Mid-Market Corporations

Add more value without adding more to your workload

Mid-market tax teams can face overwhelming workloads, resulting in overlooked details and inefficiencies. Bloomberg Tax delivers accurate tax law updates, thorough analysis, and efficient software tools to help these teams navigate their responsibilities quickly and precisely.

Work smarter

Our integrated suite of tax solutions simplifies workflows by putting everything in one place and eliminating wasted time navigating among many different tools.

Maximize efficiency

By removing the need to switch back and forth between various platforms and tools, Bloomberg Tax reduces the chance of overwhelmed tax teams making analysis errors.

Free up time

Because our reliable research and user-friendly software supports a more manageable workload, you’ll have more time for strategic planning.

How Bloomberg Tax works for mid-market corporations

Tools designed with everything your tax team needs

Bloomberg Tax offers a suite of tax solutions to help you save time and money, increase productivity and efficiency, and be a strategic advisor to the business.

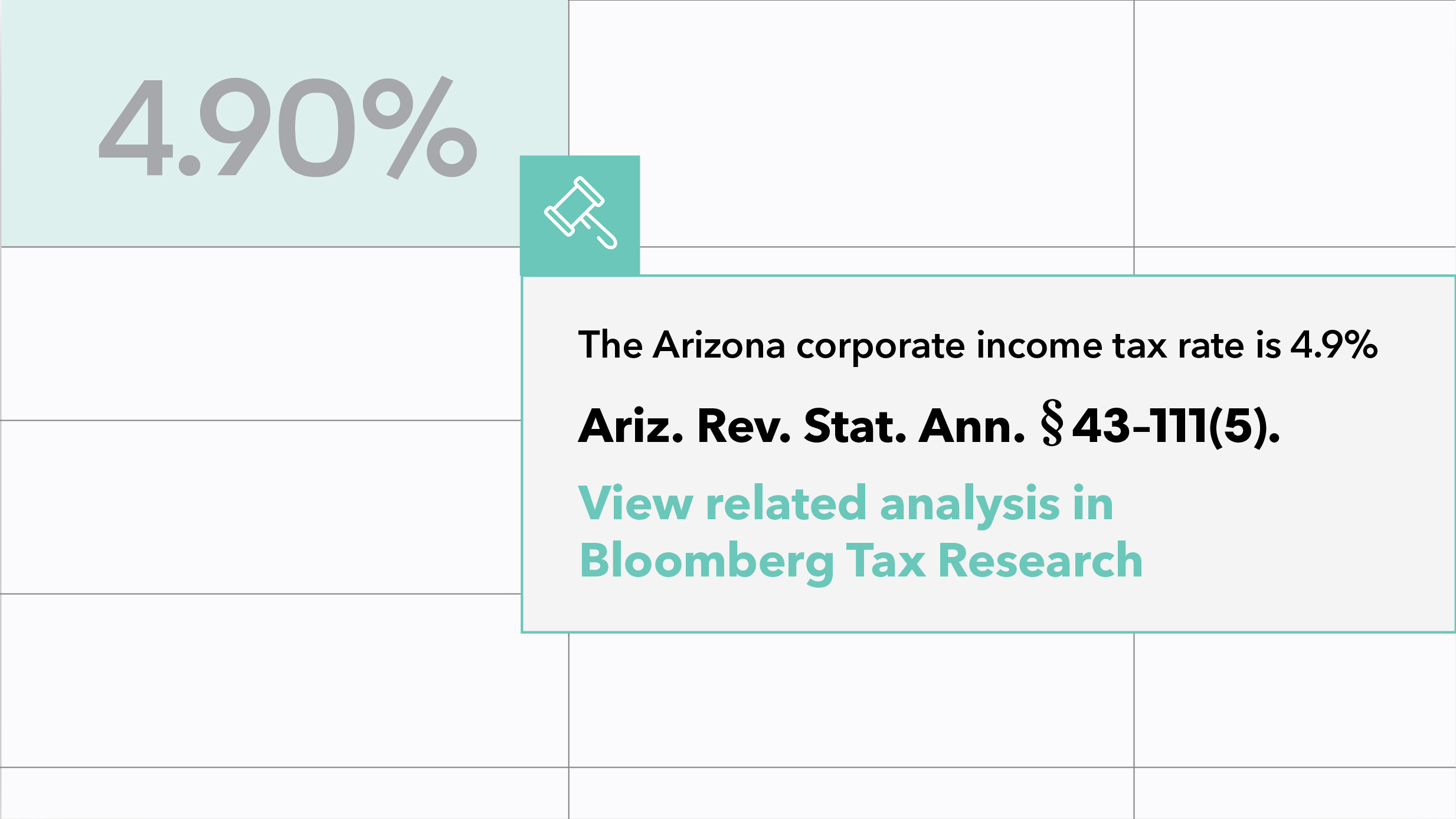

Top research tools

Stay on top of changes in federal, state, and international tax. Our Tax Management Portfolios and other gold standard tools on the Bloomberg Tax Research platform feature analysis from experts in the industry, covering the topics that matter most to your business.

