Stock-Based Compensation Accounting Under ASC 740

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. ASC 718 provides specific accounting guidance for the various types of stock options that companies use to compensate their employees. It also clarifies how the ASC 740 income tax provision should be applied to stock-based compensation.

What is the accounting treatment for ASC 718 stock-based compensation?

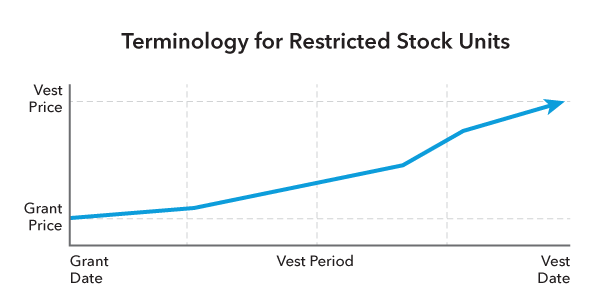

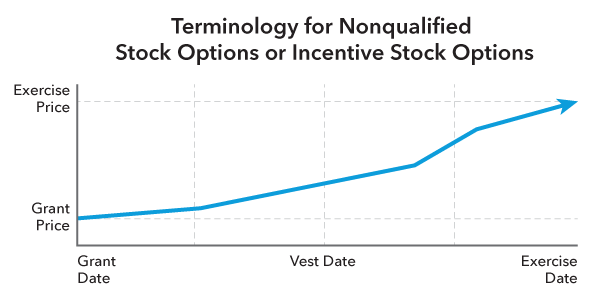

ASC 718 governs GAAP accounting for stock options. The standard requires companies to recognize compensation expense related to their equity awards on an award-by-award basis. The ASC 718 stock-based compensation expense is recorded on financial statements over a vesting period in which the award is earned and offset by a credit to additional paid-in capital (APIC). Depending on the type of equity awarded, the following variables are applied slightly differently to the accounting treatment for stock-based compensation:

- Grant date – The date on which the company grants the award to the employee and typically the day the vesting period begins

- Vest date – The date the award is available for exercise (in the case of options) or the restrictions lapse (in the case of restricted stock units). Options typically vest in tranches over three or four years with a multiple-year exercise period. Restricted stock units typically all vest on the same date after a three or four-year period. This is often referred to as a “cliff vest.”

- Exercise price or strike price – The price, established at the grant date, at which the option is exercisable

- Exercise date – The date an option is exercised

- Vesting period or service period – The period over which the award is earned and becomes available for exercise by the employee

Regardless of subsequent fluctuations in the value of the underlying stock, no subsequent adjustments are made to the total compensation expense associated with a particular award. Furthermore, the existence of underwater options (i.e., options where the exercise price exceeds the fair value) is not negative evidence in considering the need for an ASC 740 valuation allowance for deferred tax assets. However, if the deferred tax asset is material to the financial statements, it should be disclosed.

GAAP accounting for restricted stock units (RSUs)

Restricted stock units (RSUs) are shares of stock awarded to an employee at a future date if the employee satisfies specific vesting requirements, such as continued employment or achievement of performance goals.

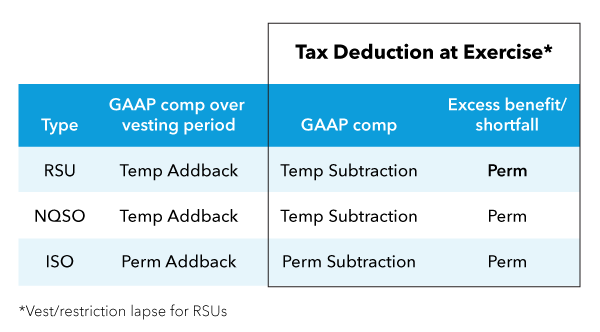

For GAAP, the company records the value of the award as of the grant date as compensation expense over the vesting period with an offsetting credit to APIC. The company also recognizes a deferred tax asset related to the compensation expense in anticipation of the future deduction.

Upon vest, the company receives a tax deduction equal to the fair value of the awards.

The company reverses the deferred tax asset associated with the restricted shares upon vest. It records any excess benefit or shortfall as a discrete benefit or cost in the period in which the RSU is exercised.

Examples of how to treat RSU expense on a balance sheet

These videos demonstrate different scenarios of how RSU awards are treated on financial statements under ASC 740 for a single entity with pretax income and temporary items.

RSUs vested

In this example, the single entity:

- Has RSUs in a vesting year

- Calculates the deferred tax asset associated with the RSU awards

RSUs exercised

In this example, the single entity:

- Has RSUs in a vesting year

- Realizes the vesting of a portion of the RSUs

- Calculates the deferred tax asset associated with the RSU awards

GAAP accounting for nonqualified stock options (NQSOs)

A nonqualified stock option (NQSO) grants an employee the opportunity to purchase a certain number of shares of stock, at the exercise price, after a vesting date. NQSOs are typically subject to a condition of continued employment.

The company calculates the intrinsic value of the options on the grant date using an option-pricing model and records the value as compensation expense over the vesting period with an offsetting credit to APIC.

