State income taxes are generally deductible on corporate federal income tax returns. So, to accurately calculate their current federal income taxes payable, companies need to understand their state income tax liability.

How are state income taxes accounted for under ASC 740?

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. Because state income taxes are deductible for corporate federal income tax purposes, a company’s state income tax calculation will impact current and deferred tax assets and liabilities as part of their ASC 740 income tax provision calculation.

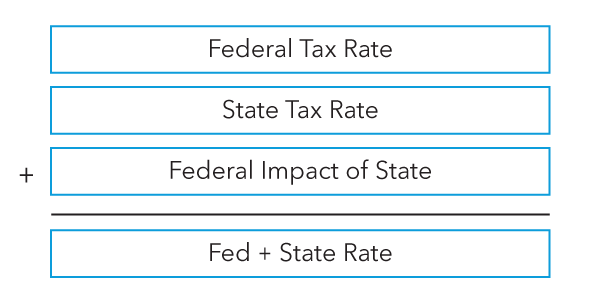

Companies calculate their deferred taxes at a combined federal and state rate, net of the federal benefit from the deduction of state income taxes. Similarly, ASC 740 disclosure requirements mean companies report the impact of state income taxes net of the federal tax benefit on the effective tax rate.

Combined federal and state tax rate calculation

Though most states use federal taxable income as the starting point for calculating state taxable income, state income tax laws often differ significantly from U.S. tax law. To account for those differences, states make modifications, known as additions and subtractions.

State income tax rates

State corporate income tax rates vary significantly among the states that impose an income tax. The top marginal tax rates are typically in the 6-12% range.

Paying income tax in multiple states

ASC 740 requires companies to calculate income tax provisions for each jurisdiction in which it is subject to tax. However, due to state apportionment and income tax rates being much lower than the federal rate, state income taxes tend to be relatively small compared to the federal income tax liability. Therefore, situations arise where a company uses a blended state tax rate to account for all or a portion of its state income tax provision. The decision to use a blended rate should be evaluated as facts change.

How do differences between federal and state income tax impact the ASC 740 income tax provision?

Certain states do not allow taxpayers to file consolidated tax returns. Consequently, many companies must file a separate return for each entity that conducts business in a particular state.

Some states allow entities to file combined returns, also known as unitary returns. However, the filing groups in these combined returns may be based on different principles than those governing federal consolidated returns. As a result, there are situations where a combined state return may include entities that are not included in the federal group or exclude entities included in the consolidated federal return.

State net operating losses and tax credits

State net operating losses (NOLs) are accounted for as deferred tax assets, similar to federal NOLs. However, they often differ in the carryforward or carryback (if any) period and whether the carryforward is based on modified state income prior to apportionment or after apportionment. Due to budget issues, some states have enacted laws suspending or limiting the use of NOLs.

Many states allow taxpayers to offset their state income tax liability with credits. These tax credits tend to relate to research and development expenditures, job creation initiatives, and certain industries in the state.

State NOLs and credits are recorded net of the federal benefit because they reduce state income taxes and, therefore, create an increase in future federal income.

Changes to state tax laws and income tax rates

Companies may encounter state tax law changes that impact the income tax provision. ASC 740 requires companies to account for changes to state income tax rates or laws during the period in which the law is enacted.

A state tax rate change will often require a company to “reprice” its deferred tax assets and liabilities, resulting in a deferred impact on the effective tax rate.

If a law changes after the end of a reporting period but prior to the release of the financial statements, the company must base its income tax provisions on the law in effect as of the balance sheet date. However, it should disclose any material impact of subsequent changes to the law.

Pass-through entity taxes

Historically, pass-through entities are not subject to state income tax because the tax consequences of transactions within the pass-through entity “flow through” to its owners. However, an increasing number of states have started embracing an entity-level income tax on pass-through entities.

Pass-through entities that issue GAAP-based financial statements must be mindful of the consequences of a state’s pass-through entity tax on its tax provision.

The first step is to determine whether the pass-through entity tax is within the scope of ASC 740. This means the tax:

- Must be paid by the pass-through entity alone

- Must be based on taxable income

Unfortunately, because state pass-through entity taxes are inconsistent, some of those taxes will be within the scope of ASC 740 while others will be treated as a transaction with the owners.

How do corporations allocate taxable income between states when calculating the income tax provision?

Certain types of income, such as portfolio interest and dividend income, may be directly allocated to a particular state. Income not directly allocated to a state is apportioned based on an apportionment percentage.

The apportionment percentage is a ratio of certain in-state apportionment factors to the total amounts for those same factors. Typically, apportionment factors include sales, property, and payroll. The specific items included in the factors and the relative weight given to each varies from state to state.

In recent years, states have made a general shift toward either a single sales factor apportionment method or increasing the sales factor weight relative to the other factors.

What are the ASC 740 disclosure requirements for state tax provision?

Typically, the rate reconciliation disclosure presents state income taxes net of the federal benefit. Alternatively, the components of expense may show the gross state current and deferred expense and the federal current and deferred expense net of the state tax.

Examples: Accounting for state income taxes under ASC 740

These videos provide examples of the different ways state income tax affects the ASC 740 tax provision calculation for various types of entities.

Example: Single state tax return

This ASC 740 example discusses the tax effects of state taxes on deferred tax assets and liabilities and the federal impact of state income taxes when the entity is:

- A single entity

- Filing a single state tax return

See how Bloomberg Tax Provision untangles ASC 740’s complexity

The ASC 740 income tax provision calculation is one of the most scrutinized and time-consuming aspects of a tax professional’s responsibilities. It requires a nuanced understanding not only of reporting and accounting standards, but also of changes in federal and state tax rules and how those laws interact to affect the income tax provision.

Watch our on-demand webinar for an overview of the basic accounting concepts for state income taxes under ASC 740, including state taxable income, state modifications, state credits, and the impact of state taxes on federal income tax provision.

For a more comprehensive look, download our Essential Guide to ASC 740 to find answers to the technical and process questions that arise when calculating your ASC 740 income tax provision.

Bloomberg Tax Provision is the most powerful ASC 740 calculation engine on the market. It helps tax professionals carry out fast, accurate calculations and deliver controlled, audit-ready reports. Learn how tax professionals can use ASC 740 tax provision software to manage controls and efficiencies better than in Excel.

Request a demo to see how our tax provision software and research platform helps tax professionals navigate the nuances of ASC 740 tax provision with confidence.