ASC 740 Reporting and Disclosure Requirements

A guide to provision disclosures, including balance sheet examples and how to account for uncertain tax positions

Calculating your company’s provision for income taxes under ASC 740 is a formidable undertaking. Companies must recognize the effects of income taxes on their financial statements, which is a time-consuming process that requires a nuanced understanding of reporting, accounting standards, and legislation. Save valuable time when you trust Bloomberg Tax Provision to tackle complex provision calculation and reporting tasks with ease.

Access the latest provision resources on Bloomberg Tax

With changing laws and business footprints, ASC 740 disclosure and reporting requirements can be hard to track. Stay on top of the dynamic field of income tax provision with expert analysis, comprehensive coverage, news, and practice tools from Bloomberg Tax.

ASC 740-10-45 and ASC 740-10-50 provide guidance on disclosures pertaining to accounting for the ASC 740 provision for income tax. The guidance outlines specific disclosures required for the balance sheet, income statement, and related notes – plus additional disclosure rules for public vs. nonpublic entities.

Reimagine your provision process with Bloomberg Tax Provision software

ASC 740 balance sheet disclosure requirements

ASC 740 requires the following disclosures about deferred tax balance sheet accounts:

- The total of all deferred tax liabilities, deferred tax assets, valuation allowance recognized for deferred tax assets, and the net change during the year in the valuation allowance (ASC 740-10-50-2). These disclosures effectively “un-net” the balance sheet deferred tax item to their original form

- The types of temporary differences and carryforwards that give rise to significant portions of a deferred tax liability or asset (ASC 740-10-50-8)

- The amounts and expiration dates of operating loss and tax credit carryforwards for tax purposes (ASC 740-10-50-3)

- Any portion of the valuation allowance for deferred tax assets for which future recognized tax benefits may be credited directly to contributed capital (i.e., by elimination of the valuation allowance) (ASC 740-10-50-3)

- Information about temporary differences for which a deferred tax liability has not been recognized because of the “indefinite reversal criteria” in ASC 740-30 (ASC 740-30-50-2)

- If not otherwise evident from other disclosures, companies should disclose the nature and effect of any significant matters affecting comparability of information for all periods presented (ASC 740-10-50-14)

Deferred tax disclosure note

ASC 740-10-50 requires all companies to disclose the types of temporary differences that give rise to significant portions of the deferred tax asset or liability balances.

Nonpublic companies aren’t required to disclose the amounts of temporary differences or describe the tax effect of each. However, public companies are required to present those additional details.

A public entity must disclose the approximate tax effect of each type of significant temporary difference and carryforward that gives rise to a significant portion of deferred tax liabilities and deferred tax assets (before allocation of the valuation allowance). Presumably, this information would be determinable by reference to the calculations that served as the basis for the intrinsic calculations of the deferred tax assets and liabilities.

For example, a company might indicate deferred tax assets relate to nondeductible warranty accruals and deferred tax liabilities relate to the use of accelerated depreciation for tax purposes.

Separate disclosure of the tax effects for each major tax jurisdiction is encouraged but not required.

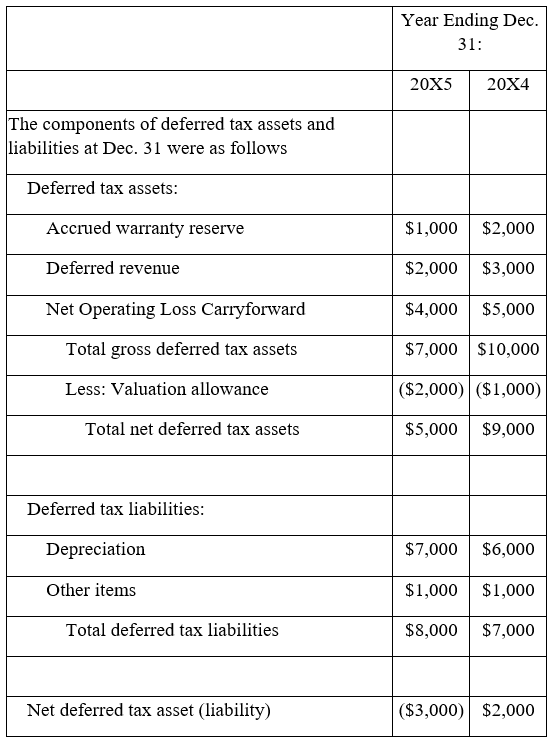

Example: Deferred tax amounts on a balance sheet

The following illustration shows a representative example of a typical public company’s fulfillment of this requirement.

