How to Solve Fixed Assets Data Challenges

[Find the tech you need to reduce risk, maximize efficiency, and cut complexity with tax software solutions from Bloomberg Tax.]

Fixed assets data management can be overly complicated. It’s often tedious, time-consuming, and relies on manual processes, leaving room for costly errors. By implementing workflow automation tools, tax professionals can solve common data flow challenges, resulting in reduced risk and more time for high value strategizing and analysis.

Use the steps outlined below to identify your top challenges and goals, and discover how workflow automation can help make them attainable.

1. Determine your most significant pain points and challenges

Study your company’s current workflow to determine where you’re encountering roadblocks, errors, and confusion.

Technical data challenges can often be divided into three groups: data extraction, data transformation, and data control.

Data Extraction Challenges

- Enterprise companies have diverse ERP landscapes and frequently must pull data from two or more ERP systems.

- Gathering data may depend on other departments.

- Data security is a prerequisite, and there is resistance to external, software connecting directly to internal ERP.

Data Transformation Challenges

- Transforming source data into a format useful for tax and accounting systems in Excel is error-prone and time consuming.

- Process involves tedious, manual steps, such as mapping, referencing external files, concatenating, and filtering.

- Existing process is not well-documented, leading to issues with auditability or troubleshooting.

- Excel spreadsheets support a limited number of data rows.

Data Control Challenges

- Source system data may have inconsistencies.

- Identifying the cause of inconsistencies can be challenging with data coming from multiple ERPs.

- Correcting a few data fields is often easier to perform manually.

2. Establish your goals

Where are you now and where do you want to be in the future? Start by understanding your department’s mandates and how they can change based on developments in your company and in the world at large.

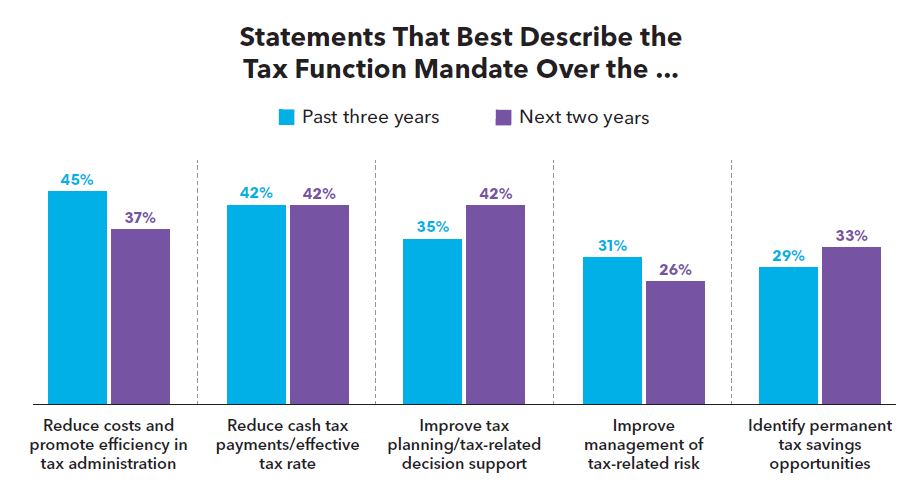

Our 2021 corporate tax survey respondents, for example, report cost reduction as the top concern over the past few years, which were riddled with turmoil due to Covid-19. In the next two years, however, that top concern shifts to a tie between two other responses. Overall, most of the key concerns can be summarized as seeking more efficiency, less risk, and more time for planning and analysis.

Once you establish your mandates, consider the goals you’ll need to achieve in order to uphold them. For many, they will include searching out ways to optimize how you handle data. Corporate tax today is highly manual, spreadsheet based, and relies on repetitive tax rule searching. Processes can be time-consuming and risky.

But the corporate tax department is also at an inflection point as it evolves to become more automated and tech-savvy. Tax professionals are increasingly implementing solutions that can merge corporate tax workflows, from workpapers to deliverables, while prioritizing integration and interconnectivity of data and calculations.

3. Assess your strategy

In terms of strategy, many tax professionals report a need to maximize a limited resource: time.

One of the most common pain points, according to our survey respondents, is simply needing more time to take on complex tasks that can result in big wins. These include planning and analysis – the types of tasks that may not be solved by automation.

What workflow automation can do is save time in other areas by handling repetitive tasks, data management, and busy work. By implementing workflow automation as a part of your strategy, you can earn more time for essential activities such as scenario modeling and strategizing.

If you currently manage fixed assets by outsourcing, for example, using a tax-specific data management solution would offer greater flexibility and direct access to data at all times. Alternatively, if you manage them via an ERP model, Bloomberg Tax Fixed Assets can automate data flow between the ERP system and our Fixed Assets product.

By automating these processes, you bring to your overall business strategy not only the timesaving necessary to achieve your goals, but also increased data accuracy and controls, resulting in risk reduction.

4. Set parameters for choosing a solution

The following checklist is a starting point for determining the attributes that are essential in a software solution:

- Look for automation software with a simple user experience allowing for data to be managed, configured, and reviewed in a single lightweight interface.

- Keep in mind that desktop tools, such as general-purpose and data prep products, are not specialized to suit tax data automation needs.

- Find software that creates traceable documentation artifacts that can be used for audits and compliance review.

- Automation software should increase confidence in the workflow process and data accuracy through a well-designed, built-in review process

5. How can Bloomberg Tax help?

With Bloomberg Tax, you get the tax-specific tools to solve your greatest challenges by automating time-consuming data management processes. We also offer the added benefit of traceable data history, creating trust in the imported data, as well as fast and simple implementation.

The result is a streamlined, lower-risk process that leaves more time for the strategizing, planning, and analysis necessary for your tax department and company at large to achieve their goals.

Using our workflow automation tools, such as Bloomberg Tax Fixed Assets, will help you:

- Gain efficiency and save time by automatically transforming ERP data to fixed assets data and making adjustments in the user interface.

- Increase controls, thanks to a secure cloud environment that offers 24/7 data availability and traceable data history.

- Reduce risk by benefiting from a well-documented, automated process.

- Improve data accuracy by reducing errors from manual entry and exposing errors for review in the user interface before data commit.