How FASB Improvements to Income Tax Disclosures Impact Your Rate Reconciliation Process

In December 2023, the Financial Accounting Standards Board (FASB) released an Accounting Standards Update (ASU) that dramatically impacts income tax provision reporting and disclosure requirements.

The update includes several amendments to address investor calls for more information about income taxes.

Those changes include:

- Enhanced disclosures around rate reconciliations

- Disclosure of income taxes paid

- Adding income tax expense as a disclosure

- Disaggregation of domestic and foreign income (or loss) from continuing operations before income tax expense (or benefit)

- Disaggregating by federal, state, and foreign taxes the income tax expense (or benefit) from continuing operations

- Eliminating unrecognized tax benefits (UTB) disclosure around the nature and estimate of the range of the reasonably possible change in the UTB balance in the next 12 months

- Eliminating the cumulative amount of each nonrecognized deferred tax liability

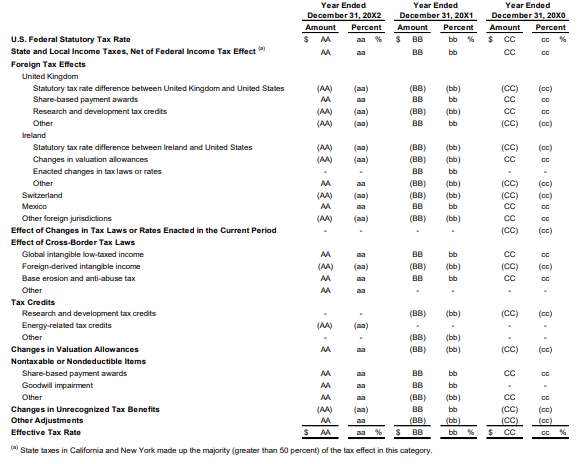

- Disclosure of states that make up the majority (greater than 50%) of state tax expense

This article will focus on the first two changes, as they require significant changes to your current process for calculating ASC 740 income tax provision and preparing disclosures.

Enhanced rate reconciliation disclosures

The FASB update requires public business entities (PBEs) to disclose percentages and amounts in their reporting currency in their rate reconciliation table for the following categories:

- State and local income tax, net of federal income tax effect. PBEs are required to provide a qualitative description of the states and local jurisdictions that make up the majority (greater than 50%) of the reconciling item for state and local taxes.

- Foreign tax effects, including any state or local taxes in foreign jurisdictions. PBEs need to separately disclose reconciling items by nature and by jurisdiction when the individual reconciling items in this category are equal to or exceed a threshold of 5% of the amount computed by multiplying the pretax income (or loss) by the applicable statutory income tax rate.

- Effect of cross-border tax laws, tax credits, and nontaxable or nondeductible items. PBEs need to separately disclose these reconciling items by nature, based on a quantitative threshold of 5%.

- Effect of changes in tax laws or rates enacted in the current period

- Changes in valuation allowances

- Changes in unrecognized tax benefits

Any other reconciling item in these categories that meets the 5% threshold has to be disaggregated by nature.

Example of FASB increased rate reconciliation transparency

The update will be applied retrospectively for all periods presented. The update included the following example reconciliation to be disclosed by a PBE. In the example, the entity is domiciled in the U.S. and presents comparative financial statements.

Income taxes paid

The ASU will require all entities to disclose the amount of income taxes paid (net of refunds received) disaggregated by federal, state, and foreign taxes on an annual basis.

All entities are also required to disclose annually income taxes paid (net of refunds received) by jurisdiction if the amount equals or exceeds a quantitative threshold of 5% of total income taxes paid (net of refunds received).

State tax disclosure

The ASU also requires entities to provide qualitative disclosures about which state and local jurisdictions make up the majority (greater than 50%) of the reconciling item for state and local income taxes.

A smarter, faster approach to income tax disclosures with Bloomberg Tax

Now is a good time to ensure you have all the right puzzle pieces on the table to provide the rate reconciliation and disaggregated income taxes paid disclosures. The changes to ASC 740 reporting and disclosure requirements are likely different from your current processes.

Download Your Guide to Proposed FASB Changes to ASC 740 for the latest developments regarding FASB’s proposed updates and how these changes will affect the tax provision process.

If you’re doing these rate reconciliations in spreadsheets, there will be a lot of work involved in updating formulas, recalculating existing or older provisions for the retrospective presentation, and determining which jurisdictions are greater than or equal to the 5% threshold.

The cumbersome part of calculating your ASC 740 income tax provision will be making spreadsheets handle layers of calculations that they weren’t designed to do.

On the other hand, when you use a provision software solution like Bloomberg Tax Provision, the information is already there, and your chances of a seamless transition are much higher. You already have the mechanics in place, and the software can deliver the reports you need to prepare the required disclosures.

Request a demo to learn how to save time and ensure accuracy with Bloomberg Tax’s powerful tax provision software.