In anticipation of future deduction, the company recognizes a deferred tax asset related to the stock-based compensation expense.

Upon exercise, the company receives a tax deduction equal to the difference between the fair value of the exercised awards and the exercised price of the awards on the exercise date.

The deferred tax asset associated with the exercised option is reversed. Any excess benefit or shortfall is recorded as a discrete benefit or cost in the period in which the NQSO is exercised.

Examples of how to treat NQSO expense on a balance sheet

These videos demonstrate different scenarios of how NQSO awards are treated on financial statements under ASC 740 for a single entity with pretax income and temporary items.

NQSOs vested

In this example, the single entity:

- Has NQSOs in a vesting year

- Calculates the deferred tax asset associated with the NQSO awards

NQSOs exercised

In this example, the single entity:

- Has NQSOs in a vesting year

- Exercises a portion of the NQSOs

- Calculates the deferred tax asset associated with the NQSO awards

GAAP accounting for incentive stock options (ISOs)

An incentive stock option (ISO) grants an employee the option to purchase a certain number of shares of stock, at the exercise price, after a vesting date. ISOs are typically subject to a condition of continued employment. An option must meet certain statutory requirements to be considered an ISO and qualify for preferential tax treatment.

For GAAP, the company calculates the intrinsic value of the options on the grant date using an option pricing model. It records the value as compensation expense over the vesting period with an offsetting credit to APIC.

Because ISOs do not result in deductions, the company does not record a deferred tax asset. In other words, it treats the compensation expense as a permanent item.

If the employee complies with the requisite holding periods, the company receives no deduction upon exercise.

If the employee does not meet the requisite holding period for preferential treatment (a disqualifying disposition), the company receives a tax deduction equal to the difference between the fair value of the exercised awards and the exercise price of the awards on the exercise date.

The company records any excess benefit or shortfall as a discrete benefit or cost in the period in which the employee exercises the ISO.

Examples of how to treat ISO expense on a balance sheet

These videos demonstrate different scenarios of how ISO awards are treated on financial statements under ASC 740 for a single entity with pretax income and temporary items.

ISOs vested

In this example, the single entity:

- Has ISOs in a vesting year

- Calculates the permanent item associated with the ISO awards

ISOs exercised

In this example, the single entity:

- Has ISOs in a vesting year

- Exercises a portion of the ISOs

- Calculates the permanent item associated with the ISO awards

Is stock-based compensation tax deductible?

Sec. 162(m) sets a $1 million deduction limitation on compensation paid to the top five employees in a publicly traded company. As a result, the company records a deferred tax asset only if it expects the compensation expense to be deductible.

Since GAAP compensation expense associated with stock awards is expensed over the vesting period in periods prior to exercise (in the case of NQSOs) or restriction lapse (in the case of RSUs), companies must estimate the amount of GAAP compensation that will be subject to Sec. 162(m) each year. They treat the estimated nondeductible amount as a permanent item.

When compensation is expected to be limited by Sec. 162(m), there are three approaches for determining the portion of the deduction limitation that is allocated to stock-based compensation:

- Deductible compensation is allocated to cash compensation first. If cash compensation is expected to exceed the limit, the company does not record a deferred tax asset for stock-based compensation.

- Deductible compensation is allocated to the earliest compensation recognized for financial statement purposes. Because stock-based compensation is typically expensed over a multiple-year vesting period but deductible when fully vested or exercised, and cash-based compensation is generally deductible when expensed for financial statement purposes, stock-based compensation is generally considered the earliest compensation recognized for financial statement purposes. The company records a deferred tax asset for stock-based compensation up to the deduction limit.

- Limitation is allocated pro-rata between stock-based compensation and cash compensation. A partial deferred tax asset may result based on the expected ratio of stock-based compensation to cash compensation.

Expired stock awards

If awards expire unexercised, the accounting depends on whether the expired awards have been vested. If an unvested award expires, the company reverses the associated compensation cost and writes off the related deferred tax asset as a permanent item to income tax expense. The compensation cost is not reversed for vested awards, but the deferred tax asset is written off to income tax expense.

Excess tax benefits from stock-based compensation

An excess tax benefit, or windfall benefit, is the amount by which the realized tax benefit associated with an award exceeds the tax benefit associated with the GAAP compensation expense. Excess benefits are recorded as permanent items.

Stock compensation tax treatment differs depending on the ultimate tax implications of stock-based compensation to the company. NQSOs and RSUs ordinarily result in tax deductions to the company and are accounted for as temporary items. Conversely, ISOs, which provide favorable tax treatment to employees and no deduction to the employer, are treated as permanent items.

Regardless of the award type, excess deductions are recorded as discrete items.

Do excess tax benefits impact the effective tax rate?

Though the excess benefits are reported as permanent items, they will not be included in calculating the annual effective tax rate. Since excess benefits will be treated as discrete items, this differentiates the treatment of excess benefits from virtually all other permanent items that would typically be reflected in a company’s return for the year. As such, the company should segregate them from the other permanent items as a process matter.