Bloomberg Tax Provision

Get your tax provision right every time — without the stress

Outdated provision software and manual processes cause too many issues and risks. Bloomberg Tax Provision is the modern solution that automates complex calculations to ensure your provision is accurate and always ties out.

The perfect balance of power and flexibility

Leverage technology that can accommodate even the most complex provision calculations while maintaining the flexibility to adapt to any business’ entity structure.

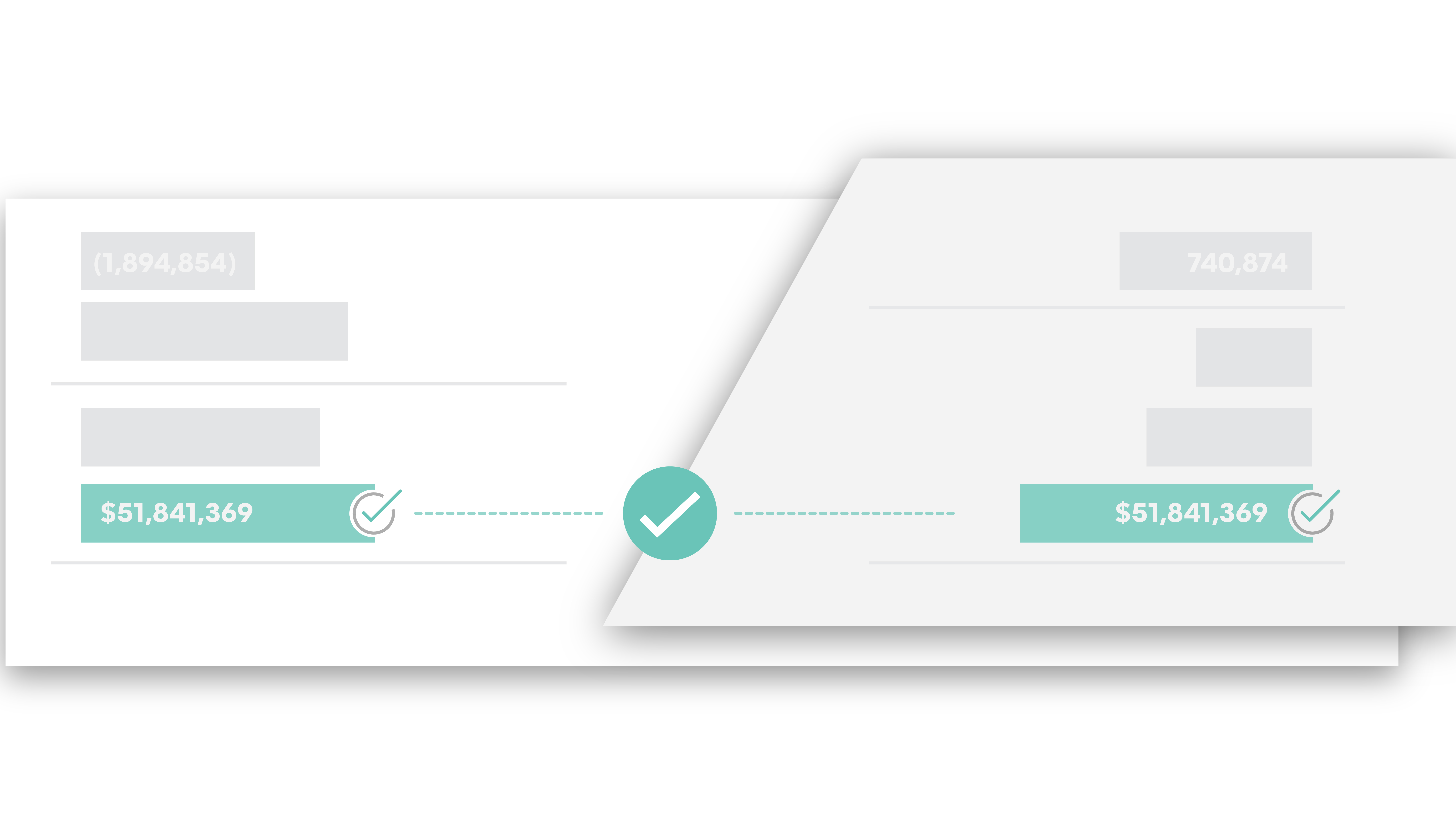

Cleaner, simpler and faster calculations

Our system automates calculations across the entire tax provision lifecycle and applies adjustments so they’re guaranteed to tie out – all within a cleanly designed interface that is intuitive to use.

Better audits with less stress

With a modern tool designed specifically for tax provision, by tax professionals, you can send reports directly to your auditors in a review-ready format that answers their questions before they even ask.

The right provision software can change everything

Bloomberg Tax Provision software is years ahead of any other tool in its class, designed to meet the needs of today’s tax professionals.

Run complete calculations

Our system automatically runs your ASC 740 tax provision calculation and applies adjustments to your rate rec and all other related schedules so they’re guaranteed to tie out.

