State Conformity to Federal Bonus Depreciation

Keeping up with changing state tax laws has always been a challenging part of state tax planning for corporations, especially because states don’t consistently conform to the federal Internal Revenue Code (I.R.C.). To help simplify your corporate tax planning strategy and reduce risk, our state tax experts have compiled each state’s specific bonus depreciation rules and how they conform to federal bonus depreciation laws.

[Download the full state I.R.C. conformity chart for each state’s conformity status, key differences between state and federal bonus depreciation rules, state resources, and expert analysis.]

Bonus depreciation qualified property

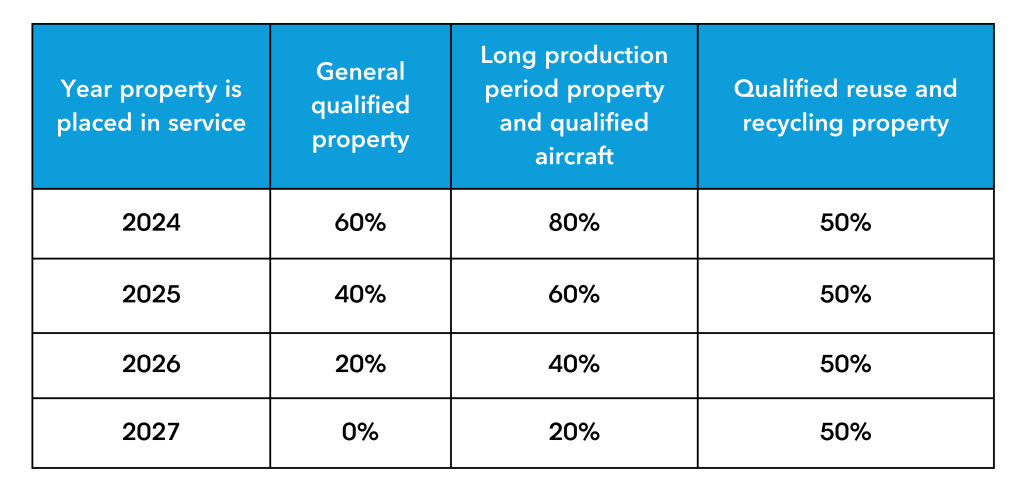

Bonus depreciation allows taxpayers to deduct a specified percentage of depreciation in the year the qualifying property is placed in service.

Bonus depreciation percentage by year

Qualified property is defined as property that meets three requirements:

- It is MACRS property with a recovery period of 20 years or less (including qualified improvement property), depreciable (off-the-shelf) computer software, water utility property (other than rate-regulated public water utility property), qualified film production, qualified television production, qualified live theatrical production, an I.R.C. §743(b) basis adjustment in qualified property, a specified plant (defined in I.R.C. §165(k)(5)), or qualified reuse and recycling property (defined in I.R.C. §165(m)(2)).

- Either its original use begins with the taxpayer, or it was not used by the taxpayer or a predecessor in the five years before the taxpayer’s current placed-in-service year and it meets certain other used property acquisition requirements.

- It is placed in service before 2027 (or before 2028 for certain longer production period property and qualified aircraft that are acquired before 2027 or acquired pursuant to a written binding contract that became binding before 2027).

Which states conform to federal bonus depreciation?

Use our lookup tool below to quickly find which states follow federal bonus depreciation rules and which states don’t allow bonus depreciation. Download the full list of state charts to easily compare how each state (plus Washington, D.C., and New York City) conforms to the federal treatment of bonus depreciation.

Your guide through the state depreciation maze

Calculating state bonus depreciation has long been a frustrating and stressful part of state tax planning for corporations, with tax accountants going cross-eyed staring at complicated spreadsheets while under the looming threat of audits or fines. Bloomberg Tax Research helps you easily compare state conformity to federal tax code sanctions in an instant with our I.R.C. State Conformity Chart Builder. With just a few clicks, you’ll select the state and I.R.C. section to compare, see if the state conforms, and quickly link to key expert analysis and primary source materials for a corporate tax planning strategy that ensures compliance no matter the state.

