Large Multinational Corporations

Optimize your corporate tax process with proven tools

For today’s tax professional, we’re a partner whose deep expertise and practical perspectives are essential to simplifying the complex, mitigating risk, and seizing opportunities. Our practitioner-driven research and calculation solutions enable a seamless workflow that modernizes your tax process.

Reduce risk

Remove the chance of manual errors and know you’re always accurate with automated calculations that run on built-in, up-to-date tax laws.

Optimize your tax position

Leverage expert analysis, modeling tools, and powerful calculation solutions to effectively plan strategies that help your organization see better tax savings.

Work smarter

Our integrated suite of tax solutions simplifies workflows by putting everything in one place and eliminating wasted time navigating between many different tools.

How Bloomberg Tax works for large multinational corporations

Tools designed with everything your tax team needs

Bloomberg Tax offers a suite of tax solutions to save time and money, increase productivity and efficiency, and be a strategic advisor to the business.

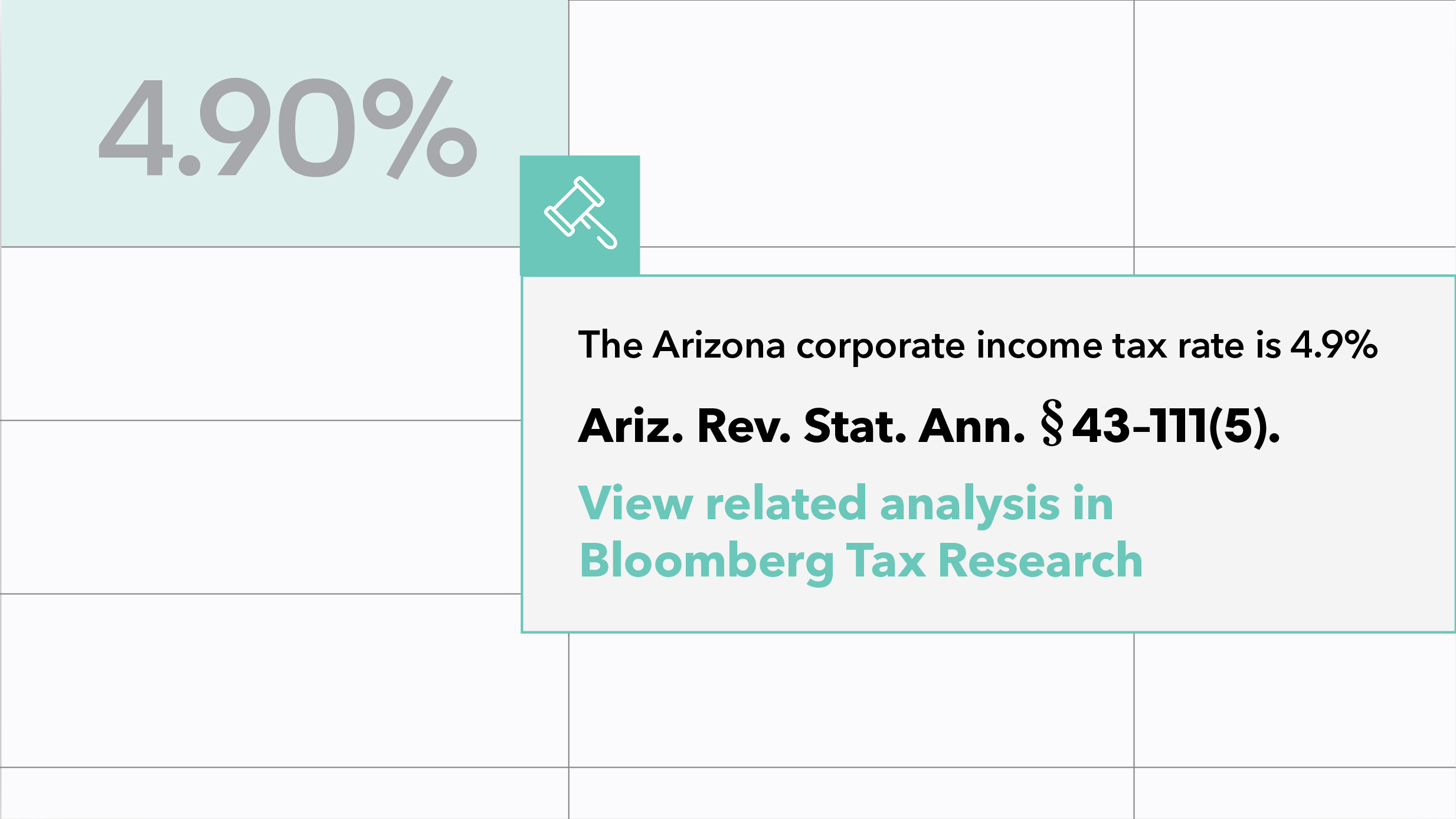

Top research tools

Stay on top of changes in federal, state and international tax. Our Tax Management Portfolios and other gold standard tools on the Bloomberg Tax Research platform feature analysis from industry experts on the topics that matter most to your business.

