Advisory Firms

Deliver the best client strategy, backed by best-in-class tax tools

Multiple workflows, lack of automation, and compliance management create unnecessary stress for advisory firm professionals that could result in client attrition, legal risks, and regulatory consequences. Bloomberg Tax provides integrated practitioner-driven research and technology solutions to help you accurately, efficiently, and easily deliver timely, strategic insights and perform tax calculations for your clients.

Always be accurate

Know you’re accurate every time with technology that minimizes manual risks and gives you practical insight on how to best apply tax law for your clients.

Gain efficiency

Automate repetitive processes, streamline client work, and have confidence in your calculations with tools that are purpose-built for tax.

Save time

Because our reliable research and user-friendly software supports a more manageable workload, you’ll have time to focus on providing strategic, high-value guidance to your clients.

How Bloomberg Tax works for advisory firms

Tools designed with everything your tax team needs

Bloomberg Tax offers a suite of tax solutions to save time and money, increase productivity and efficiency, and help maximize your clients’ cash flow.

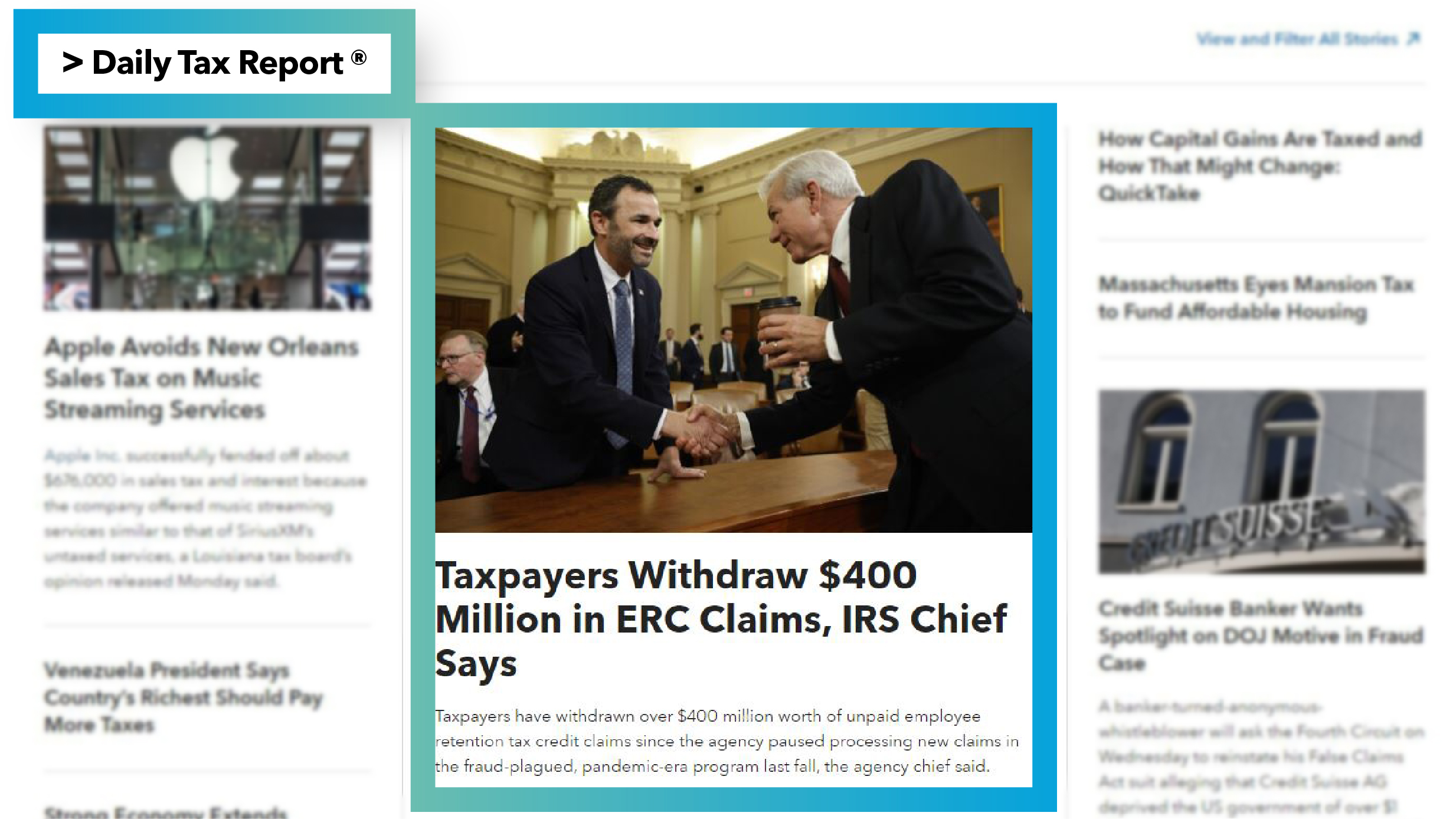

Top research tools

Stay on top of changes in federal, state, and international tax. Our Tax Management Portfolios and other gold standard tools on the Bloomberg Tax Research platform feature analysis from experts in the industry, covering the topics that matter most to your business.