Request a demo to see our platform in action.

Conformity charts: State bonus depreciation rules

The following charts explain how each state conforms to federal bonus depreciation rules for tax years after 2007 and before 2020 under I.R.C. § 168(k) – Current Year Computation of Taxable Income.

Alabama

State website

Conformity status

Partial conformity

Description

Corporate: Partial conformity. While Alabama conforms to the federal treatment of bonus depreciation, Alabama does not permit bonus depreciation for property acquired after Dec. 31, 2007 and placed in service before Jan. 1, 2009. Ala. Code § 40-18-33; Alabama Analysis of Federal Tax Law Revisions on the State of Alabama (July 30, 2018); CITN AL 5.3.1.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Alabama Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Alaska

State website

Conformity status

Partial conformity

Description

Corporate: Partial conformity. While Alaska conforms to the federal treatment of bonus depreciation, including amendments made by the 2017 tax act, oil and gas producers are required to follow I.R.C. § 167 as was in effect on June 30, 1981. Alaska Stat. § 43.20.021(a); Alaska Stat. § 43.20.144(b)(4); Alaska Admin. Code tit. 15, § 20.480(b); AK CITN 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Alaska Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Arizona

State website

Conformity status

Does not conform

Description

Corporate: Arizona does not conform to the federal treatment of bonus depreciation and requires an addition modification for any bonus depreciation taken, but then allows a corresponding deduction, which is computed as if the taxpayer had not elected bonus depreciation. Ariz. Rev. Stat. Ann. § 43-1121(4); Ariz. Rev. Stat. Ann. § 43-1122(20); Arizona Dept. of Rev., Income Tax Notice for Corporate Taxpayers (June 4, 2019); CITN AZ 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Arizona Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Arkansas

State website

Conformity status

Does not conform

Description

Corporate: Arkansas does not conform to the federal treatment of bonus depreciation and requires taxpayers to add back any bonus depreciation deducted at the federal level. Ark. Code Ann. § 26-51-428(a), as amended by 2019 Ark. H.B. 1953, effective for taxable years beginning on or after Jan. 1, 2019; Arkansas Schedule 1100REC: Corporation Income Tax Reconciliation Schedule; CITN AR 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Arkansas Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

California

State website

Conformity status

Does not conform

Description

Corporate: California disallows a deduction for bonus depreciation. Cal. Rev. & Tax. Code § 24349; California Tax Publication FTB 1001; CITN CA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

California Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

ARTICLE

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Colorado

State website

Conformity status

Conforms

Description

Corporate: Colorado conforms to the federal treatment of bonus depreciation. Colo. Rev. Stat. § 39-22-304; CITN CO 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Colorado Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Connecticut

State website

Conformity status

Does not conform

Description

Corporate: Connecticut does not conform to the federal treatment of bonus depreciation, because Connecticut has passed legislation decoupling from I.R.C. § 168(k). Taxpayers are required to add back any bonus depreciation deduction taken at the federal level in computing Connecticut net income, but 25% of the amount added back in the prior year may be subtracted in each of the four succeeding years. Connecticut has decoupled from I.R.C. § 168(k), and therefore does not conform to the amendments to I.R.C. § 168(k) made by the 2017 tax act. Conn. Gen. Stat. § 12-217(b)(1), as amended by 2018 Conn. S.B. 11, effective May 31, 2018; Connecticut Office of the Commissioner Guidance OCG-5 (June 14, 2018); Connecticut Special Notice SN 2018(9.1) (March 1, 2019) (provides conformity information for Connecticut state income tax purposes); CITN CT 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Connecticut Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Delaware

State website

Conformity status

Conforms

Description

Corporate: Delaware conforms to the federal treatment of bonus depreciation. Del. Code Ann. tit. 30, § 1901(10); Del. Code Ann. tit. 30, § 1903(a); CITN DE 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Delaware Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