The 20X5 balance sheet would report a net deferred tax liability of $3,000. The 20X4 balance sheet would report a net deferred tax asset of $2,000.

Accounting for unrecognized tax benefits associated with uncertain tax positions

ASC 740-10-50-15 and 15A require additional disclosure of information describing various aspects of unrecognized tax benefits associated with tax positions of unknown eventual outcome. Uncertain tax positions often result in the benefit amount recognized in financial statements differing from the tax return amount. These differences between a tax position taken and a tax position reported under generally accepted accounting principles constitute an unrecognized tax benefit. The unrecognized tax benefit represents either a current or deferred liability – or reduction of net operating loss (NOL) carryforward or reduction of refund – to a taxing authority because it involves a potential future payment.

An unrecognized tax benefit (or portion thereof) giving rise to a NOL or credit carryforward should be presented as a reduction of a deferred tax asset attributable to a net operating loss carryforward (or similar tax loss or tax credit carryforward). Otherwise, the unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined with deferred tax assets. This liability would be reported as a current item in a classified balance sheet when it is anticipated that cash payment (or reduction of receipt) will occur within one year or the operating cycle, whichever is longer. Otherwise, the tax liability will be classified as noncurrent as opposed to a deferred tax liability.

If settlement will occur by other than cash payment, the obligation should not be shown as a current liability. A liability produced for an uncertain tax position should not be combined with deferred tax liabilities except to the extent the recognized tax position affects the tax bases of assets or liabilities, which could result in a taxable temporary difference and change the deferred tax liability.

Typical examples of this situation are where the uncertain tax position relates to the acceleration of a tax deduction in advance of the correct or otherwise more certain tax year.

An entity should not evaluate whether a deferred tax asset expires before the statute of limitations on the tax position or whether the deferred tax asset may be used prior to the unrecognized tax benefit’s settlement.

Disclosure requirements for uncertain tax positions

U.S. GAAP imposes a substantial disclosure requirement for uncertain tax positions. ASC 740-10-50-15 requires a disclosure of the following at the end of each annual reporting period presented:

- The total amounts of interest and penalties recognized in the statement of operations and in the statement of financial position

- For positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change within 12 months of the reporting date:

- The nature of the uncertainty

- The nature of the event that could occur in the next 12 months to cause the change

- An estimate of the range of the reasonably possible change or a statement that an estimate of the range cannot be made

- All tax years that remain open to assessment by major tax jurisdictions

Public entities must additionally disclose the following at the end of each annual reporting period presented:

- A tabular reconciliation of the total amounts of unrecognized tax benefits at the beginning and end of the period, which includes:

- The gross amounts of increases and decreases in unrecognized tax benefits due to tax positions taken during a prior period

- The gross amounts of increases and decreases in unrecognized tax benefits resulting from tax positions taken during the current period

- The amounts of decreases in the unrecognized tax benefits relating to settlements with taxing authorities

- Reductions to unrecognized tax benefits because of a lapse of the applicable statute of limitations

- The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate

These disclosures are required at the end of each annual reporting period, but generally a public company would also be required to disclose events that have a material effect in interim reports. Article 10, Interim Financial Statements, Regulation S-X requires disclosure, generally governed by U.S. GAAP, of significant changes during interim periods of information. Also note that ASC 740-10-50-19 requires, in the notes to its financial statements, that an entity disclose its policy on classification of interest and penalties, per the alternatives permitted in ASC 740-10-45-25.

Net operating loss and tax credit carryforwards

If a portion of a deferred tax asset arises from a net operating loss carryforward (and/or tax credit carryforward), the entity should indicate the amounts and expiration dates, if any. The amount should be determined using the applicable tax laws for the reduction of taxes payable in specific future years’ returns.

It is consistent with full disclosure principles to also note any other limitations that may relate to the realizability of these potential benefits, such as limitations on the use of tax attributes under IRC Section 382 and 383.

Companies should also disclose the nature and potential effects of any tax law provisions that might limit the availability or utilization of those carryforward amounts (e.g., separate-return limitations or limitations caused by changes in ownership).

Subsequent recognition of tax benefits

The tax benefits of an acquired company’s deductible temporary differences, net operating losses, and tax credit carryforwards could be offset by a valuation allowance at the acquisition date in the event management believed that it was more likely than not that the related tax benefits would not be realized. In those cases, the subsequent recognition of the acquired tax benefits that occurred within the measurement period resulting from new information about the facts and circumstances that existed at the acquisition date are recognized through an adjustment to goodwill. Once goodwill is reduced to zero, any additional decrease in the valuation allowance should be reported as a bargain purchase (i.e., as a gain attributable to the acquirer). Effects of changes outside of the measurement period to the valuation allowance established in acquisition accounting, or changes during the measurement period that do not relate to facts and circumstances that existed at the acquisition date, are reported directly as a reduction of income tax expense.

