Stay ahead of tax law changes. Join one of our 30-minute Bloomberg Tax webinar series for powerful use cases and tips.

Bloomberg Tax Fixed Assets

Streamline your projections

If you don’t have an efficient way to manage your fixed assets, you’ll constantly get pulled away from more strategic work. Bloomberg Tax Fixed Assets software is a cloud-based fixed assets subledger that automatically and accurately calculates depreciation so you can maximize tax savings.

Easily manage assets

With asset depreciation software that is fully integrated with the rest of your ecosystem, you can automate time-intensive, complex processes.

Reduce manual risk

Remove the chance of manual errors and know you’re always accurate with automated depreciation calculations based on built-in, up-to-date tax laws.

Gain more tax advantages

Manage your PP&E to move beyond compliance and effectively plan strategies that help your organization see better tax savings from your fixed assets.

A new era of fixed assets technology

From automation to precise reporting, Bloomberg Tax Fixed Assets is a powerful solution that adapts to meet your tax needs.

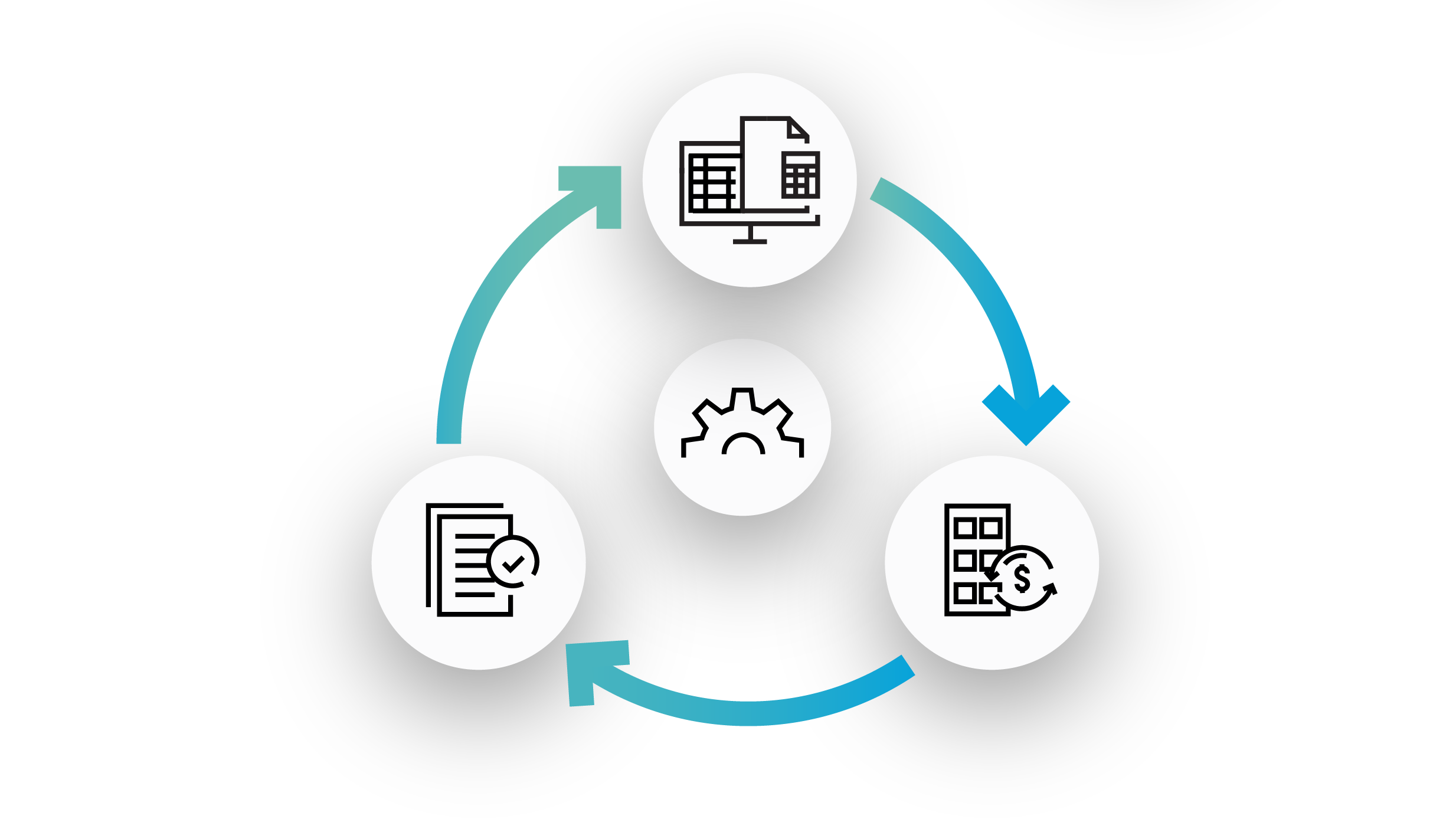

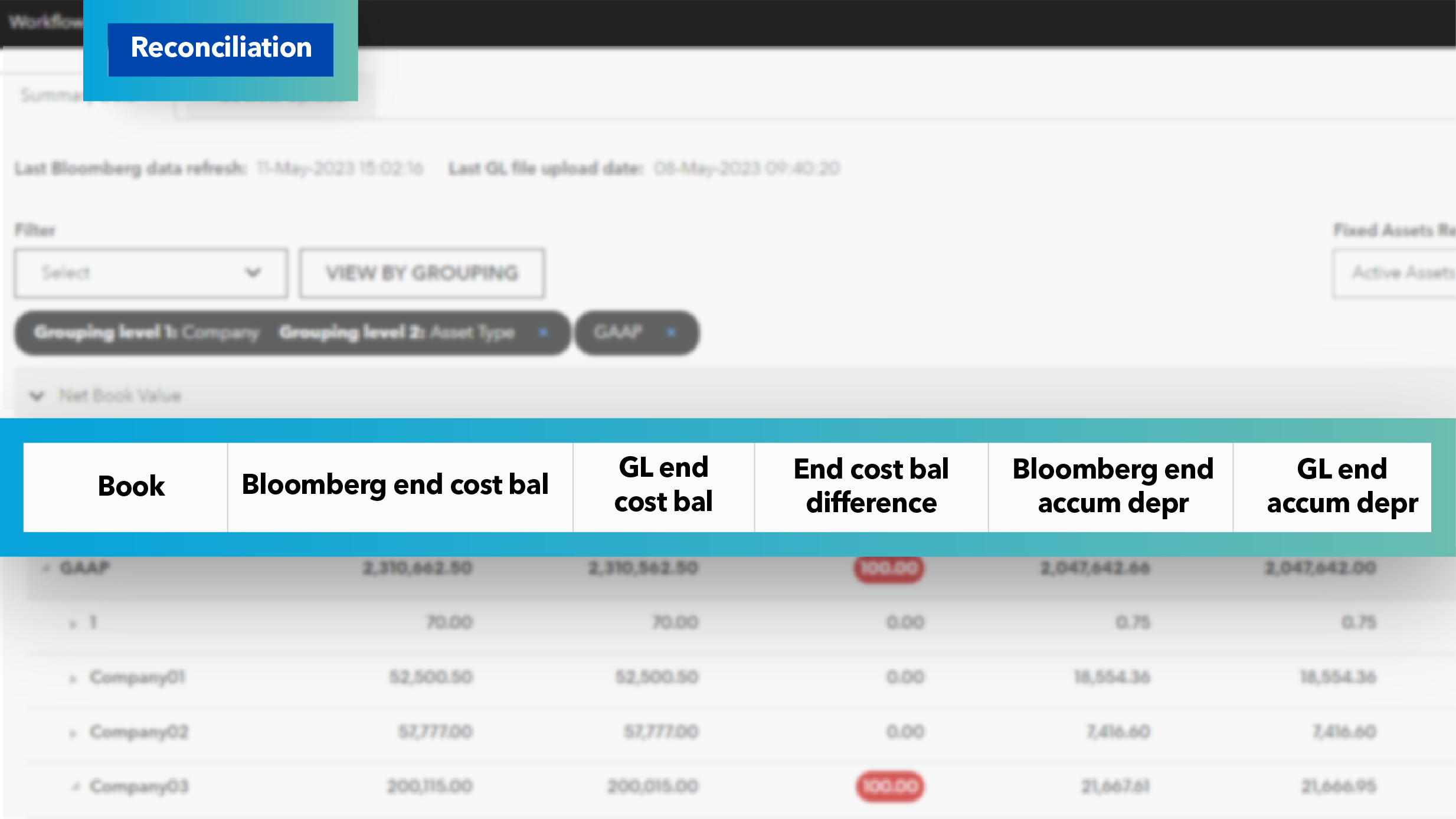

Workflow automation

Eliminate the painful process of manually inputting, reconciling, and reporting data. Save time by automating fixed assets workflows from beginning to end with ERP integration.

- Automate all asset transactions and journal entry creation.

- Reconcile your fixed assets transactions with your general ledger and schedule custom reports.

