How ASC 740 Applies to Foreign-Source Income

ASC 740 accounting for international operations, including foreign-source income, worldwide and territorial tax systems, and foreign tax credits

Accounting for income taxes under ASC 740 is evolving due to changes in how federal, state, local, and foreign governments levy taxes on a taxpayer’s worldwide income. The market’s most powerful tax provision software provides tax practitioners with an accurate calculation, intuitive design, and thorough footnotes. See how Bloomberg Tax Provision untangles ASC 740’s complexity.

Calculate your ASC 740 tax provision for international operations accurately and efficiently

Discover all the resources, innovations, and unmatched expertise that only Bloomberg Tax provides, including up-to-the-minute intelligence and expert analysis.

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. But recent changes like the 2018 Tax Cuts and Jobs Act are significantly changing the way the U.S. imposes tax on international activities and affecting how the ASC 740 provision for income taxes is calculated for income earned outside the U.S.

U.S. taxation of international operations

There are two fundamental issues when dealing with income tax on activities outside of the U.S.:

- How the international activities are taxed from a local perspective under foreign law.

- The U.S. taxation of those international activities.

This page focuses primarily on the U.S. taxation of international operations.

Worldwide vs. territorial systems

Most countries have territorial tax systems, where income tax is imposed only on the income earned in the country. Under most territorial systems, dividends and capital gains or losses are fully or partially excluded from taxable income.

Historically, the U.S. has had a worldwide system, meaning there are U.S. income tax consequences for U.S.-based corporations regardless of where the activity occurred. Under a worldwide system, a U.S. corporation would not pay current U.S. income tax associated with the income of its foreign subsidiaries until the foreign subsidiary made a dividend distribution, was sold, or was dissolved.

However, exceptions to this general rule existed where U.S. tax would be imposed on some or all of the earnings of a U.S. corporation’s foreign subsidiaries prior to these events.

Since 2018, the U.S. has been moving toward a more territorial system, where dividends from foreign subsidiaries are exempt from U.S. tax. However, the U.S. still retains some elements of its historic worldwide system.

General U.S. international framework

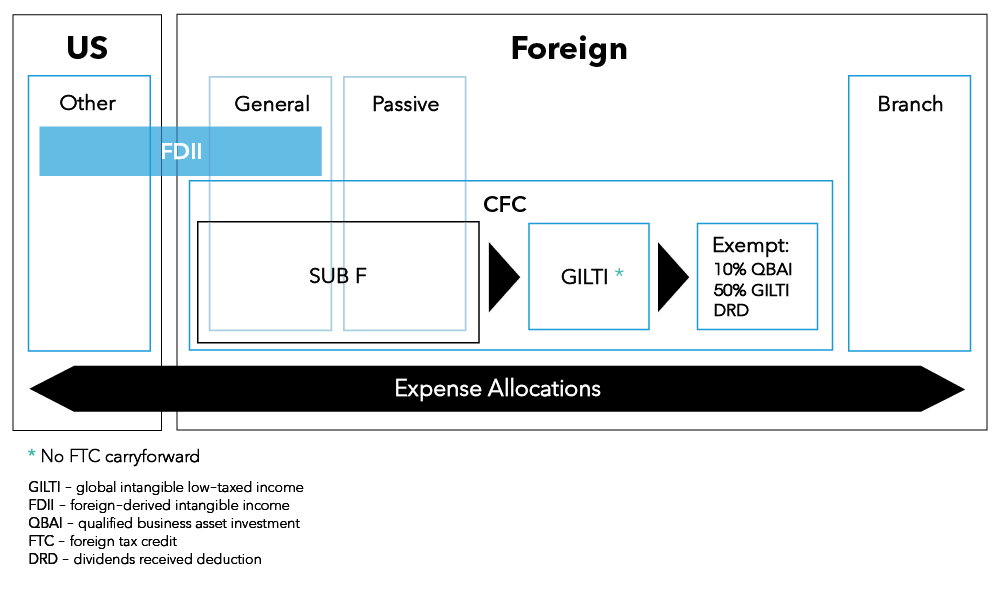

At the highest level, the basic framework for U.S. tax on international activities is focused on a few key dimensions:

- The source of the income, i.e., U.S. vs. foreign

- The type of entity with the income-producing activity, i.e., branch/partnership or corporation

- The type or nature of the income earned, i.e., trade or business income versus passive income

The U.S. tax consequences of a particular activity vary depending on these dimensions.

How much foreign-source income is tax-free in the U.S.?

To mitigate the impact of double taxation on worldwide income, U.S. tax law allows a taxpayer to either deduct foreign taxes paid or claim a foreign tax credit (FTC). The amount of foreign tax eligible for credit in a particular year is generally limited to the amount of U.S. tax on foreign income.

