International

Avoid unintended international tax consequences

International tax laws are complex and change frequently, making it tough to keep track and stay compliant. Bloomberg Tax simplifies things with expert insights, integrated news, and handy tools conveniently in one place, making it easier to stay updated on cross-border transactions and tax regulations by country.

Stay ahead of change

Operate globally and remain in compliance with information and insights for every country in the world.

Maximize efficiency

Get the latest information and expert analysis of ever-changing global tax policies and developments in one place.

Free up time

With on-the-ground analysis and practical insights from our extensive network of expert practitioners, you get more time to work on strategic planning.

International tax laws are complex, but navigating changes shouldn’t be.

Streamline your global tax research with Bloomberg Tax – a powerful combination of tax-intelligent technology, expert analysis, primary sources, practice tools, and in-depth news.

How Bloomberg Tax works for international tax professionals

Tools designed with everything your global tax team needs

Bloomberg Tax offers a suite of tax solutions to save time and money, increase productivity and efficiency, and help maximize your cash flow.

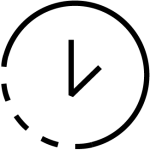

Expert analysis and practice tools

Country Guides and VAT Navigator on Bloomberg Tax Research help you comply with tax laws and regulations across more than 220 countries and jurisdictions.

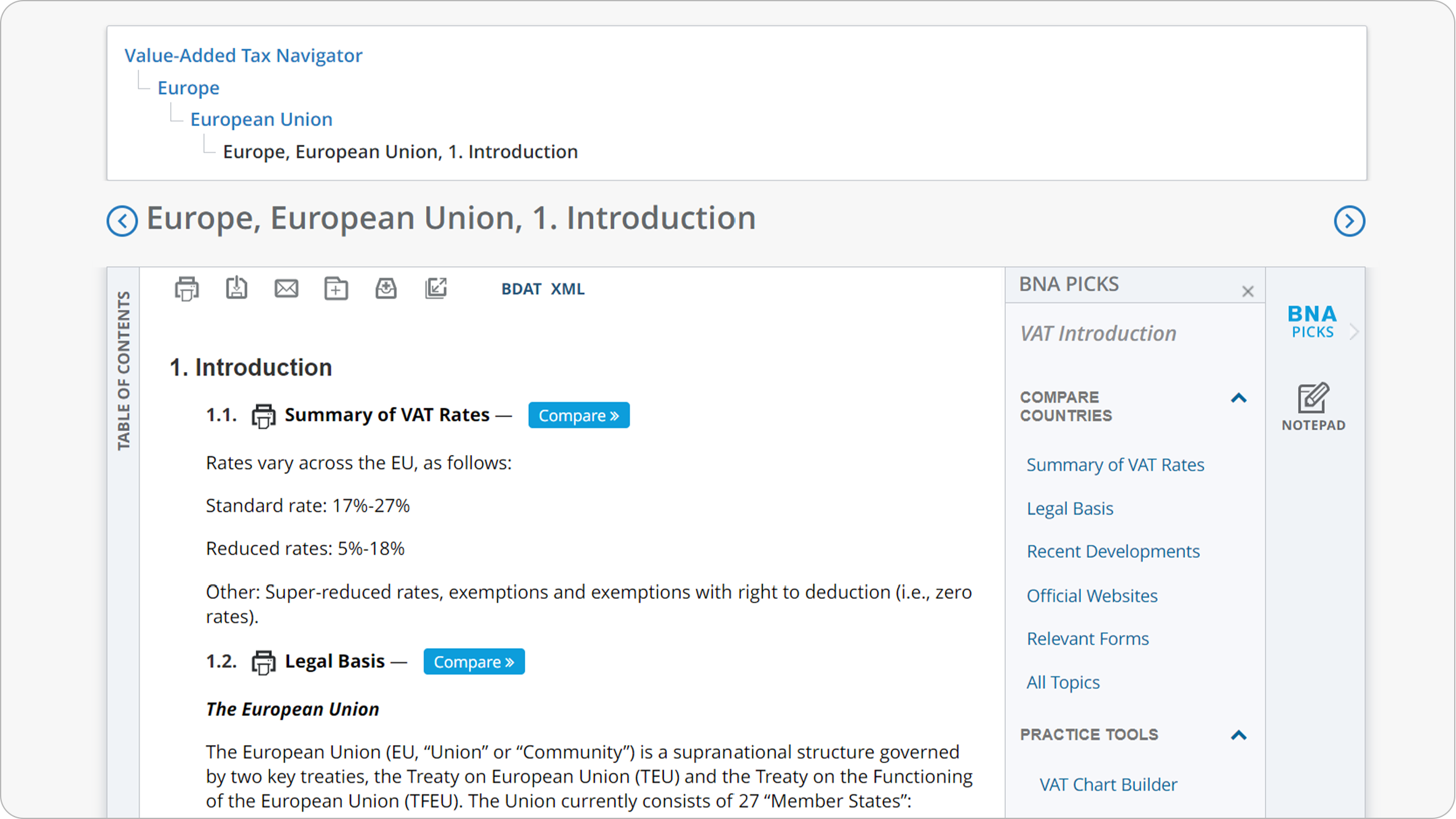

Global tax news and developments

Our fully customizable global tax news publication on Bloomberg Tax Research features breaking news and practitioner commentary for more than 200 jurisdictions to help you effectively manage your compliance strategy and face any tax challenge.

