ASC 740 Net Operating Losses and Credit Carryforward Rules

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP.

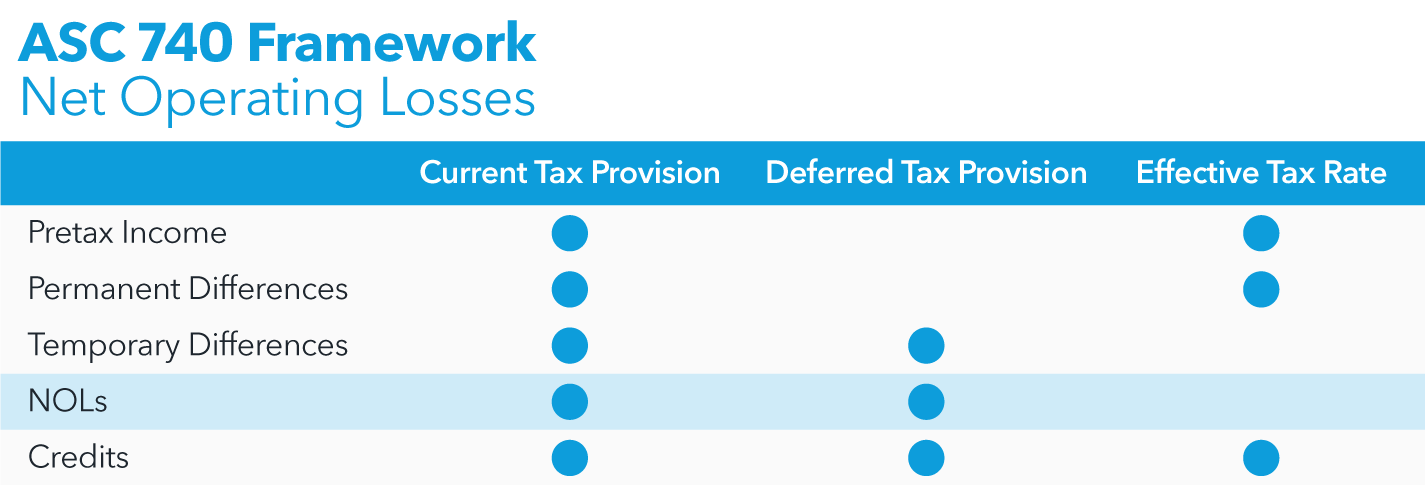

Net operating losses (NOLs) and tax credits impact the ASC 740 provision for income tax. If a company’s deductions exceed its income in a given year, it reports a net operating loss for federal income tax purposes. NOL and credit carryforwards create deferred tax assets subject to valuation allowances.

How do NOL carrybacks and carryforwards affect the ASC 740 income tax provision?

When utilized, carrybacks and carryforwards affect the current-year ASC 740 tax provision – subject to certain exceptions.

Current-year net operating losses reduce the ASC 740 deferred tax provision by the amount of the NOL tax benefit that the company will more likely than not realize. Create a valuation allowance for any portion of the NOL that fails the more-likely-than-not standard.

NOLs do not impact the ASC 740 effective tax rate calculation.

NOL formula

For federal income tax purposes, the NOL for a given year is:

NOL = Allowable deductions – Gross income

When calculating the NOL, ignore any NOLs from other years and any taxable income limitation on the dividends-received deduction.

NOL carryforward rules

To correctly calculate valuation allowances and carry NOLs to other years, companies must separately track NOLs each year a net operating loss occurs. Different carryback and carryforward rules apply to federal NOLs generated in different tax years:

- NOLs created in tax years ending before Jan. 1, 2018: Carry back to two prior years and carry forward for up to 20 subsequent years.

- NOLs created in tax years ending between Dec. 31, 2017, and Jan. 1, 2021: Carry back five years and carry forward indefinitely until used.

- NOLs created in tax years ending after Dec. 31, 2020: Can’t be carried back but can instead be carried forward indefinitely until used. Can be used only to offset up to 80% of taxable income.

ASC 740 requires companies to disclose the amounts and expiration dates of all NOL carryforwards.

How are tax credit carrybacks and carryforwards accounted for under ASC 740?