Foreign income taxes are generally translated to U.S. dollars at the average foreign exchange rate during the year. Additionally, the U.S. tax system has various rules to deal with foreign exchange issues that may arise from conducting activities in other currencies.

How does foreign-source income affect the ASC 740 income tax provision?

Income derived directly or indirectly from the foreign operations and activities included in a U.S. tax return is called foreign-source income (FSI).

Several calculations may impose U.S. tax on foreign earnings, like Global Intangible Low Tax Income (GILTI) and the base erosion and anti-abuse tax (BEAT) and may provide a deduction related to certain export income, such as foreign-derived intangible income (FDII).

Foreign-source income baskets

Foreign-source income and the related foreign tax credits are tracked in several categories, known as “baskets.”

Those baskets are:

- Section 951A basket. Section 951A income, also known as GILTI, is earned by foreign affiliates of U.S. companies from intangible assets, such as patents, trademarks, and copyrights.

- Foreign branch basket. Foreign branch category income consists of the business profits of U.S. persons attributable to one or more qualified business units (QBUs) in one or more foreign countries.

- Passive basket. The passive basket generally includes investment income such as interest, dividends, rent, and royalties.

- Certain income re-sourced by treaty basket. If the U.S. has an income tax treaty with a country, and a sourcing rule in that treaty treats U.S. sourcing income as foreign source, the taxpayer can elect to apply the treaty. The tax treaty provision converts (i.e., re-sources) U.S. source income into foreign source, thus allowing foreign tax credits to offset the U.S. income tax imposed on it.

- General limitation basket. The general basket includes all other types of foreign-source income that do not fit into another category. Some examples include salary and wages, taxable employee benefits, active trade or business income, and gains from the sale of inventory or depreciable property used in a trade or business.

Allocation of expenses to U.S.- and foreign-source income

Certain expenses are “not definitely allocable” to either the U.S. or foreign operations of a company. These expenses, such as state income taxes, research and development costs, stewardship costs, and interest expenses, are apportioned to the various baskets of foreign source income, therefore reducing the limitations for the respective baskets. Reg. §1.861 includes various allowable methodologies for allocation and apportionment.

Essentially, these expenses are not allocated to the activities of the entity or entities that incur them but are instead allocated between U.S. source income and foreign source income.

How are foreign entities classified for federal income tax purposes?

A company’s foreign operations are generally conducted by foreign branches, controlled foreign corporations (CFCs), or foreign corporate joint ventures.

U.S. tax law allows companies to make elections concerning the treatment of an entity. Due to these elections, the treatment of that entity for U.S. income tax purposes may differ from its treatment for local country tax purposes or legal purposes.

Companies may elect to treat certain legal entities as disregarded entities for U.S. tax purposes. A disregarded entity is an entity that has no status for U.S. tax purposes and therefore is treated as a branch for U.S. income tax purposes. Transactions between the owner of a disregarded entity and the entity itself are also disregarded.

The U.S. income tax treatment of international activities varies significantly depending on the type of entity conducting the activity.

What effect do foreign branches have on the ASC 740 income tax provision?

A foreign branch is a foreign taxpayer that is also either:

- A disregarded entity or flow-through entity for U.S. income tax purposes

- A U.S. entity

The foreign tax credits associated with foreign branches are direct credits (§901). Direct credits are for taxes paid directly to the foreign country by a U.S. taxpayer based on net income.

The foreign-source income and related foreign tax credits from foreign branches are accounted for in the foreign branch basket.

Historic general and passive foreign tax credit carryovers from before 2018 cannot be used against branch income. Conversely, new foreign tax credits in the branch basket cannot be used against general basket foreign-source income, such as Subpart F.

The foreign branch basket has the effect of segregating the activities of branches from those of controlled foreign corporations.

Calculating income tax provision for foreign branch operations

A foreign branch will calculate a separate current, deferred, and noncurrent income tax provision for each jurisdiction in which it is subject to tax.

U.S. deferred taxes are recognized to reflect the future U.S. income tax consequences of any foreign deferred tax accounts. If a company is claiming a foreign tax credit, the existence of a foreign branch deferred tax asset or deferred tax liability gives rise to a future reduction or increase in U.S. foreign tax credits (anticipatory FTCs).

A deferred tax asset for an anticipatory FTC carryover would be subject to analysis to determine if a valuation allowance is needed. If a valuation allowance has been recorded in the foreign country against its deferred tax assets and no net deferred taxes exist, no U.S. anticipatory FTCs should be recorded. Under this scenario, the company has concluded that it is not more likely than not that the foreign deferred tax assets will be realized, and therefore those deferred items will not give rise to a U.S. tax consequence.

For a company deducting foreign taxes rather than claiming a foreign tax credit, U.S. deferred taxes are considered based on the foreign deferred taxes by applying the appropriate federal and state rate to the foreign deferred tax assets and deferred tax liabilities.