Likewise, the subsequent recognition of tax benefits (by a reduction or elimination of a valuation allowance) that were initially recorded with a valuation allowance as a direct benefit to shareholders’ equity may be credited directly to shareholders’ equity, as opposed to being included in the income statement, depending on the nature of the change of the valuation allowance. In this regard, ASC 740-10-50-3 requires disclosure of any portion of the valuation allowance for deferred tax assets for which subsequently recognized tax benefits will be directly credited to shareholders’ equity.

Indefinite reversal criteria and other exceptions

ASC 740-30-50-2 requires additional disclosures whenever a deferred tax liability has not been recognized for temporary differences because an exception has been met – for example, the indefinite reversal criteria of ASC 740-30. The temporary differences covered by ASC 740-30 include:

- Undistributed earnings of domestic and foreign subsidiaries

- Bad debt reserves of savings and loan institutions

- Policyholders’ surplus of stock life insurance companies

The following should be disclosed whenever a deferred tax liability is not recognized for taxable temporary differences because of the exceptions allowed under ASC 740-30:

- A description of the nature of the temporary differences and the types of events that would cause them to become taxable

- The cumulative amount of each type of temporary difference

- The amount of unrecognized deferred tax liabilities for temporary differences related to investments in foreign subsidiaries and foreign corporate joint ventures that are essentially permanent in duration, if determining that amount is practicable, or a statement that determination of that amount is not practicable

Income statement disclosure requirements

ASC 740-10-50-9 requires companies to disclose the significant components of income tax expenses or benefits attributed to continuing operations for each year presented. These include:

- Current tax expense or benefit

- Deferred tax expense or benefit (exclusive of the effects of other components listed below)

- Investment tax credits

- Government grants (to the extent recognized as a reduction of income tax expense)

- The benefits of operating loss carryforwards

- Tax expense that results from allocating certain tax benefits either directly to contributed capital or to reduce goodwill or other noncurrent intangible assets of an acquired entity

- Adjustments of a deferred tax liability or asset for enacted changes in tax laws or rates or a change in the tax status of the enterprise (e.g., a change from a partnership status to regular corporate tax status)

- Adjustments of the beginning-of-the-year balance of a valuation allowance because of a change in circumstances that causes a change in judgment about the realizability of the related deferred tax asset in future years

ASC 740 requires, for disclosure purposes, that the sum of the above tax components relating to continuing operations equals the amount of income tax expense or benefit reported in the income statement for continuing operations. In other words, insignificant components should be aggregated and included as one amount in the disclosure.

In the case of tax benefits first recognized in the income statement for the utilization of operating loss carryforwards, tax credits, and tax credit carryforwards, the FASB requires separate disclosure of those amounts “in the year recognized” for financial reporting purposes.

Accordingly, disclosure is not required in the year an operating loss or tax credit carryforward is realized in the income tax return if it previously had been recognized in the income statement as part of the deferred tax provision. However, separate disclosure would have been required in that previous year if the item was an operating loss carryforward, tax credit, or tax credit carryforward at that time.

Disclosure of changes in tax laws or rates

A change in tax law, rates, or status can result in a significant adjustment of the total provision for income taxes. For financial reporting purposes, ASC 740 requires disclosure of the effect of adjustments to deferred tax amounts for enacted changes in tax laws or rates as well as, for interim periods, the effect of the change in the estimated annual effective tax rate.

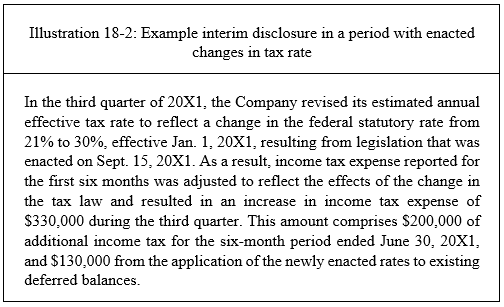

Sample interim disclosure of a change in tax rate

We suggest the following disclosure to be included in interim financial statements for periods that include the effects of enacted changes in tax laws and/or rates.

Interest and penalties on tax deficiencies

Some companies include interest and penalties assessed on income tax deficiencies as a component of interest/other expense while others net these items in the calculation of income tax expense. Either approach is permitted under GAAP. A company’s policy with respect to interest and penalties should be applied consistently, and separately disclosed if material.