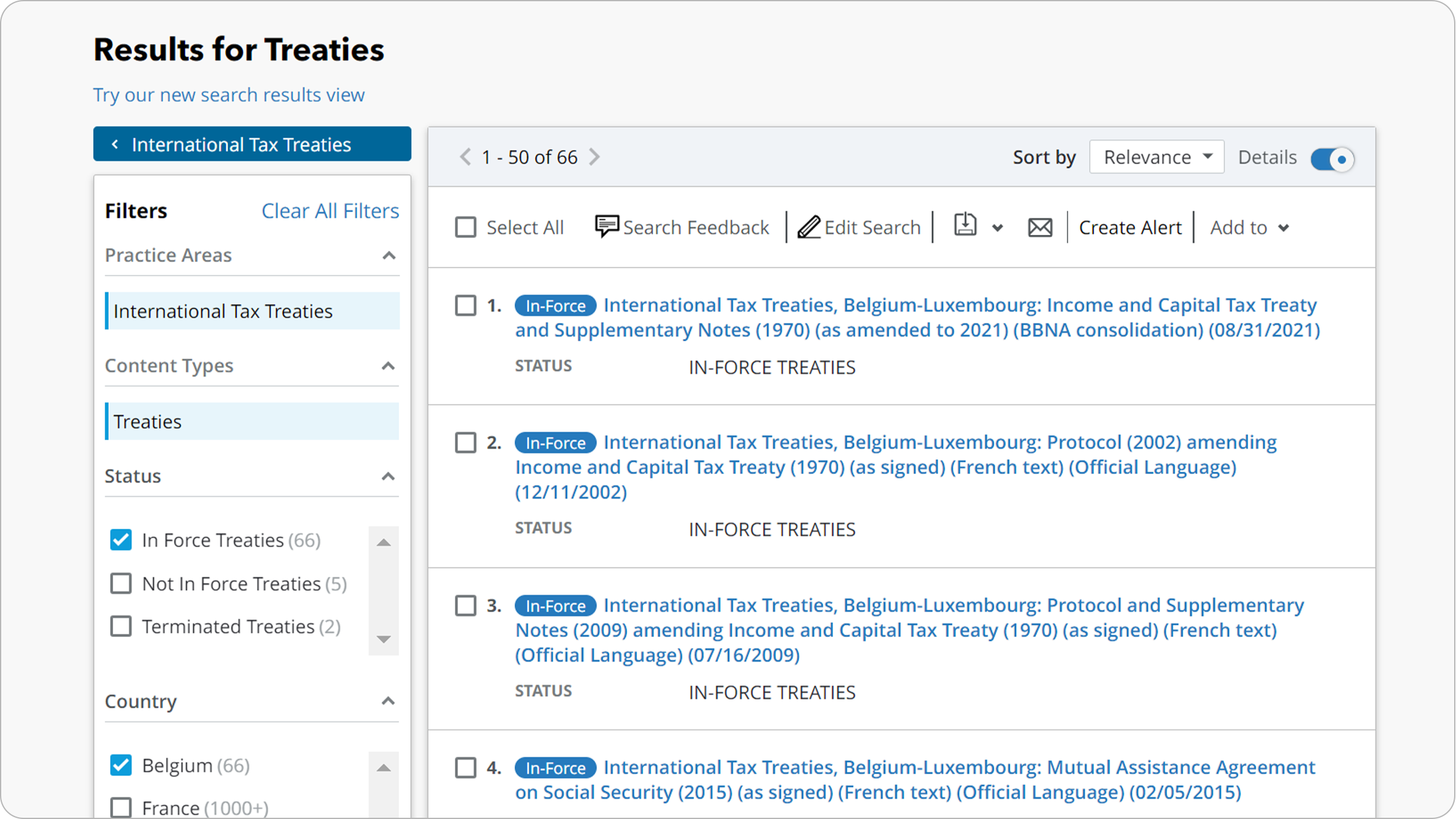

Treaties database

Explore over 22,500 full text treaty documents on Bloomberg Tax Research – including foreign language and English translations – featuring expert analysis and the most comprehensive, up-to-date, and easy-to-use international tax treaties database.