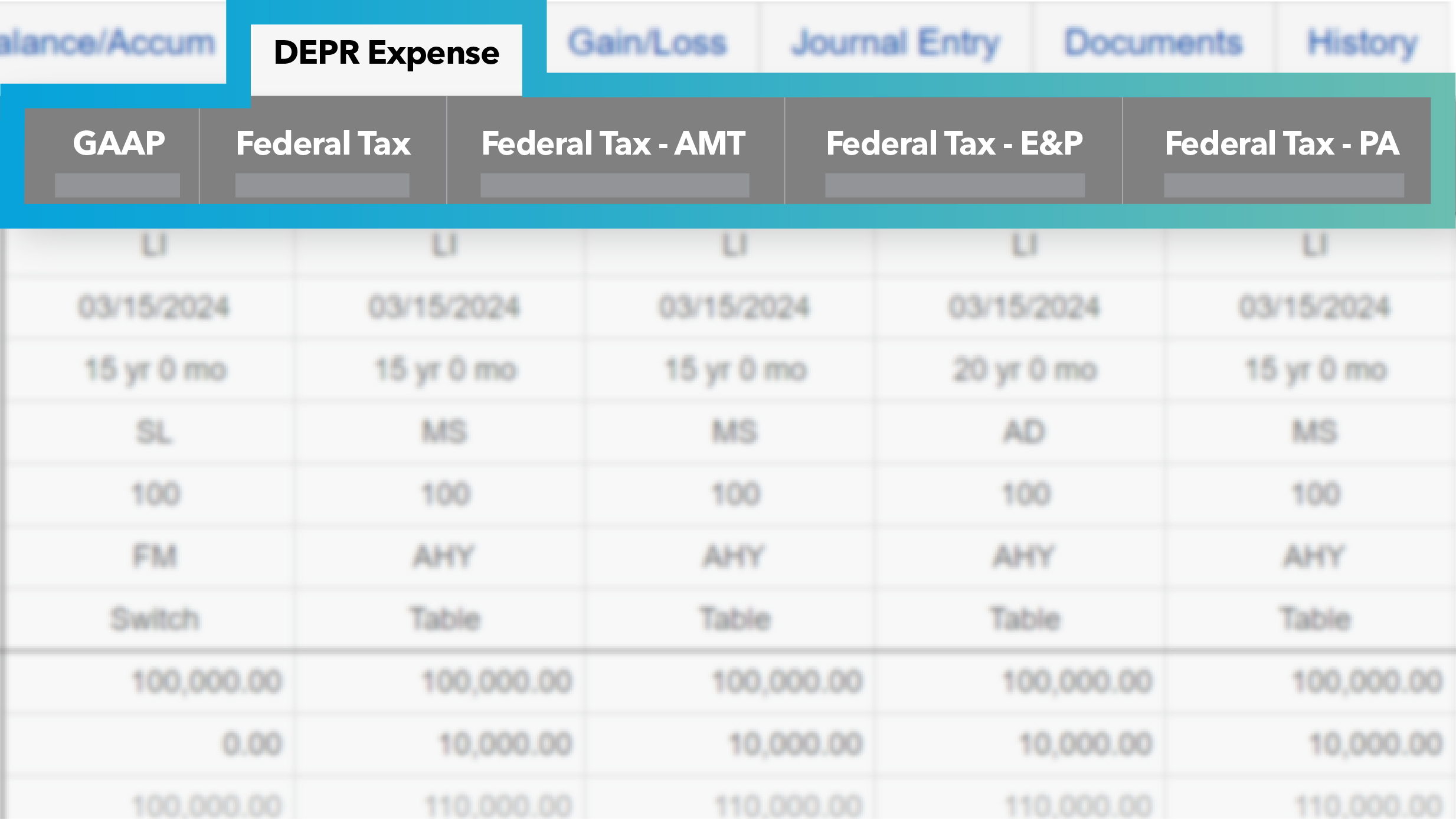

Depreciation modeling

Experience efficiency like never before with our cloud-based Bloomberg Tax Fixed Assets solution that offers seamless integration and access to secure data for multiple clients anytime, anywhere – with no risk of data loss.