District of Columbia

State website

Conformity status

Does not conform

Description

Corporate: The District of Columbia does not conform to the federal treatment of bonus depreciation. D.C. Code Ann. § 47-1803.03(a)(7); CITN DC 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

District of Columbia Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Florida

State website

Conformity status

Does not conform

Description

Corporate: Florida does not conform to the federal treatment of bonus depreciation. Amounts deducted as bonus depreciation under I.R.C. § 168(k) for assets placed in service after Dec. 31, 2007, but before Jan. 1, 2027, must be added back. However, Florida permits a state deduction over seven years for one-seventh of the amounts that were added back, beginning with the taxable year of the addition. Fla. Stat. § 220.13(1)(e)(1)(a), (b); Florida Tax Information Publication 20C01-01R (Aug. 13, 2021); CITN FL 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Florida Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Georgia

State website

Conformity status

Does not conform

Description

Corporate: Georgia does not conform to the federal treatment of bonus depreciation under I.R.C. § 168(k) and requires an addition to federal taxable income for any bonus depreciation taken at the federal level. Ga. Code Ann. § 48-1-2(14), as amended by, and as amended by Ga. S.B. 56, effective for taxable years beginning on or after Jan. 1, 2022; Georgia Dept. of Rev., Income Tax Federal Tax Changes (last visited May 15, 2024); CITN GA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Georgia Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Hawaii

State website

Conformity status

Does not conform

Description

Corporate: Hawaii does not conform to the federal treatment of bonus depreciation under I.R.C. § 168(k) and requires an addition to federal taxable income for any bonus depreciation taken at the federal level. Haw. Rev. Stat. § 235-2.4(m), as amended by 2023 Haw. H.B. 1100, effective for taxable years beginning after Dec. 31, 2022; CITN HI 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Hawaii Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Idaho

State website

Conformity status

Does not conform

Description

Corporate: Idaho does not conform to the federal treatment of bonus depreciation under I.R.C. § 168(k) and requires an addition to federal taxable income for any bonus depreciation taken at the federal level. Idaho provides an exception for property placed into service in 2008 and 2009. Idaho Code § 63-3022O(1), as amended by 2022 Idaho H. 714, effective retroactively to Jan. 1, 2016; Idaho Admin. Rules § 35.01.01.105.06; Idaho Regs. § 35.01.01.125; Idaho State Tax Comn., (last visited May 15, 2024); CITN ID 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Idaho Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Illinois

State website

Conformity status

Partial conformity

Description

Corporate: For property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023, Illinois allows a deduction for 100% bonus depreciation under I.R.C. § 168(k) and does not require taxpayers to report any deduction taken for federal tax purposes. Illinois requires an addition modification for 40% bonus depreciation deducted under I.R.C. § 168(k) for qualified property acquired before Sept. 27, 2017, and placed in service in 2018. 35 ILCS 5/203(b)(2)(E-10); (T), (U); Illinois Form IL-4562: Instructions for Special Depreciation; Illinois Dept. of Rev., Explanation of the Impact on Illinois Tax Revenue Resulting From the Federal Tax Cuts and Jobs Act (March 1, 2018); CITN IL 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Illinois Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Indiana

State website

Conformity status

Does not conform

Description

Corporate: Indiana disallows a deduction for bonus depreciation. Ind. Code Ann. § 6-3-1-3.5(b)(5); Ind. Code Ann. § 6-3-1-33; Indiana Tax Information Income Tax Bulletin 118; Indiana Dept. of Rev., Tax Chapter 2020 for the 2019 Filing Year; CITN IN 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Indiana Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Iowa

State website

Conformity status

Partial conformity

Description

Corporate: For tax years beginning, and property placed in service, on or after Jan. 1, 2021, Iowa conforms to the federal treatment of bonus depreciation under I.R.C. § 168(k). For tax years beginning, and property placed in service, before Jan. 1, 2021, Iowa does not conform to bonus depreciation and requires an addition modification for any bonus depreciation taken at the federal level. Former Iowa Code Ann. § 422.35(19A), repealed by 2021 Iowa S.F. 619, effective for tax years beginning, and property placed in service, on or after Jan. 1, 2021; Iowa Admin. Code r. 701–53.22; Iowa Nonconformity: Coronavirus Aid, Relief, and Economic Security Act of 2020; CITN IA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Iowa Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Kansas