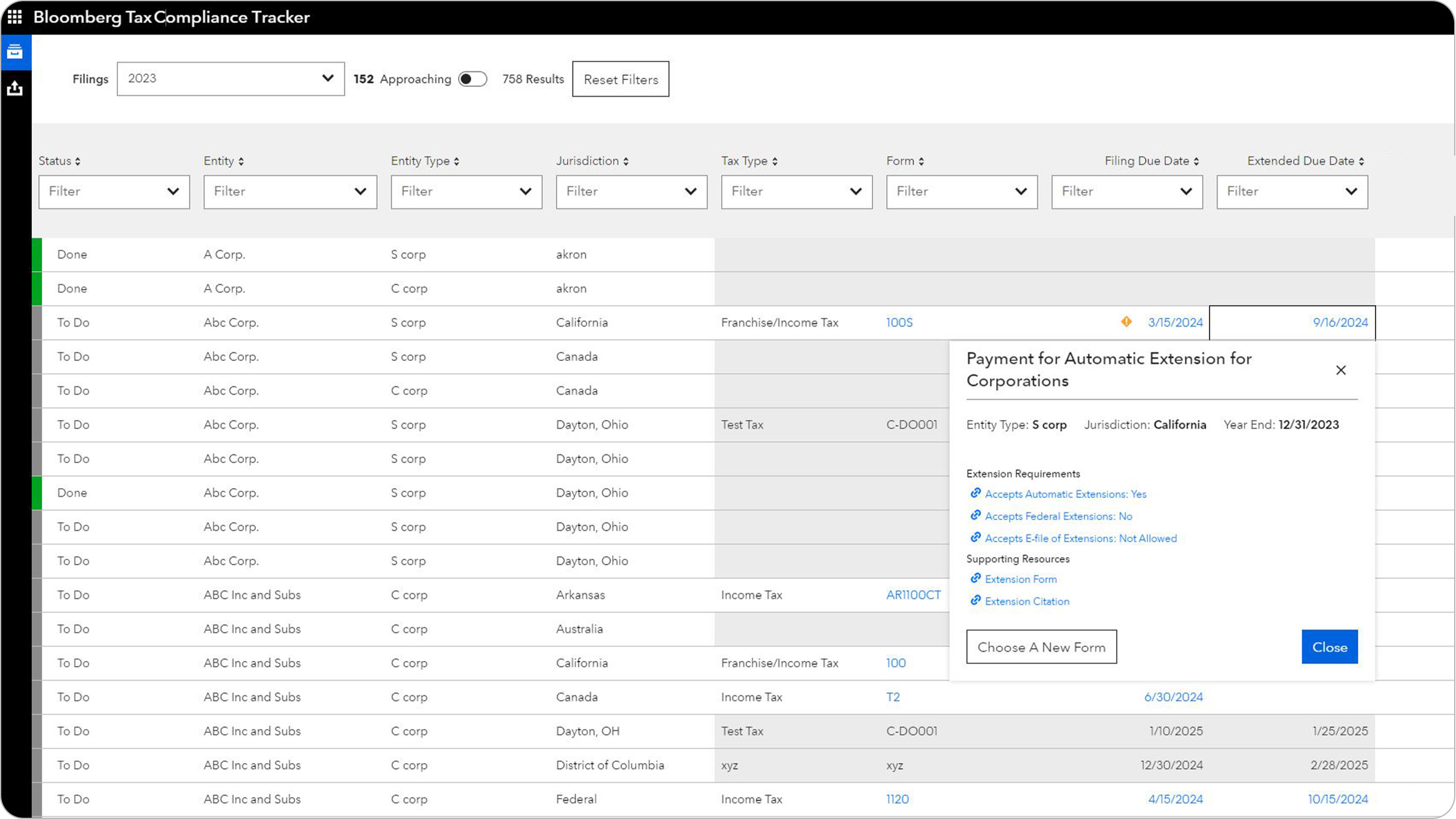

Track compliance

Reduce risk, save time, and stay up to date on tax deadlines across countries with Compliance Tracker on Bloomberg Tax Research. Automate the manual process of gathering and verifying international tax forms and due dates, and get alerts about approaching filing obligations.

Smarter automation

Tax-focused automation capabilities in Bloomberg Tax Workpapers create more efficient workflows and remove risk from your process so you can spend more time on higher-value activities.