ASC 740-10-50-19 requires that an entity disclose its policy on classification of interest and penalties due to taxing authorities in the notes to the financial statements. In addition, ASC 740-10-50-15(c) requires that all entities disclose in the statement of operations and in the statement of financial position the total amounts of the interest and penalties related to tax positions recognized.

The recognition principles that apply when the tax law requires interest to be paid on an underpayment of income taxes require that interest expense be recorded in the first period the interest would begin accruing under the relevant tax law. When a tax position does not meet the minimum statutory threshold to avoid payment of penalties, an expense should be recognized for the amount of the statutory penalty in the period in which the entity claims or expects to claim the position in the tax return (or, if penalties were not recognized when the position was initially taken, then when the entity’s judgment about meeting the minimum statutory threshold changes).

Effective tax rate reconciliation and disclosure requirements

ASC 740 deals with reconciliations of reported tax expense to the amount of tax expense that would result from applying statutory rates to income from continuing operations before tax. The required manner of reconciliation depends on whether the reporting enterprise is public or nonpublic.

ASC 740-10-50-12 requires public companies to reconcile the income tax expense (or benefit) from continuing operations with the amount that would result from applying the domestic federal statutory rate to pretax income (loss) from continuing operations. The statutory rate is the federal or national income tax rate in the entity’s country of domicile (if the company is not domiciled in the U.S.). Different rates should not be used for subsidiaries or other segments of a reporting entity.

When the rate used by a reporting person is other than the U.S. federal corporate income tax rate, the company must disclose the rate used and basis for using such rate. Nonetheless, nonpublic companies also may wish to include an effective tax rate reconciliation to assist users of the financial statements in understanding their tax situation.

While the disclosure rules require public companies to present the nature and amount (using percentages or dollar amounts) of each significant reconciling item (Regulation S-X, Rule 4-08(h)(2)), nonpublic companies need only explain major reconciling items and may omit a numerical reconciliation.

In applying that rule, if no individual reconciling item amounts to more than 5% of the amount computed by multiplying the income before tax by the applicable statutory federal income tax rate, and the total difference to be reconciled is less than 5% of such computed amount, no reconciliation need be provided unless it would be significant in appraising the trend of earnings. Reconciling items that are individually less than 5% of the computed amount may be aggregated in the reconciliation.

The reconciliation may be presented in percentages rather than in dollar amounts. Anecdotal evidence regarding the public entity reconciliation (using percentages or dollars) suggests a slight preference for the percentage-reconciliation approach. There is an impression that the relative impact (percentages) is more meaningful than a dollar value in understanding and evaluating significant drivers of total tax expense.

Some of the typical reconciling items between recorded tax expense and income tax expense computed at the statutory rate are:

- Effects of enacted tax law and tax rate changes on existing temporary differences

- Effects of differences between the enacted tax rate for the current year for net originating temporary differences and enacted tax rates in future periods (or rates used in carryback computations)

- Effects of permanent differences on the current and deferred provisions (e.g., nondeductible items, tax-exempt interest income, alternative minimum tax, investment tax credits)

- Effects of valuation allowances on deferred tax assets

- Effects of differing tax rates in effect in different jurisdictions

An analysis of factors included in a rate reconciliation will serve as a final check on computations made and often will help management explain effects of the liability method computations to others.

Special situations and considerations

Entities not subject to income tax

Some entities are not taxed on their earnings because their income is taxed directly to the owners or shareholders of the entity (e.g., S corporations, limited liability companies, partnerships, and joint ventures). ASC 740-10-50-16 requires public entities not subject to income tax to disclose that fact and the difference between financial reporting and tax bases of assets and liabilities.

Tax-exempt entities such as real estate investment trusts (REITs) and regulated investment companies (RICs) also must disclose that they are not subject to income tax (if they continue to meet the requirements) but may have taxable subsidiaries for which income tax disclosures must still be made.

Separately issued financials for a member of a group filing a consolidated return

An entity that is a member of a group that files a consolidated tax return is required to disclose in its separately issued financial statements:

- The amount of any tax-related balances due to or from affiliates as of each balance sheet date

- The amount of current and deferred tax expense for each income statement presented

- The method of allocating consolidated current and deferred tax expense to members of the group and the effect of any changes in that method during the years presented

ASC 740 now requires an entity that both (1) is not subject to tax and disregarded by the taxing authority and (2) elects to include the allocated amount of current and deferred tax expense in its separately issued financial statements to disclose the fact of the election and provide the disclosures required by ASC 740-10-50-17.