State website

Conformity status

Conforms

Description

Corporate: Kansas conforms to the federal treatment of bonus depreciation. Kan. Stat. Ann. § 79-32,138; CITN KS 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Kansas Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Kentucky

State website

Conformity status

Does not conform

Description

Corporate: Kentucky does not conform to the federal treatment of bonus depreciation. For property placed in service after Sept. 10, 2001, Kentucky conforms to the depreciation deduction under I.R.C. § 168 as was in effect on Dec. 31, 2001. Ky. Rev. Stat. Ann. § 141.0101(16)(a); CITN KY 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Kentucky Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Louisiana

State website

Conformity status

Conforms

Description

Corporate: Louisiana conforms to the federal treatment of bonus depreciation. La. Rev. Stat. Ann. § 47:65; La. Rev. Stat. Ann. § 47:287.65; Louisiana Revenue Information Bulletin 08-008; La. Rev. Stat. Ann. § 47:287.701(A); CITN LA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Louisiana Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Maine

State website

Conformity status

Does not conform

Description

Corporate: Maine does not conform to the federal treatment of bonus depreciation. Maine requires an addback for the net increase in depreciation attributable to the deduction claimed under I.R.C. § 168(k). However, Maine offers a capital investment tax credit in an amount equal to 9% of the amount claimed for the federal bonus depreciation deduction. Me. Rev. Stat. Ann. tit. 36, § 5200-A(1)(CC), (2)(FF); Me. Rev. Stat. Ann. tit. 36, § 5219-NN(1)(A); Maine Guidance Document: Modifications Related to Bonus Depreciation & Section 179 Expensing; CITN ME 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Maine Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Maryland

State website

Conformity status

Does not conform

Description

Corporate: Maryland does not conform to the federal treatment of bonus depreciation. Maryland requires an addition modification for bonus depreciation taken at the federal level in computing state adjusted gross income. Md. Code Ann., Tax-Gen. § 10-210.1(b)(1); Md. Code Ann., Tax-Gen. § 10-310; Md. Code Ann., Tax-Gen. § 10-305(d)(2); Md. Comp. of the Treas., Maryland Administrative Release No. 38 (Sept. 2010); Md. Comp. of the Treas., Instructions Maryland Form 500DM: Decoupling Modification; CITN MD 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Maryland Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Massachusetts

State website

Conformity status

Does not conform

Description

Corporate: Massachusetts disallows a deduction for bonus depreciation. Mass. Gen. L. ch. 63, § 30(4)(iv); Massachusetts Technical Information Release TIR 02-11 (Aug. 1, 2002); Massachusetts Technical Information Release TIR 03-25 (April 29, 2004); CITN MA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Massachusetts Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Michigan

State website

Conformity status

Does not conform

Description

Corporate: Michigan does not conform to the federal treatment of bonus depreciation. However from Jan. 1, 2008 through Dec. 31, 2011, Michigan provided a MBT credit for bonus depreciation claimed on the federal return. Mich. Comp. Laws § 206.607(1); Mich. Comp. Laws § 208.1461; CITN MI 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Michigan Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Minnesota

State website

Conformity status

Does not conform

Description

Corporate: Minnesota does not conform to the federal treatment of bonus depreciation and requires an addition modification to federal taxable income of 80% of bonus depreciation taken at the federal level in computing state taxable income. Minn. Stat. § 290.0133(11); Minn. Stat. § 290.0134(13); CITN MN 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Minnesota Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Mississippi