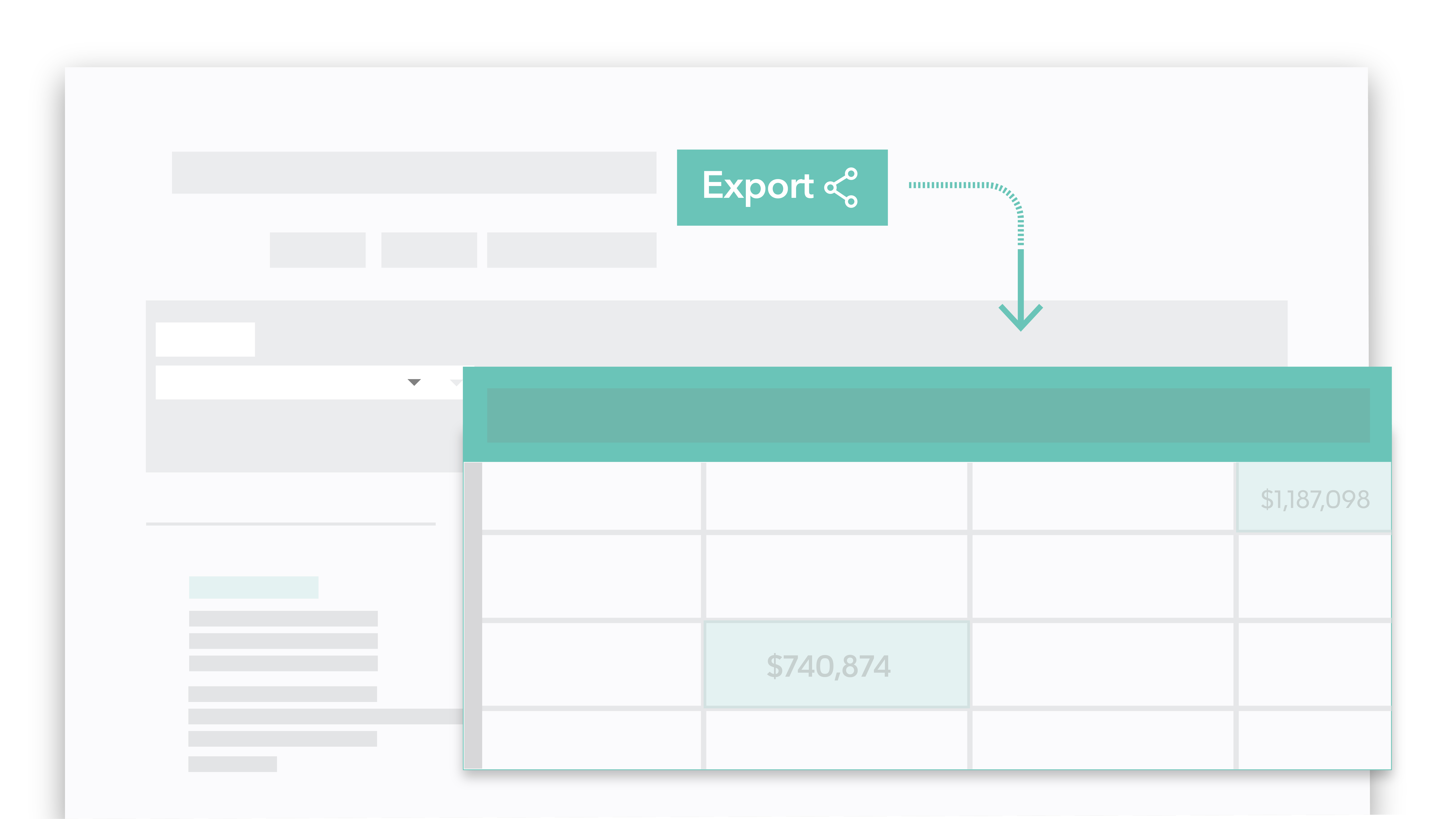

Deliver audit-ready reports

Export robust reports for your income tax provision directly to your auditors in a review-ready Excel output.