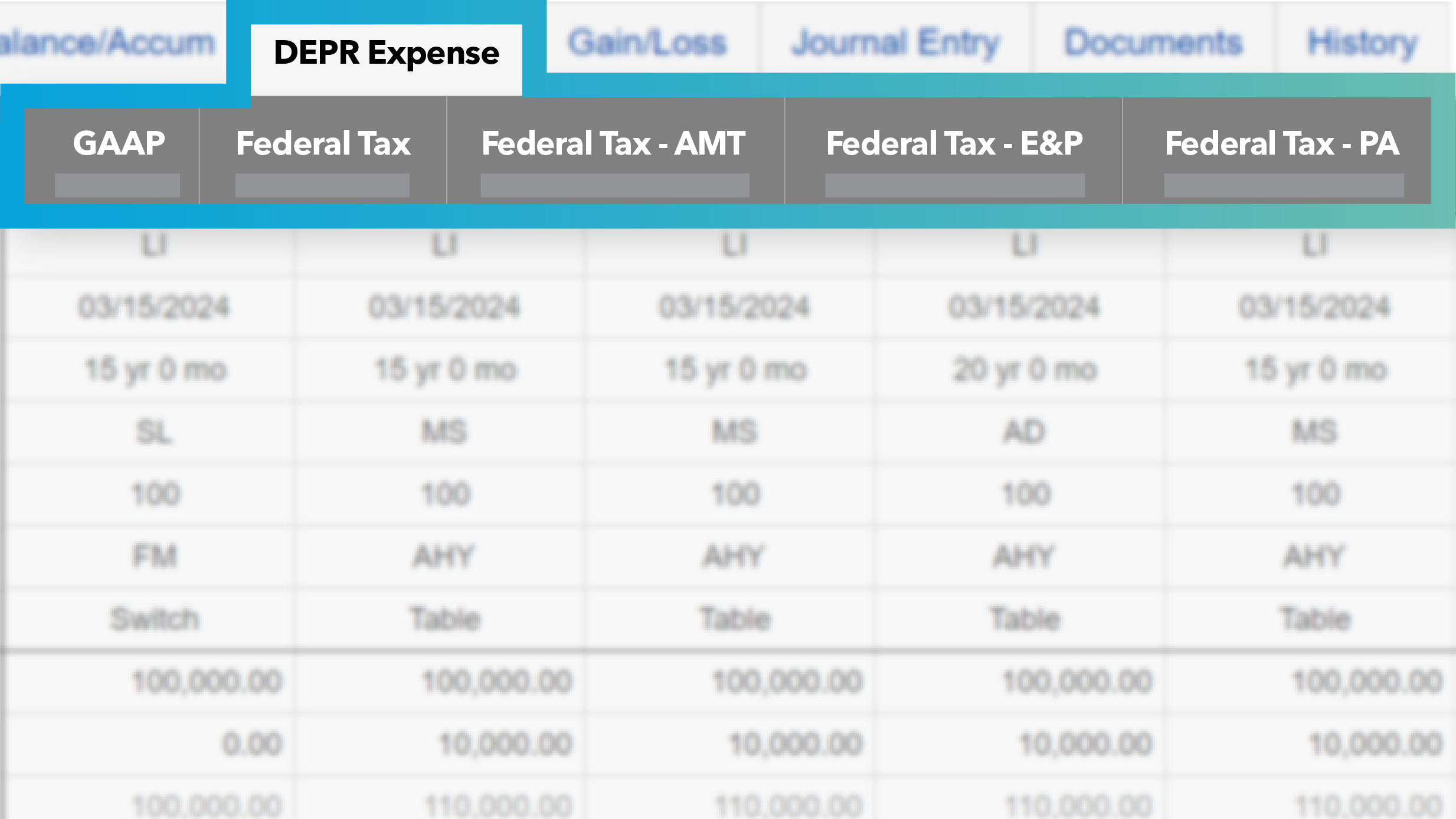

Accurate calculations

Access the most accurate and expansive depreciation features, including bonus calculations and complex, nonconforming state capabilities. Project future-year impact while maintaining previously reported numbers.

- Easily manage revisions to properly treat late capitalizations or trailing invoices.

- Federal and state tax laws are automatically updated.

Scalable software

As your business grows, your asset transactions inevitably become more complex. Bloomberg Tax Fixed Assets manages increased data complexities and prepares you to handle new challenges.

- Unlimited customization of up to 99 books helps you meet your business needs for additional jurisdictions, planning, or scenario modeling.

- Our cloud-based solution can handle the data needs of companies of all sizes, with no asset or record limitations.

Granular tax-focused reporting

Leverage a full suite of standard and custom reports.

- Generate 4562 and 4797 reports easily and accurately.

- Run consolidated reports with ease.

- Leverage intuitive roll forward reports.

Automation is one click away

Unlock automation and integration at every step of your tax workflow.

Get a demo

Get a firsthand look at how our fixed assets solution will transform your work and address your specific needs.

Customize for your business structure

Bloomberg Tax experts will make sure your experience is nothing short of excellent. Whether that’s ensuring a smooth implementation, helping convert data, or integrating with your tax compliance and accounting systems, we’ll make it simple.

Automate your fixed assets calculations

Gain efficiencies and save money with a depreciation software that automates time-consuming calculations.

Why customers love Bloomberg Tax Fixed Assets

In a 2023 Bloomberg Tax survey, customers shared why they rely on our software to simplify how they manage fixed assets.