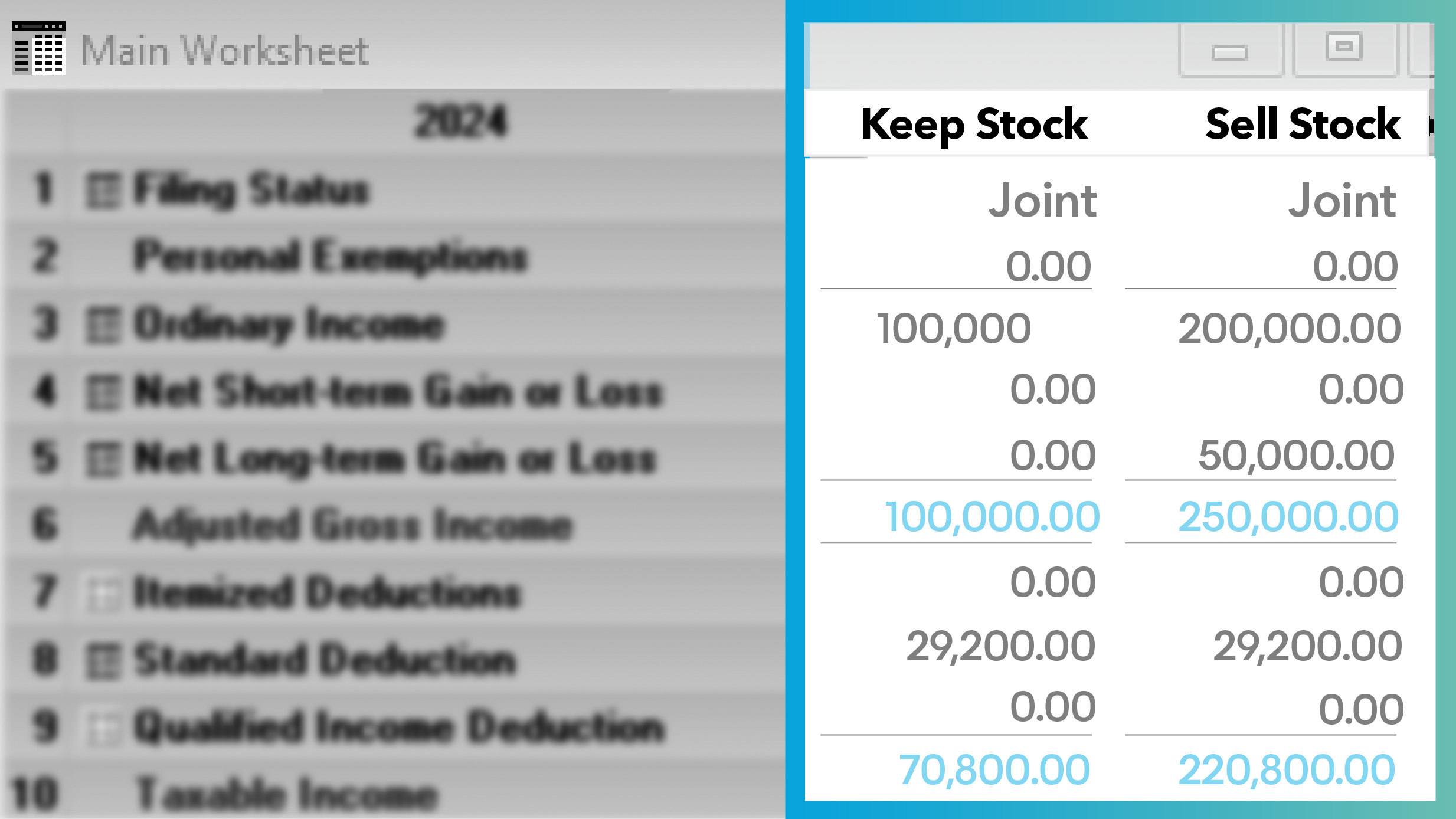

Tax planning software

Bloomberg Tax Income Tax Planner empowers you to help clients grow and preserve wealth. Tax regulations are seamlessly updated within the platform, along with in-depth analysis and side-by-side comparisons. Conduct tax projections up to 20 years into the future and effortlessly import data from multiple sources to streamline processes and reduce errors.

Accurate provision calcs

Bloomberg Tax Provision is the go-to solution made just for provision pros. It helps organize company information to meet ASC 740 footnote needs and, compared to other overly complicated software, ours is easier to use.

Smarter automation

Tax-focused automation capabilities in Bloomberg Tax Workpapers create more efficient workflows and remove risk from your process so you can spend more time on higher-value activities.

