What Is the ASC 740 Interim Reporting Requirement?

ASC 740 is the accounting standard that governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. An ASC 740 income tax provision represents the total income tax expense for the reporting period.

ASC 740 reporting and disclosure requirements mandate that a company’s balance sheet must net all deferred tax assets and liabilities that can offset for tax purposes. More specifically, ASC 740-270 sets the requirements for how corporations allocate tax expenses among fiscal quarters, known as interim reporting.

What are the key features of interim financial reports?

ASC 740-270 interim reporting disclosures are usually required of any publicly held company. These interim reports provide investors, financial institutions, and the public more transparency into a corporation’s performance and ability to generate revenue.

Typically, interim financial statements include condensed versions of the following components:

- Balance sheet

- Income statement, or a statement of profit and loss

- Cash flow statement

Estimating the annual effective tax rate to forecast the income tax provision

When preparing quarterly interim financial statements, companies don’t have full-year earnings information available, and can’t calculate all deferred and temporary items the same way they would for an annual income tax return. It’s not simply a matter of taking quarterly income and performing an income tax calculation on that information. Instead, FASB prescribes a methodology for estimating full-year income tax expense based on forecasts and using that as a foundation for interim financial reporting of income tax expense.

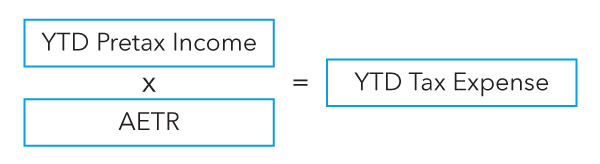

Generally, ASC 740-270 requires a company to calculate the income tax associated with ordinary income using an estimated annual effective tax rate (AETR). At the end of each interim reporting period, the company applies the AETR to year-to-date (YTD) ordinary income (or loss) to arrive at the YTD income tax expense.

The AETR is the company’s best estimate of the effective tax rate expected for the full year. The estimated AETR should include any changes in a valuation allowance for deferred tax items.

Typically, a company bases its estimated AETR on a variety of data sources, including forecasts, prior year information, and YTD results.

Example: Recognizing an interim valuation allowance

This ASC 740 interim financial reporting example includes an interim period in which a valuation allowance is recognized against a foreign subsidiary’s net deferred tax assets. The portion of the valuation allowance relating to current-year activity is recorded in the AETR. In contrast, the remaining amount, the result of past activity and future forecasts, is recorded as a discrete item.

Example: Removing an interim valuation allowance

This ASC 740 interim financial reporting example includes an interim period in which a valuation allowance is removed because of improved profitability at a foreign subsidiary. The portion of the valuation allowance relating to current-year activity is recorded in the AETR, whereas the remaining amount, the result of past activity and future forecasts, is recorded as a discrete item.

Is the annual effective tax rate the same as the reported income tax rate?

Although companies estimate an AETR for each interim period, it is distinct from the reported income tax rate in the interim period. The AETR is applied to year-to-date pretax income to derive the interim reported income tax rate.

Even without discrete items (items excluded from the AETR), changes to the AETR estimate between interim periods will have an exaggerated impact on the reported income tax rate because the subsequent interim period must include any “catch up” amount to arrive at the appropriate YTD AETR.

What happens if a corporation can’t estimate an annual effective tax rate?

A company that can’t reliably estimate some or all of its AETR will record its income tax provision for those items during the interim reporting period in which the items that cannot be reliably estimated occur.

Under these circumstances, the company calculates its interim provision for those items or jurisdictions based on actual results consistent with how it would calculate them at year-end.

Recording discrete tax items separately from reported income

Certain items are excluded from the AETR. These are known as discrete items and are instead recorded in the interim period in which they occur. Typically, discrete items don’t relate directly to the ordinary income expected to be reported in the fiscal year.

Examples of common discrete tax items include:

- Provision to return true-ups

- Interest expense associated with uncertain tax benefits

- Excess benefits or shortfalls from share-based compensation

- Impacts of changes to the income tax rate or tax law accounted for in the period in which the change is enacted

- Taxes related to significant unusual or extraordinary items that will be separately reported or reported net of their related tax effect

- Changes in judgment about beginning-of-the-year valuation allowances

- Changes in the recognition test or measurement test of an uncertain tax position

Example: Interim U.S. true-up

This ASC 740 interim financial reporting example calculates a tax return true-up and incorporates it into the subsequent-year provision in an interim period.