Respond to change quickly

say they can respond to change more quickly and have more time for strategic activities.

Quick and easy period close

say Bloomberg Tax Fixed Assets shortened their organization’s closing period.

Full visibility of asset lifecycle

of users agree that Bloomberg Tax Fixed Assets reduced the time it takes to make changes to an asset’s life while preserving historical calculations.

Automatic tax law updates

of customers said that having automatic tax law updates has been extremely useful.

Don’t take it from us

“Having automatic updates allows us to focus on other things. Once we become aware of any changes, we know that it will be updated in the platform, and we will not have to worry about making any adjustments immediately. The platform does the calculation, and makes all future changes.”

Tax Manager

Cronimet Corporation

“We have used this product for decades as it is the most comprehensive and easy-to-use fixed asset software on the market. We can always count on timely product updates and 100% accurate calculations. It is our go-to product to manage our exhaustive list of fixed assets from acquisition to disposal and everything in between.”

CFO

Pam Transport

“Bloomberg Tax Fixed Assets allows my organization to efficiently complete all monthly, quarterly, and annual fixed asset tasks and federal and state tax filings … If my organization’s fixed asset related tasks were outsourced I would anticipate $50k+ in spend required.”

Senior Tax Manager

Public Corporation

Insights

Request a demo

Bloomberg Tax simplifies the entire tax process with technology that automates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and we’ll be in touch to schedule a demo so you can see how our solutions transform your work and meet your unique needs.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.