State website

Conformity status

Partial conformity

Description

Corporate: Partial conformity. Mississippi allows a 100% bonus depreciation deduction for qualified property in the year the property was placed in service. However, Mississippi allows an election to depreciate qualified property in accordance with I.R.C. § 168(k). Miss. Code Ann. § 27-7-17(1)(f), as amended by 2023 Miss. H.B. 1733, effective Jan. 1, 2023; et seq.; Mississippi Notice 80-23-003 (Oct. 20, 2023); Mississippi Form 83-100: Instructions to Corporate Income and Franchise Tax Return; CITN MS 5.3.1.2.Miss. Regs. § 35.III.05.04.100 et seq.; Mississippi Notice 80-23-003 (Oct. 20, 2023); Mississippi Form 83-100: Instructions to Corporate Income and Franchise Tax Return; CITN MS 5.3.1.2 CITN MS 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Mississippi Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Missouri

State website

Conformity status

Partial conformity

Description

Corporate: Partial conformity. Missouri conforms to the federal treatment of bonus depreciation, except that bonus depreciation is not allowed for property purchased on or after July 1, 2002 and prior to July 1, 2003. Mo. Rev. Stat. § 143.431(2); Mo. Rev. Stat. § 143.121(2)(3); CITN MO 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Missouri Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Montana

State website

Conformity status

Conforms

Description

Corporate: Montana conforms to the federal treatment of bonus depreciation. Mont. Code Ann. § 15-31-113; Mont. Code Ann. § 15-31-114; Mont. Code Ann. § 15-31-114(1)(b)(i); CITN MT 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Montana Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Nebraska

State website

Conformity status

Conforms

Description

Corporate: Nebraska conforms to the federal treatment of bonus depreciation, including amendments made by the 2017 tax act and the CARES Act. Neb. Rev. Stat. § 77-2714; Neb. Rev. Stat. § 77-2716(9); Nebraska Dept. of Rev., Effects of the Coronavirus Aid, Relief, and Economic Security Act on the State of Nebraska’s Tax Revenue; CITN NE 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Nebraska Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Nevada

State website

Conformity status

Nevada does not impose a corporate income tax.

Description

Corporate: Nevada does not impose a corporate income tax.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Nevada Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

New Hampshire

State website

Conformity status

Does not conform

Description

Corporate: No, New Hampshire does not conform to the federal treatment of bonus depreciation. New Hampshire decouples from I.R.C. § 168(k). N.H. Rev. Stat. Ann. § 77-A:3-b; N.H. Rev. Stat. Ann. § 77-A:1(XX)(o), as added by 2019 N.H. H.B. 4, effective for taxable years beginning on or after Jan. 1, 2020; CITN NH 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

New Hampshire Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

New Jersey

State website

Conformity status

Does not conform

Description

Corporate: New Jersey does not conform to the federal bonus depreciation deduction. New Jersey requires an addition to net income for any bonus depreciation amounts. N.J. Rev. Stat. § 54:10A-4(k)(12); N.J. Admin. Code tit. 18, § 7-5.2(a)(2)(iv); New Jersey Form CBT-100: Instructions for Corporation Business Tax Return; CITN NJ 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

New Jersey Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

New Mexico

State website

Conformity status

Conforms

Description

Corporate: New Mexico conforms to the federal treatment of bonus depreciation. N.M. Stat. Ann. § 7-2A-2(C), as amended by 2019 N.M. H.B. 6, effective for taxable years beginning on or after Jan. 1, 2020; CITN NM 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

New Mexico Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

New York

State website

Conformity status

Does not conform

Description

Corporate: New York does not conform to the federal treatment of bonus depreciation. However, New York allows for bonus depreciation of qualified resurgence zone property and qualified New York Liberty Zone property. N.Y. Tax Law § 208(9)(b)(17); N.Y. Tax Law § 208(9)(q); CITN NY 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

New York Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

New York City

City website

Conformity status

Does not conform

Description

Corporate: New York City does not conform to the federal treatment of bonus depreciation, because New York City has enacted legislation decoupling from I.R.C. § 168(k). New York City requires an addback to federal taxable income for any bonus depreciation taken at the federal level. However, New York City allows for bonus depreciation of qualified resurgence zone property and qualified New York Liberty Zone property. N.Y.C. Admin. Code § 11-641(b)(13); CITN NYC 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