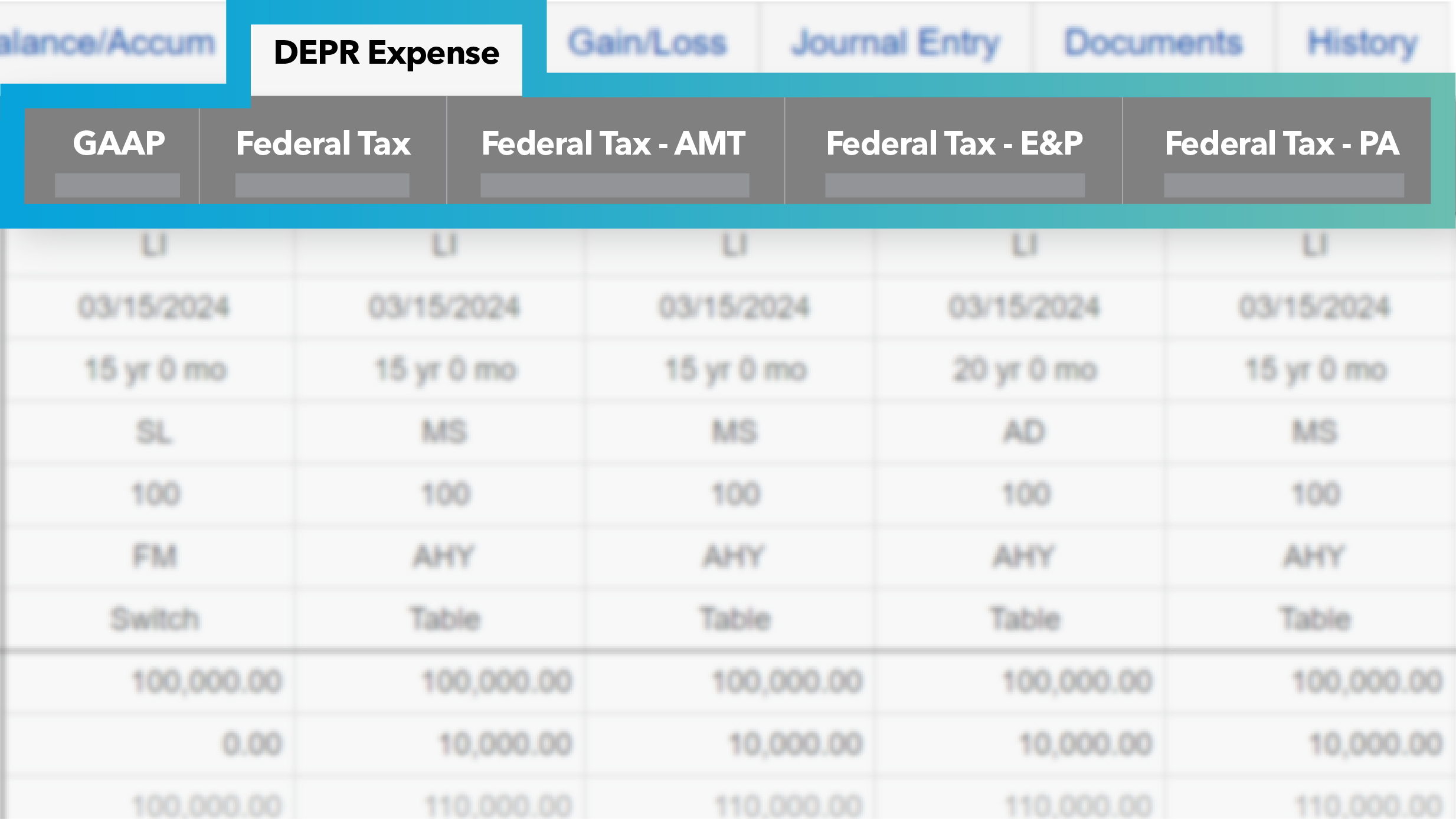

Depreciation modeling

Automatically and accurately calculate depreciation with Bloomberg Tax Fixed Assets so you can focus on more strategic initiatives.

Accurate provision calcs

Bloomberg Tax Provision is the go-to solution made just for provision pros. It helps organize company information to meet ASC 740 footnote needs and, compared to other overly complicated software, ours is easy to use.

Spreadsheets made just for tax

Like the spreadsheets you know, but better. Bloomberg Tax Workpapers automates calculations to remove manual errors and offers a whole new world of spreadsheets loaded with custom tax features.

Smarter automation

Tax-focused automation capabilities in Bloomberg Tax Workpapers create more efficient workflows and remove risk from your process so you can spend more time on higher-value activities.