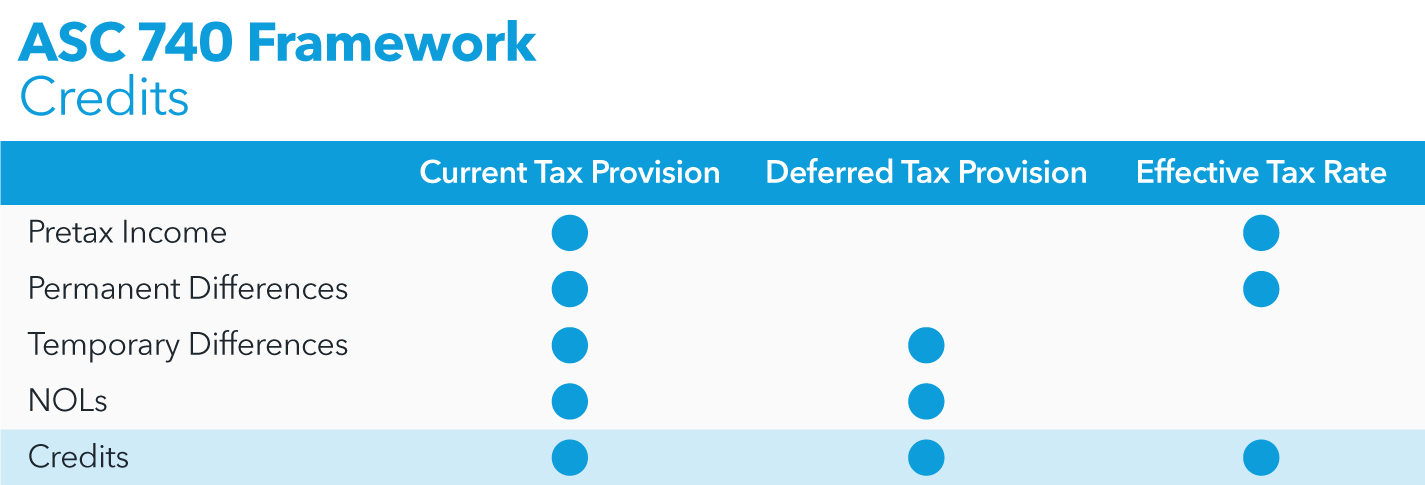

Tax credits reduce the current ASC 740 income tax provision to the extent they offset the current year’s tax liability. Credits grant a dollar-for-dollar reduction in tax liability, so the tax benefit equals the amount of the credit.

Current federal tax law generally doesn’t offer refundable income tax credits to corporations. Any excess tax credit over current-year liability generates a deferred tax asset and reduces the ASC 740 deferred tax provision. A valuation allowance applies to the deferred tax asset for any portion that fails to meet the more-likely-than-not standard for recognition.

Unused tax credits generally carry back one year and carry forward 20 years, though certain small businesses can carry general business credits back five years and forward 25 years. Foreign tax credits have a 10-year carryforward.

ASC 740 doesn’t specifically address how to account for the tax benefit of a tax credit carryforward or carryback. Some practitioners apply the rules for NOLs and recognize the tax benefit of a credit in the year in which the activity that gives rise to the credit occurs. The amount used is recognized as a current benefit and the carryforward amount is recognized as a deferred benefit.

Unlike NOLs, the ASC 740 effective tax rate is affected by tax credits generated by current-year activity regardless of carryback or carryforward. Credits reduce the effective tax rate for companies with taxable income. However, credits increase the effective tax rate for companies reporting an NOL – the credit increases the benefit associated with current year income.

Like NOLs, under ASC 740 companies must disclose the amounts and expiration dates of all tax credit carryforwards.

Simplify your ASC 740 process with Bloomberg Tax Provision

Like most ASC 740 tax provision subjects, handling net operating losses and tax credits correctly requires both tax and accounting expertise. Manually tracking NOL and credit carryforwards, expiration dates, and valuation allowances for deferred tax assets can consume considerable time and lead to errors. The frequent carryforward and carryback period changes for NOLs can prove particularly burdensome. Find answers to the technical and process challenges that arise when calculating your ASC 740 income tax provision with this comprehensive Essential Guide to ASC 740.

Thankfully, practitioners no longer need to maintain cumbersome spreadsheets. Bloomberg Tax Provision offers a complete ASC 740 tax provision solution, allowing companies to handle NOL and credit carryforwards with ease. Request a demo to learn more about how Bloomberg Tax Provision software can help you calculate your ASC 740 tax provision accurately and efficiently.