New York City Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

North Carolina

State website

Conformity status

Does not conform

Description

Corporate: North Carolina does not conform to the federal treatment of bonus depreciation and requires taxpayers to add back 85% of the bonus depreciation taken at the federal level, which then may be deducted on the state level over a five-year period. N.C. Gen. Stat. § 105-130.5(a)(24); N.C. Gen. Stat. § 105-130.5B; CITN NC 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

North Carolina Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

North Dakota

State website

Conformity status

Conforms

Description

Corporate: North Dakota conforms to the federal treatment of bonus depreciation. N.D. Cent. Code § 57-38-01(5)(c); N.D. Cent. Code § 57-38-01(13); N.D. Cent. Code § 57-38-01.1; N.D. Cent. Code § 57-38-01.3(1); CITN ND 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

North Dakota Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Ohio

State website

Conformity status

Does not conform

Description

Corporate: Ohio does not conform to the federal treatment of bonus depreciation. Ohio imposes a Commercial Activity Tax based on gross receipts in lieu of a corporate income or franchise tax. Ohio Rev. Code Ann. § 5751.02; Ohio Rev. Code Ann. § 5751.01(F); CITN OH 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Ohio Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Oklahoma

State website

Conformity status

Does not conform

Description

Corporate: Oklahoma does not conform to the federal treatment of bonus depreciation under I.R.C. § 168(k). For property acquired and placed in service after Dec. 31, 2021, Oklahoma requires the addition of the federal bonus depreciation deduction to federal taxable income. Oklahoma then allows a 100% bonus depreciation deduction, notwithstanding changes to the bonus depreciation amount at the federal level. Okla. Stat. Ann. tit. 68, § 2358.6A(B), as added by 2022 Okla. H.B. 3418, effective for tax years beginning after Dec. 31, 2021; Okla. Stat. Ann. tit. 68, § 2353(3); Okla. Stat. Ann. tit. 68, § 2353(10) Okla. Admin. Code § 710:50-15-69.1, as amended effective Aug. 11, 2023; CITN OK 5.3.1.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Oklahoma Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Oregon

State website

Conformity status

Partial conformity

Description

Corporate: Oregon conforms to the federal treatment of bonus depreciation. Note for tax years 2009 and 2010 Oregon did not allow bonus depreciation. Or. Rev. Stat. § 317.301(2); Or. Rev. Stat. § 317.010(8), (9); CITN OR 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Oregon Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Pennsylvania

State website

Conformity status

Does not conform

Description

Corporate: Pennsylvania does not conform to the federal treatment of bonus depreciation and requires companies to calculate depreciation under the modified accelerated cost recovery system. 72 Pa. Stat. § 7401(3)(1)(r)(2), (3)(1)(q); Pennsylvania Corporate Tax Bulletin No. CT 2018-03 (July 6, 2018); Pennsylvania Tax Bulletin: Tax Cuts and Jobs Act 2017 – What does it mean for Pennsylvania Taxpayers?; CITN PA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Pennsylvania Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Rhode Island

State website

Conformity status

Does not conform

Description

Corporate: Rhode Island does not conform to the federal treatment of bonus depreciation and requires an additional modification for bonus depreciation taken at federal level. R.I. Gen. Laws § 44-61-1; CITN RI 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Rhode Island Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

South Carolina

State website

Conformity status

Does not conform

Description

Corporate: South Carolina does not conform to the federal treatment of bonus depreciation. South Carolina specifically does not adopt I.R.C. § 168(k). S.C. Code Ann. § 12-6-50(4); CITN SC 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

South Carolina Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

South Dakota

State website

Conformity status

South Dakota does not impose a corporate income tax.