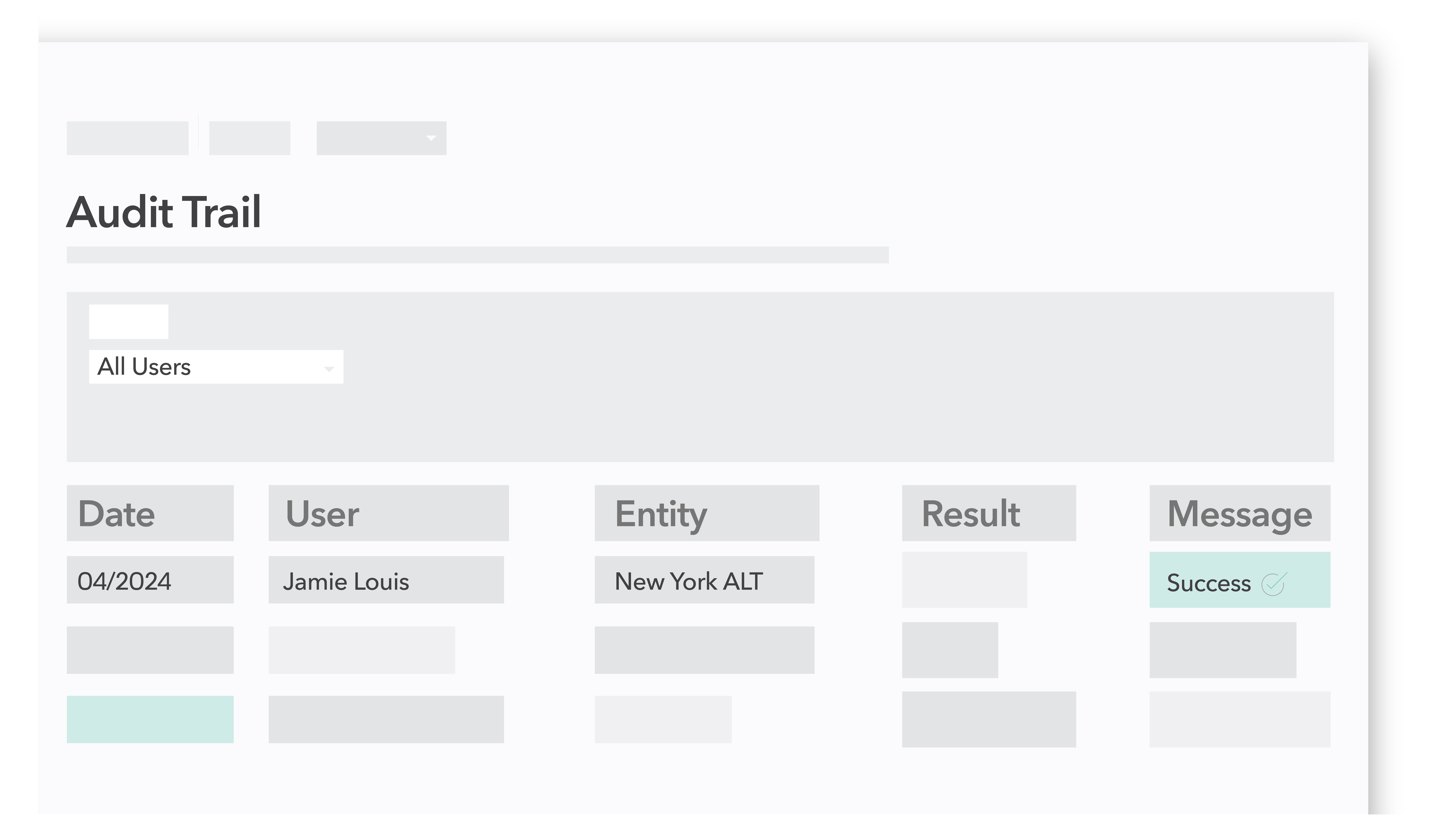

Achieve total control

Control all aspects of your tax provision process with a full audit trail, including review features, user permissions management, and automatically updated tax rates.

Jump in without missing a beat

Easy-to-use templates make it simple to upload data from your existing workpaper into Bloomberg Tax Provision.

Export footnotes with ease

Quickly export footnote detail that’s purpose-built for the required financial statement tax footnotes and disclosures.

Comply with confidence

Adherence to ASC 740 provides a jurisdiction-by-jurisdiction calculation and presentation — no need for a blended state calculation.

Getting started is simple

And so is everything else.

Get a demo

Get a firsthand look at how our provision solution will transform your work and address your specific needs.

Implement in four weeks

With a revolutionary implementation process, it takes only four guided sessions to onboard your team. These can take place weekly, so you can be fully up and running in the first month.

End the stressful cycle

As long as you’re using Bloomberg Tax Provision, you can work confidently and rest well, knowing your calculations are correct.

Way better and way faster than last year

It’s tempting to think you don’t have time to improve your process and implement better tools. But consider how much your current process is costing you. With the time and frustration you save using Bloomberg Tax Provision, you’ll feel less stressed and have more bandwidth to focus on higher-value activities. At least, that’s what our users say.

“Bloomberg Tax Provision significantly reduced the time we spend on a provision. I saved close to a month over the time it used to take working in Excel.”

Sherri Throop

Tax and Financial Reporting Manager

Novo Building Products

“I’ve done implementations of other software, and this one was hands-down the easiest to get the hang of. It was just a matter of weeks before we had full implementation and re-creation of our prior year provision ready to go.”

Corporate Tax Manager

Flexential

“We can compare prior to current quarters. Or if changes arise that need to change the comparative rate rec, you can identify those differences to make sure you’re comfortable with everything before you book entries.”

Director of Tax and Accounting

Insights

Request a demo

Bloomberg Tax simplifies the entire tax process with technology that automates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and we’ll be in touch to schedule a demo so you can see how our solutions transform your work and meet your unique needs.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.