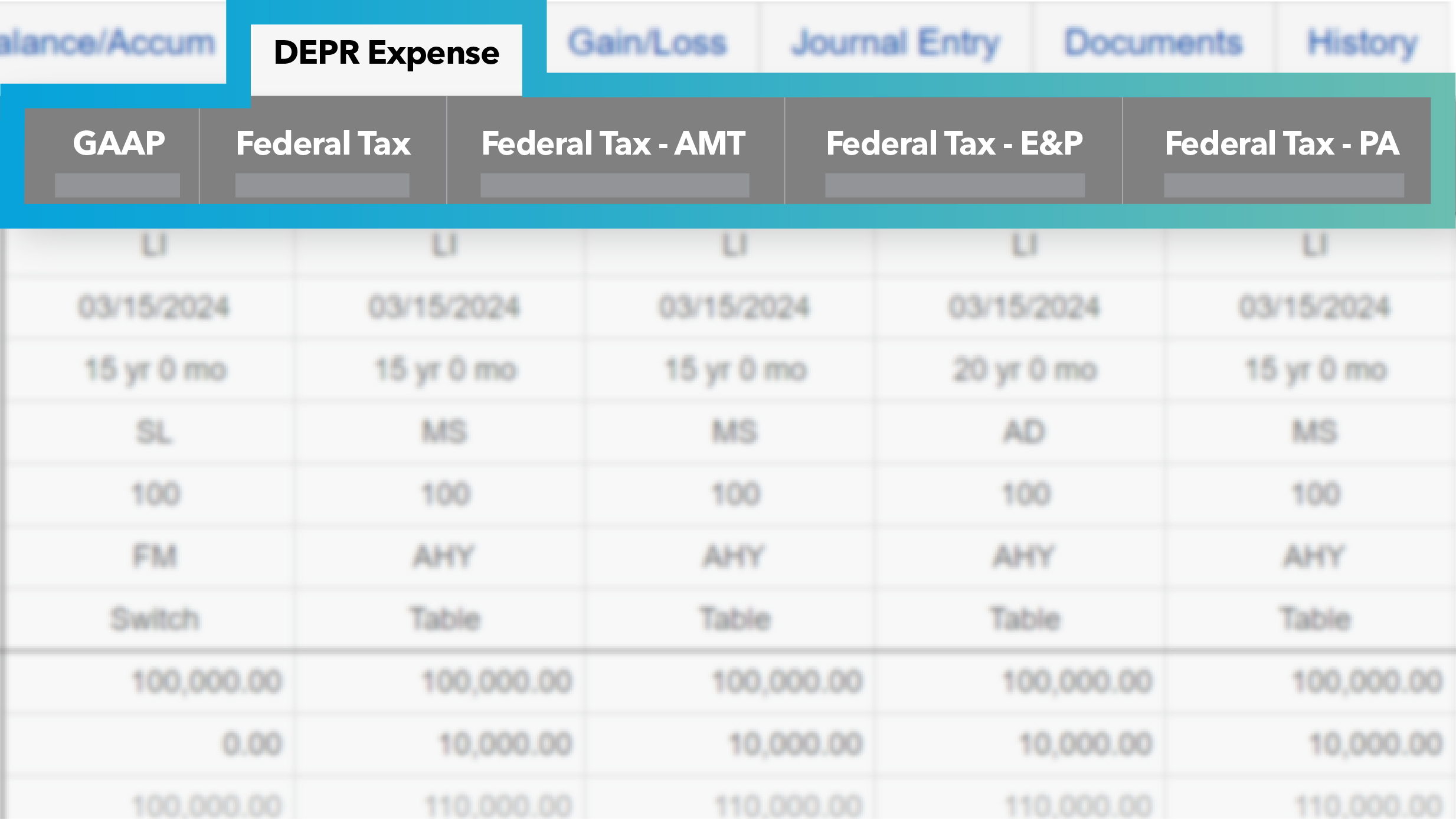

Depreciation modeling

Bloomberg Tax Fixed Assets automatically and accurately calculates depreciation so you can focus more on strategic initiatives.