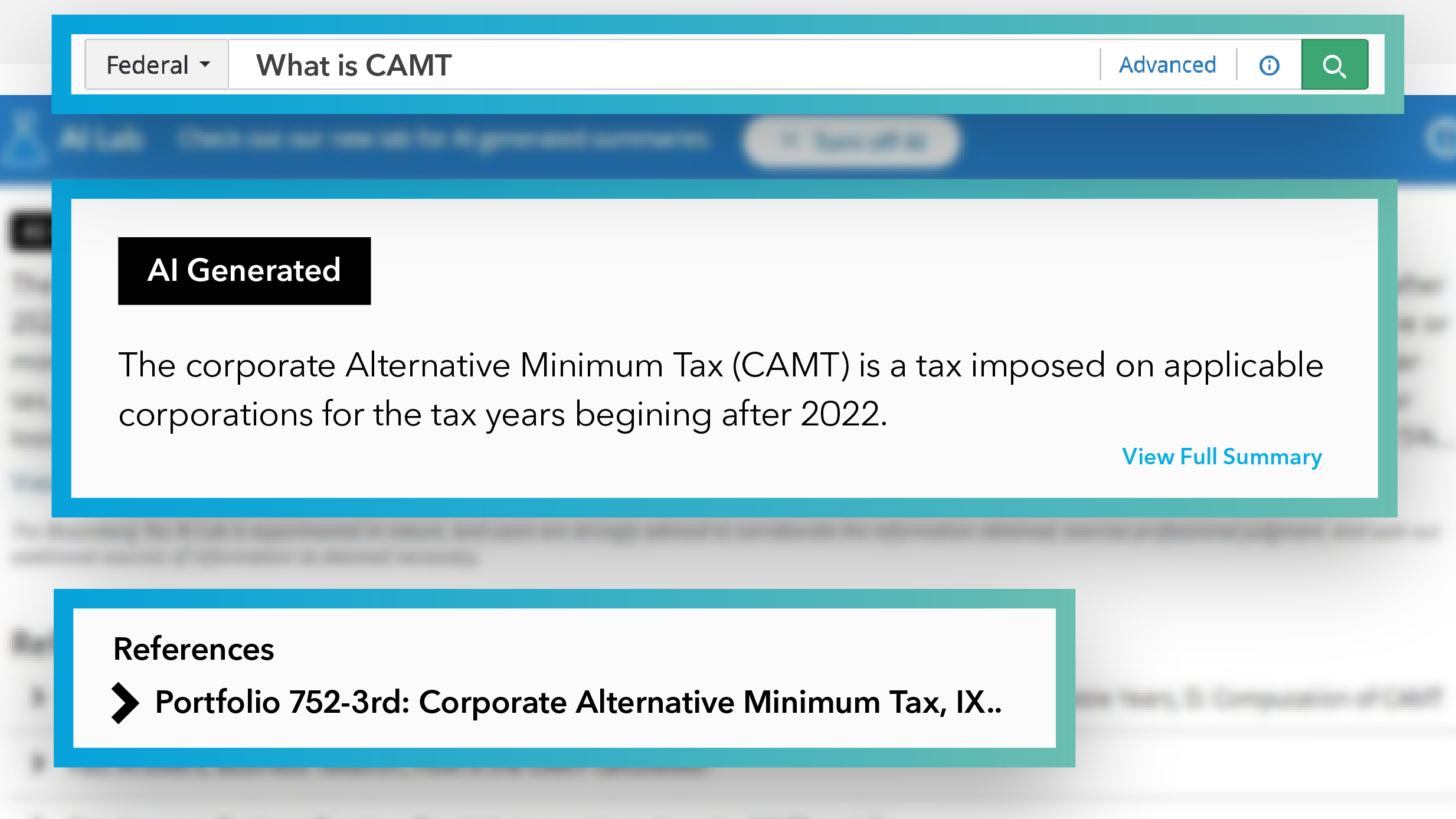

Trustworthy AI

AI-powered answers save you time while still giving you the same reliable response you expect from our trusted Portfolios and Tax Practice Series.

Explore Bloomberg Tax’s suite of solutions

Bloomberg Tax is the only solution you need to deliver the best client strategy.

Why customers love Bloomberg Tax

“Bloomberg Tax can give you an in-depth crash course on those inscrutable bits of tax law. Consider it an essential component of your staff-level resources.”

Thomas DeHart

Tax Associate

Rodefer Mos, PLLC

“We currently use Bloomberg Tax Provision, Research, and Workpapers. It’s great to have tools that are interconnected so that you’re not having to go to multiple platforms.”

Becky Hawkins

Associate Tax Director

Riveron

“I have been impressed by the responsiveness and timely communication from the Bloomberg Tax Research support team whenever I have had an inquiry – even on the weekend outside of “tax season”!”

Kelly Brown

Tax Manager

Yeo & Yeo

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.