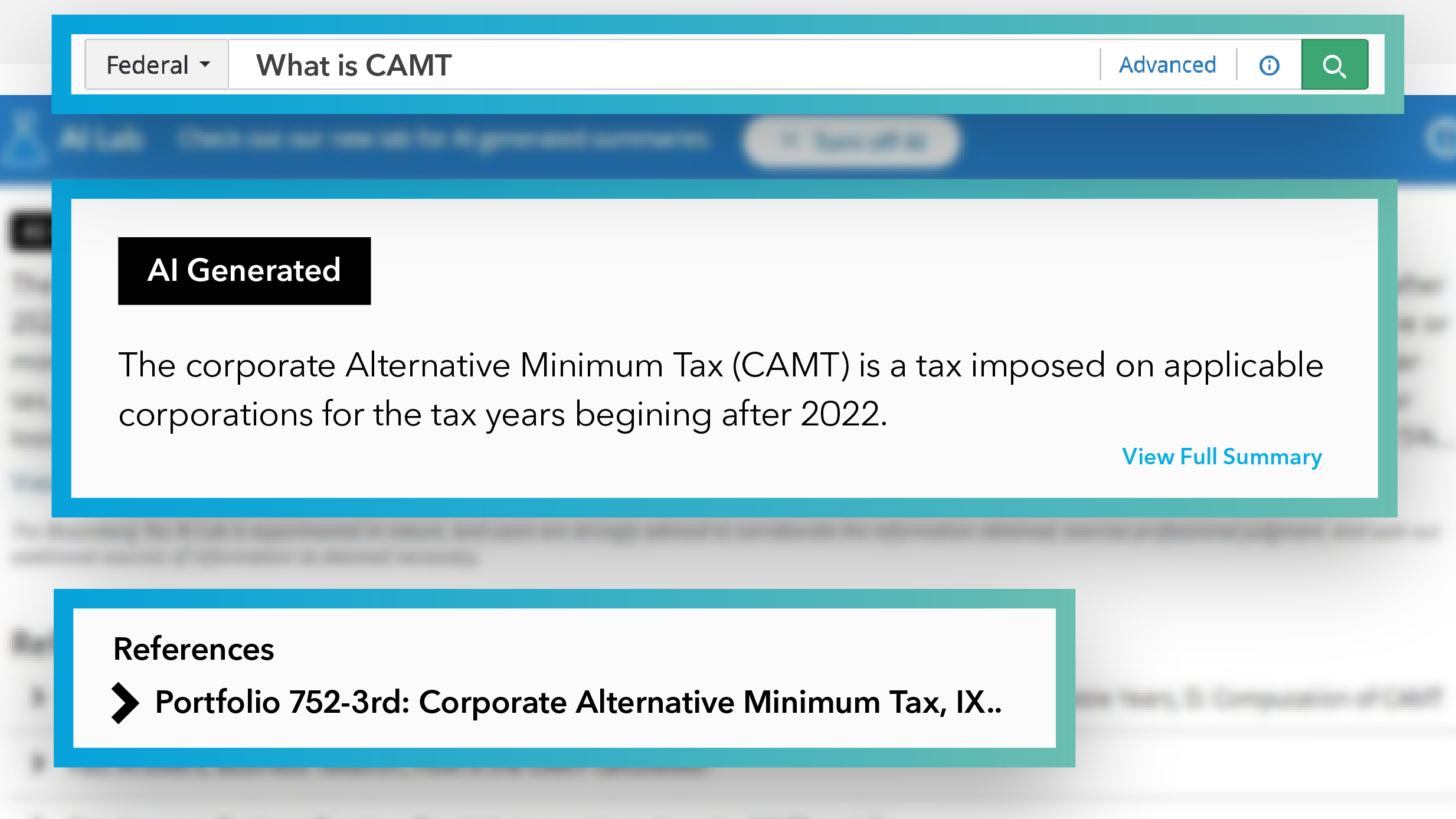

Trustworthy AI

AI-powered answers within Bloomberg Tax Research save you time while still giving you the same reliable response you expect from our trusted analysis.

Unravel the complexity of international tax challenges with on-the-ground analysis

Our extensive worldwide network of authors, expert practitioners, and local thought leaders provides authoritative analysis, country-specific practical insights, tax profiles, and detailed descriptions of VAT and GST laws in over 220 jurisdictions.

Explore Bloomberg Tax’s suite of solutions

Bloomberg Tax is the only solution you need to be a strategic advisor to the business.

Why tax professionals rely on Bloomberg Tax

“Whether it’s looking up definitions for permanent establishment in the treaty finder or using the document translator to translate receipts from local finance teams for tax returns, Bloomberg Tax Research is fantastic for our needs.”

Alex Garcia

Senior International Tax Analyst

Avnet, Inc.

“Have really enjoyed the recent enhancements to the tax withholdings calculator on Bloomberg Tax. The inclusion of business profits has been a real timesaver. This feature alone has been a tremendous asset to me and my team to answer questions by our business operations team.”

Paul Kohout

Vice President of Tax

Lionbridge Technologies, Inc.

“One of my favorite international tax solutions is the withholding tax chart builder. This tool allows me to easily determine the withholding tax rate between two countries for common transactions such as dividends, interest, and royalties, with the click of a button. The additional commentary available regarding reduced withholding rates and treaty rates is also beneficial.”

Jennifer Koorie

Corporate Tax Manager

Victaulic

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.