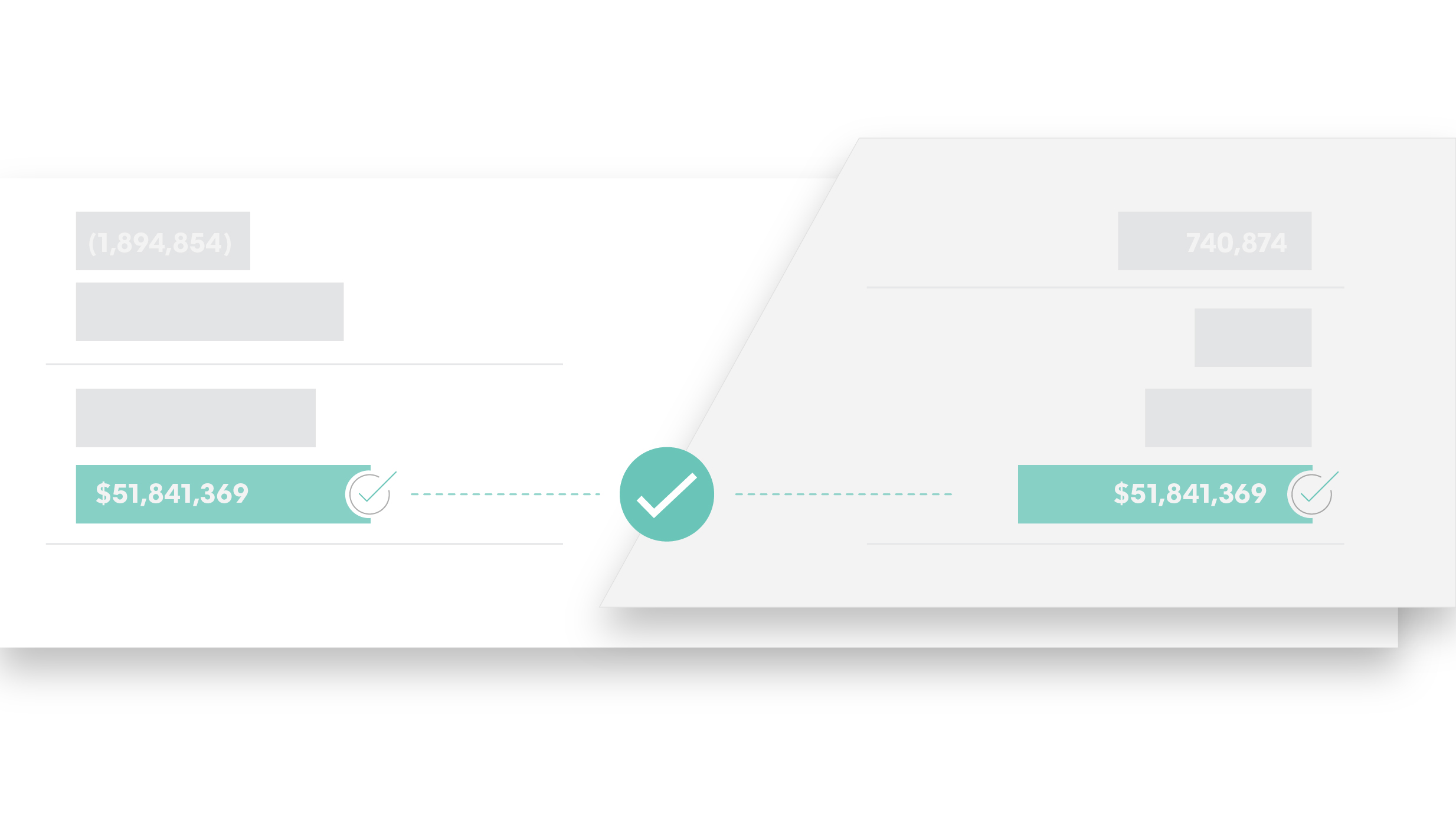

Accurate provision calcs

Bloomberg Tax Provision is the go-to solution made just for provision pros. It organizes company information to meet ASC 740 footnote needs, and unlike other overly complicated software, ours is easy to use.

Spreadsheets made just for tax

Like the spreadsheets you know, but better. Bloomberg Tax Workpapers automates calculations to remove manual errors and offers a whole new world of spreadsheets loaded with custom tax features.

Smarter automation

Tax-focused automation capabilities in Bloomberg Tax Workpapers create more efficient workflows and remove risk from your process so you can spend more time on higher-value activities.

