Example: How Is a Valuation Allowance Recorded for Deferred Tax Assets?

Companies must record a valuation allowance against a deferred tax asset if it is more likely than not that the deferred tax asset won’t be recognized by the taxing authority. Valuation allowances impact the ASC 740 provision for income taxes required by U.S. GAAP. Like most tax provision topics, correctly recording valuation allowances requires tax and accounting expertise.

Countless potential scenarios could be used to illustrate the interactions that must be considered in deciding on the amount, if any, of a valuation allowance account. The following example illustrates the essential concepts in determining the amount of a valuation allowance account.

Deferred tax asset valuation allowance example

In this example, a company began operations in Year 1 and incurred an operating loss in Year 3. Because a net operating loss carryforward gives rise to a deferred tax asset, the question becomes the degree to which this deferred tax asset should be reduced by a valuation allowance (i.e., how much of the deferred tax asset is not considered realizable). The tax rate is 25% for all years and the only temporary differences are taxable temporary differences related to depreciable assets that are subjected to alternative deprecation rates for tax versus book purposes.

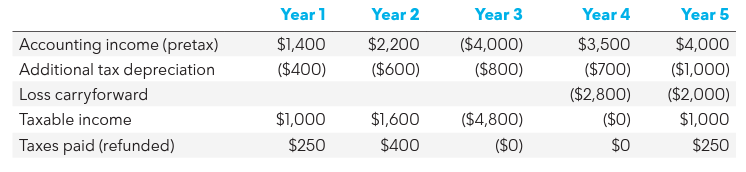

The following table shows the company’s pretax accounting income, along with a reconciliation of taxable income for each year. The actual taxes paid in each year are also shown.

The company performed an assessment as of the end of Year 3 and was unable to conclude that it would be profitable again in the future sufficient to ensure utilization of any of the loss carryforward that then existed (other than by offset against “reversals” of taxable temporary differences). If the positive evidence was deemed sufficient to conclude that the net operating loss was more likely than not to be realized, no valuation allowance would be needed.

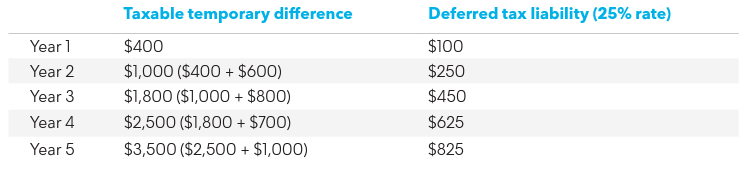

The depreciation pattern results in a book/tax difference in the underlying basis of the depreciable assets, and accordingly produces taxable temporary differences (and corresponding deferred tax liabilities) as follows:

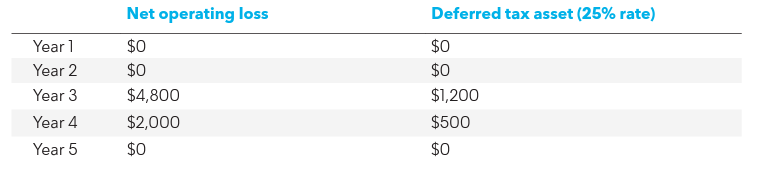

The net operating loss produces the following deferred tax asset, before considering any valuation allowance:

At the end of Year 3, the $1,200 deferred tax asset can be partially realized by an offset against $450 of deferred tax liabilities, but no more. Therefore, an allowance account of $750 ($1,200 – $450) must be established. By the end of Year 4, the valuation allowance would no longer be needed because the deferred tax liabilities ($625) are again more than the deferred tax assets ($500).

Deferred tax valuation allowance journal entry

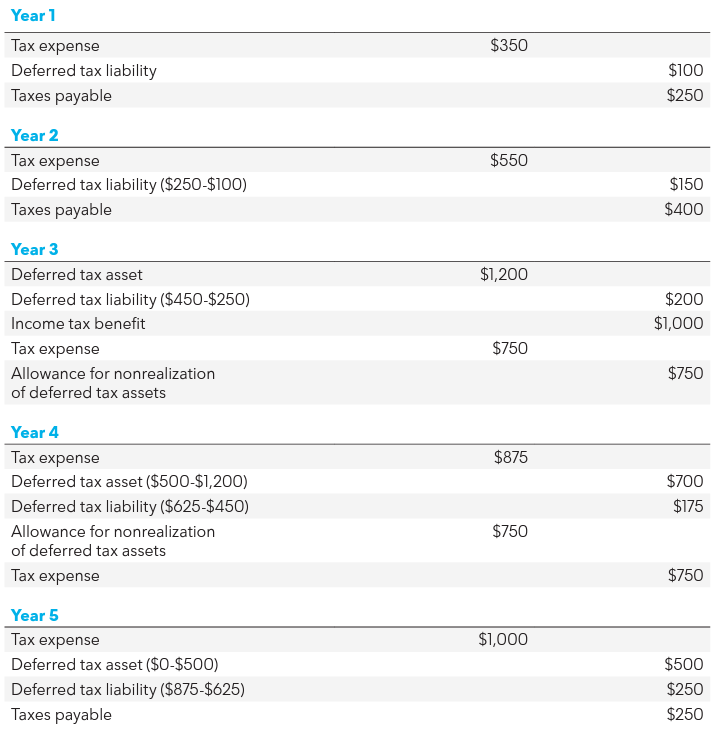

The bookkeeping implications of the preceding illustration are best understood in the context of the following summary journal entries for each year:

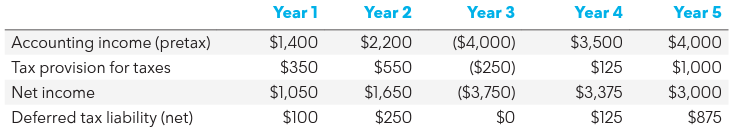

The final financial accounting outcomes from the above are summarized in the following table:

A perfect tax provision tool

Calculating the provision for income taxes under ASC 740 presents a difficult technical challenge. Tax rate changes, new corporate facts, and valuation allowances for deferred tax assets can cause the total income tax provision calculation to change. Watch our on-demand valuation allowances webinar to learn more about the basic concepts of accounting for valuation allowances, including sources of taxable income, evaluating positive and negative evidence, and the tax consequences of valuation allowances.

As the market’s most powerful tax provision software, Bloomberg Tax Provision offers a complete ASC 740 tax provision solution, allowing corporate tax practitioners to easily handle valuation allowances. Request a demo to see how Bloomberg Tax Provision untangles ASC 740’s complexity.