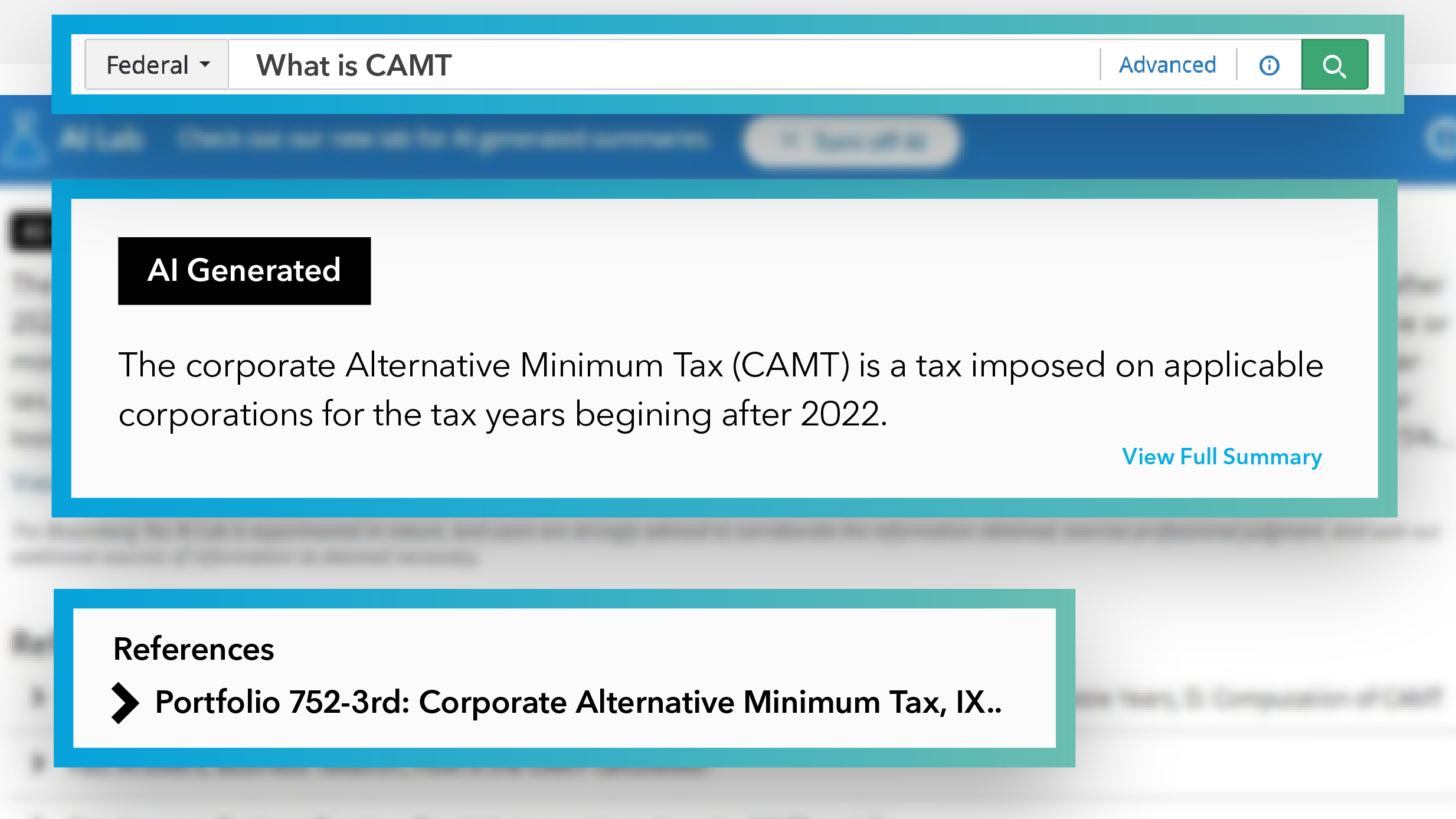

Trustworthy AI

AI-powered answers within our product suite save you time while still giving you the same reliable response you expect from our trusted Portfolios and Tax Practice Series.

Explore the Bloomberg Tax suite

Bloomberg Tax’s suite of tools was built just for you with streamlined technology, familiar workflows, and powerful data connections.

Why customers love Bloomberg Tax

“I really like the fact that you can just click on a link within Bloomberg Tax Workpapers and go straight into the research tool to get the information needed for calculations.”

Christine Kennedy

Vice President, Tax and Treasury

Hyland Software

“Bloomberg Tax Provision significantly reduced the time we spend on a provision. I saved close to a month over the time it used to take working in Excel.”

Sherri Throop

Tax and Financial Reporting Manager

Novo Building Products

“With our subscription to Bloomberg Tax Research we get the expert analysis, news, and resources we need to help us navigate our complex tax environment as an independent company no longer relying on our parent.”

Senior Vice President of Taxes

Match Group

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.