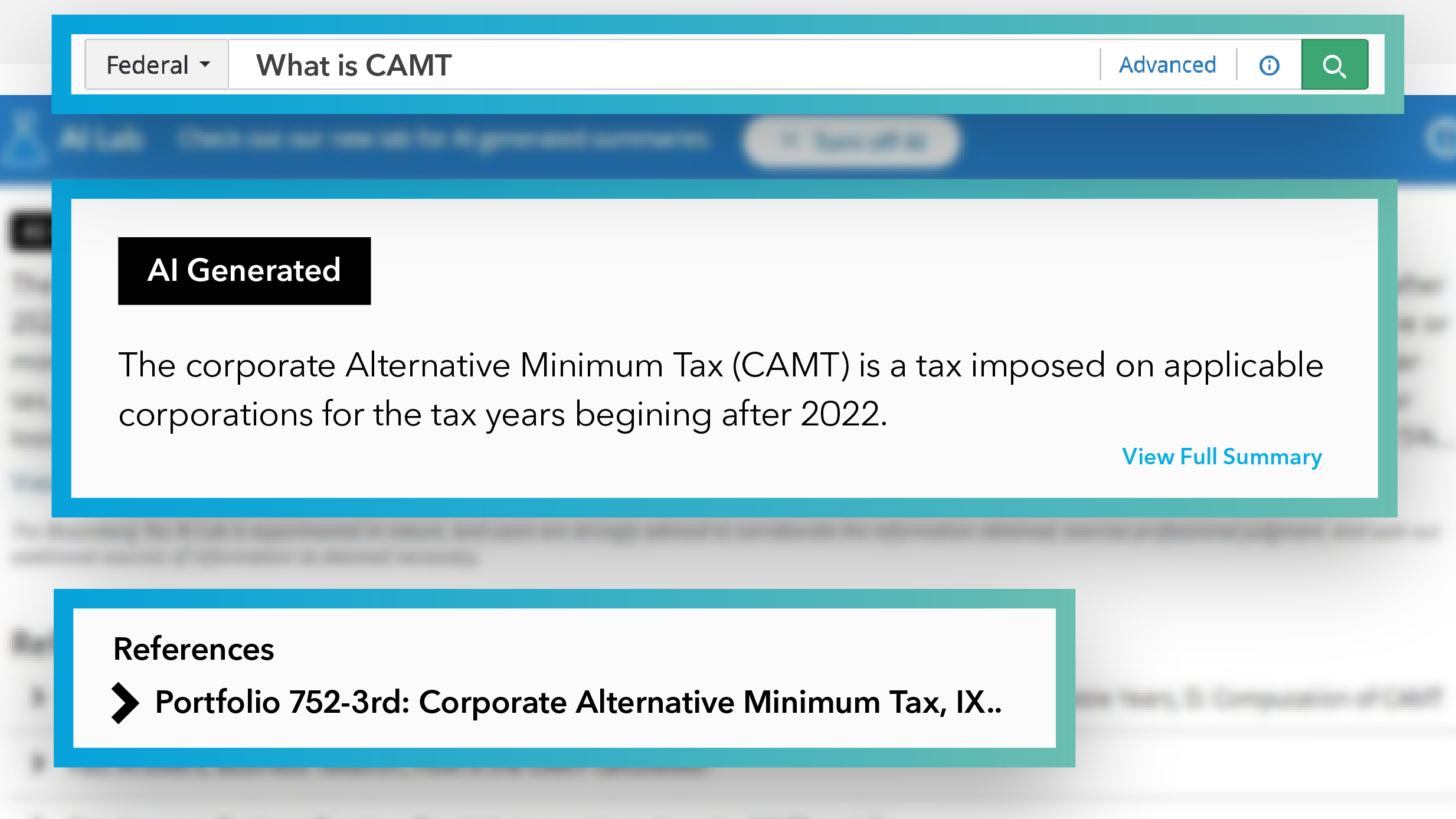

Trustworthy AI

AI-powered answers save you time while still giving you the same reliable response you expect from our trusted Portfolios and Tax Practice Series.

Explore the Bloomberg Tax suite

Bloomberg Tax’s suite of tools was built just for you with streamlined technology, familiar workflows, and powerful data connections.

Why tax professionals rely on Bloomberg Tax

“This is probably the first year I’m not panicking [going into year-end]. We now have simplified things with Bloomberg Tax, and I think we’re in a really

good spot.”

Senior Director of Tax

Large Corporation

“Instead of getting lost in a non-curated search engine, my team can turn to Bloomberg Tax Research for relevant, up-to-date content including BNA Picks, forms, best practices, charts, and much more, It’s a rich source of information and tools that help us work more efficiently.”

Jennifer Koorie

Manager of Corporate Tax

Victaulic

“Whether it’s looking up definitions for permanent establishment in the treaty finder or using the document translator to translate receipts from local finance teams for tax returns, Bloomberg Tax Research is fantastic for our needs.”

Alex Garcia

Senior International Tax Analyst

Avnet

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.