Description

Corporate: South Dakota does not impose a corporate income tax.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

South Dakota Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Tennessee

State website

Conformity status

Partial conformity

Description

Corporate: For assets purchased on or after Jan. 1, 2023, Tennessee conforms to the federal treatment of bonus depreciation. For assets purchased on or before Dec. 31, 2022, Tennessee does not conform to the federal treatment of bonus depreciation and requires taxpayers to add back bonus depreciation taken at federal level in computing Tennessee taxable income. Tenn. Code Ann. § 67-4-2006(a)(12), (b)(1)(H), as amended by 2023 Tenn. H.B. 323, effective May 11, 2023; CITN TN 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Tennessee Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Texas

State website

Conformity status

Does not conform

Description

Corporate: No, Texas does not conform to the federal treatment of bonus depreciation. Current federal bonus depreciation rules are not part of the Internal Revenue Code in effect on Jan. 1, 2007. Tex. Tax Code Ann. § 171.0001(9); Tex. Tax Code Ann. § 171.1012(c)(6); Tex. Tax Code Ann. § 171.1012(h); CITN TX 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Texas Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Utah

State website

Conformity status

Conforms

Description

Corporate: Utah conforms to the federal treatment of bonus depreciation, including amendments made by the 2017 tax act. Utah Code Ann. § 59-7-101(22); Utah Admin. Code § R865-6F-14(2); CITN UT 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Utah Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Vermont

State website

Conformity status

Does not conform

Description

Corporate: Vermont disallows a deduction for bonus depreciation. Vt. Stat. Ann. tit. 32, § 5811(18); Vermont Dept. of Taxes, Tax Cuts and Jobs Act (TCJA) Conformity; CITN VT 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Vermont Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Virginia

State website

Conformity status

Does not conform

Description

Corporate: Virginia does not conform to the federal treatment of bonus depreciation under I.R.C. § 168(k) and requires an addition to federal taxable income for any bonus depreciation taken at the federal level. Va. Code Ann. § 58.1-301(B)(1), as amended by 2023 Va. S.B. 882, effective Feb. 27, 2023, and 2023 Va. H.B. 2193, effective for taxable years beginning on or after Jan. 1, 2023; CITN VA 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022, under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Virginia Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Washington

State website

Conformity status

Washington does not impose a corporate income tax.

Description

Corporate: Washington does not impose a corporate income tax.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Washington Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

West Virginia

State website

Conformity status

Conforms

Description

Corporate: West Virginia conforms to the federal treatment of bonus depreciation. W. Va. Code § 11-24-2; W. Va. Code § 11-24-3(a), as amended by 2024 W. Va. S.B. 483, effective Jan. 29, 2024; W. Va. Code § 11-24-3a; W. Va. Code § 11-24-6; CITN WV 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

West Virginia Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Wisconsin

State website

Conformity status

Does not conform

Description

Corporate: Wisconsin does not conform to the federal treatment of bonus depreciation. Wis. Stat. § 71.26(3)(y); Wis. Stat. § 71.01(7r)(a); Wis. Stat. § 71.98(3); Wisconsin Adoption of I.R.C. Provisions in the Federal Tax Cuts and Jobs Act (April 27, 2018); CITN WI 5.3.1.2.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Wisconsin Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]

Wyoming

State website

Conformity status

Wyoming does not impose a corporate income tax.

Description

Corporate: Wyoming does not impose a corporate income tax.

Editors’ note: The 2017 tax act (Pub. L. No. 115-97) expands the definition of qualified property and allows full expensing for property placed in service after Sept. 27, 2017, and reduces the percentage that may be expensed after Dec. 31, 2022 under I.R.C. § 168(k). The CARES Act (Pub. L. No. 116-136) includes a technical correction to treat qualified improvement property as 15-year property eligible for 100% bonus depreciation. I.R.C. § 168(k).

Wyoming Conformity Resources

REPORT

Survey of State Tax Departments

ARTICLE

Three Ways to Detangle State Conformity

TOPIC

[Download the full list of state charts to easily compare how they each conform to federal treatment of bonus depreciation.]