Example: Interim unrecognized tax benefits

This ASC 740 interim financial reporting example covers the thorough process that should be applied to unrecognized tax benefits on an interim basis.

Recognizing tax benefits from losses

The estimated AETR may include only the amount of benefit from a loss that is expected to be realized and recognized at the end of the fiscal year, meaning the amount won’t require a valuation allowance.

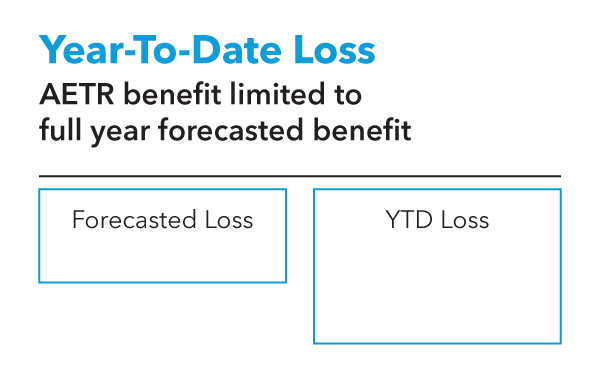

If the company incurs year-to-date ordinary losses, the amount of benefit recognized can’t exceed the benefit estimated in the AETR.

Example: Interim loss

This ASC 740 interim financial reporting example includes an interim period in which the year-to-date loss exceeds the forecasted full-year loss.

What if a company reports losses in multiple jurisdictions?

Generally, a company that operates in multiple jurisdictions should apply a consolidated AETR to its year-to-date consolidated ordinary income to calculate the tax provision for an interim period.

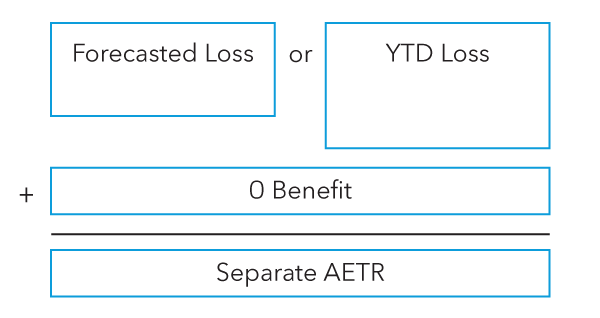

However, if the company reports a loss for which it doesn’t expect to recognize a tax benefit or anticipates a fiscal year loss in a jurisdiction, it must exclude the loss from that jurisdiction from both the consolidated AETR calculation and the YTD ordinary income to which a consolidated AETR is applied.

For each jurisdiction in which a company reports a loss for which it doesn’t expect to recognize a tax benefit, or anticipates a fiscal year loss, a separate AETR is calculated and applied to the YTD ordinary income of that jurisdiction.

Example: Separate interim AETR for loss jurisdictions

This ASC 740 interim financial reporting example includes a separate jurisdiction with a year-to-date loss and a full valuation allowance, resulting in that jurisdiction being excluded from the consolidated AETR.

Untangle ASC 740’s complexity with Bloomberg Tax Provision

Bloomberg Tax offers unmatched expert guidance and industry perspectives to help tax professionals navigate the nuances of the ASC 740 tax provision with confidence. Watch our on-demand Interim Reporting Webinar to dive deeper into the accounting concepts for interim reporting of the ASC 740 income tax provision, including how to handle the annual effective tax rate, discrete items, losses, and operating in multiple tax jurisdictions.

While calculating your interim ASC 740 income tax provision may seem straightforward, FASB has proposed an update that would significantly affect your current process for calculating income tax provisions and preparing disclosures. Our Guide to Proposed FASB Changes to ASC 740 brings you the latest developments regarding FASB’s proposed updates and how these changes will affect your tax provision process.

Many companies rely on Excel for calculating their income tax provision. But relying on intricate Excel workbooks to maintain your tax provision can lead to major setbacks. Tax provision is a major part of interim financial statements and annual disclosures, and manual calculations put you at risk of highly visible errors and increased scrutiny. Even if you think your company’s current tax provision processes are manageable, tax provision software might be a better fit.

Save time and ensure accuracy with Bloomberg Tax Provision, the most powerful ASC 740 calculation engine on the market. Our integrated balance sheet approach takes manual risks out of the equation and lets you easily export summarized footnotes and prepare audit-ready financial reports. Request a demo to see how Bloomberg Tax Provision can work for you and your company.