to deferred tax assets associated with share-based awards, the existence of underwater options (i.e., options where the exercise price exceeds fair value) is not negative evidence in considering the need for a valuation allowance. However, if a deferred tax asset associated with underwater options is material, it should be disclosed.

Weight given to positive and negative evidence

ASC 740-10-30-23 states that:

“An entity shall use judgment in considering the relative impact of negative and positive evidence. The weight given to the potential effect of negative and positive evidence shall be commensurate with the extent to which it can be objectively verified. The more negative evidence that exists, the more positive evidence is necessary and the more difficult it is to support a conclusion that a valuation allowance is not needed for some portion or all of the deferred tax asset. A cumulative loss in recent years is a significant piece of negative evidence that is difficult to overcome.”

According to ASC 740-10-30-24, future realization of a tax benefit sometimes will be expected for a portion, but not all, of a DTA and the dividing line between the two portions may be unclear. In those circumstances, application of judgment based on a careful assessment of all available evidence is required to determine the portion of a deferred tax asset for which it is more likely than not that a tax benefit will not be realized.

In practice, companies will often record a valuation allowance in a period in which they report a cumulative pretax loss, adjusted for permanent items, based on the previous 12 quarters of activity. A company in that situation will typically not consider forecasts of future income as positive evidence.

How is a valuation allowance recorded in income statements?

If the determination is made that a valuation allowance is necessary, the existence of deferred tax liabilities related to indefinite-lived intangibles will result in a situation where the valuation allowance recognized either exceeds the amount of any net deferred tax asset or requires the recognition of a valuation allowance for a company in a net DTL position.

Releasing a valuation allowance

A valuation allowance should be reversed in the period in which the positive evidence outweighs the negative evidence. The reversal of the valuation allowance will be recorded as a deferred income tax benefit.

A company should give significant attention to the appropriate timing of releasing a valuation allowance. Companies should particularly focus on the interim period in which evidence becomes known or knowable with respect to the recognition or reversal of a valuation allowance.

No backward tracing to other comprehensive income

Certain items are recorded in other comprehensive income (OCI) rather than the income statement. These items include, among others:

- Currency translation adjustments (CTAs)

- Pension and post-retirement actuarial gains and losses and amortization of prior service costs

- Unrealized gains and losses on available-for-sale (AFS) securities

To the extent a valuation allowance is established against an item recorded to the OCI, the valuation allowance will not be recorded to OCI but instead will be recorded to income tax expense.

Interim reporting

For interim reporting, if a portion of the valuation allowance recorded or removed relates to current year activity (i.e., earnings, permanent items, and reversals of temporary items), that amount is included in the annual effective tax rate calculation rather than adjusted discretely. Conversely, the amount of valuation allowance that relates to past and future earnings is released as a discrete item.

Examples of ASC 740 valuation allowances

These videos demonstrate various scenarios of how valuation allowances under ASC 740 affect income statements for a single U.S. entity with a single state income tax return.

Example 1: Full U.S. valuation allowance

In this example, the single U.S. entity:

- Has a history of losses

- Has concluded that a valuation allowance is required against its net deferred tax assets

- Owns a controlled foreign corporation (CFC) with a history of profitability

Example 4: CFC valuation allowance release

In this example, the single U.S. entity:

- Owns a CFC with a history of losses but has become profitable

- Has concluded that a valuation allowance is no longer required against its net deferred tax assets

This ASC 740 example discusses the interim impacts of the valuation release regarding the component recognized in the annual effective tax rate versus as a discrete item.

Example 5: U.S. valuation allowance release

In this example, the single U.S. entity:

- Has a history of losses but has become profitable

- Has concluded that a valuation allowance is no longer required against its net deferred tax assets

- Owns a CFC with a history of profitability

This ASC 740 example discusses the interim impacts of the valuation release regarding the component recognized in the annual effective tax rate versus a discrete item.