Explore Bloomberg Tax Research

[Save time and money with our research platform.]

Bloomberg Tax is designed to get you to the right answers faster and more efficiently. Our intuitive tax research platform provides expert insights, practice tools, primary sources, news, and analysis across federal, state, and international jurisdictions.

While not an exhaustive list of product features, this article highlights several of the most valued ones, which are built to help you save time and money, minimize tax compliance mistakes and audit risks, and make well-informed decisions for your business or clients.

Expert insights you can trust

For more than six decades, Bloomberg Tax has established a formidable network of 1,000+ tax experts who track tax developments daily and translate that information into plain language for subscribers. Our experts analyze broad to niche tax topics across state, federal, and international jurisdictions, giving you accurate, up-to-date information needed to strategize and plan for the future.

Tax Management Portfolios

Bloomberg Tax Management Portfolios – one of our most widely used and highly regarded features – are a series of in-depth tax and accounting guides, designed to offer a comprehensive understanding of federal tax; estates, gifts, and trusts (EGT); state tax; payroll; U.S. income tax; international tax; and more.

Popular portfolios include:

- Portfolio 519 (Travel and Transportation Expenses).

- Portfolio 780 (Net Operating Losses).

- Portfolio 531 (Depreciation: MACRS and ACRS).

Authored by leading tax practitioners around the world, Tax Management Portfolios are updated regularly to reflect the most recent tax code, making them an invaluable research resource for in-house tax professionals to write memos and tax positions, instead of outsourcing their research to a law firm. Without the need to outsource, some Bloomberg Tax subscribers report saving upwards of $100,000, allowing customers to invest those funds into other areas of their businesses.

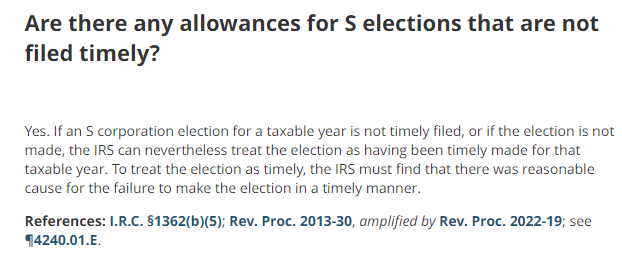

Fast Answers

While ChatGPT and Google can generate quick answers to pressing tax questions, these tools often produce inaccurate responses. Basing tax decisions on this misinformation could have dire consequences – an increased audit risk, penalties and fines, or reputational damage.

However, our Fast Answers provide short, accurate, and easily digestible responses concerning a wide range of tax areas, including tax provision, compliance reporting, business taxation, benefits, and compensation, among other topics. All Fast Answers are written by our team of experts and are updated regularly to ensure that subscribers have the most precise, up-to-the-minute information on key tax developments.

Sample Fast Answer:

OnPoint presentations

Although automated technologies offer workflow efficiency, tax professionals’ job responsibilities keep expanding – from reviewing financial statements and preparing tax returns to meeting with new or existing clients and providing administrative support. With time being a scarce commodity, OnPoints offer ready-made PowerPoint slides on key tax developments, considerations, and implications to present to team members and stakeholders.

Such topics include:

State and international tracker tools

With our tracking tools, you can receive a summary of daily developments across state and international borders. Filter by jurisdiction, topic, type of tax, and date range and then export your findings to Excel to manipulate the data. If you specialize in international tax, we also offer a BEPS tracker to trace country-by-country developments in response to the OECD’s Base Erosion and Profit Shifting (BEPS) action plan.

Practice tools to save you time

A range of timesaving tools on Bloomberg Tax Research allows subscribers to aggregate and narrow down essential, reliable tax information with a simple click of a button, instead of manually tracking down the same information from multiple sources. More than 75% of our customers stated that practice tools have provided them with time savings of 33-50%, allowing them to place their energy elsewhere to grow their businesses.

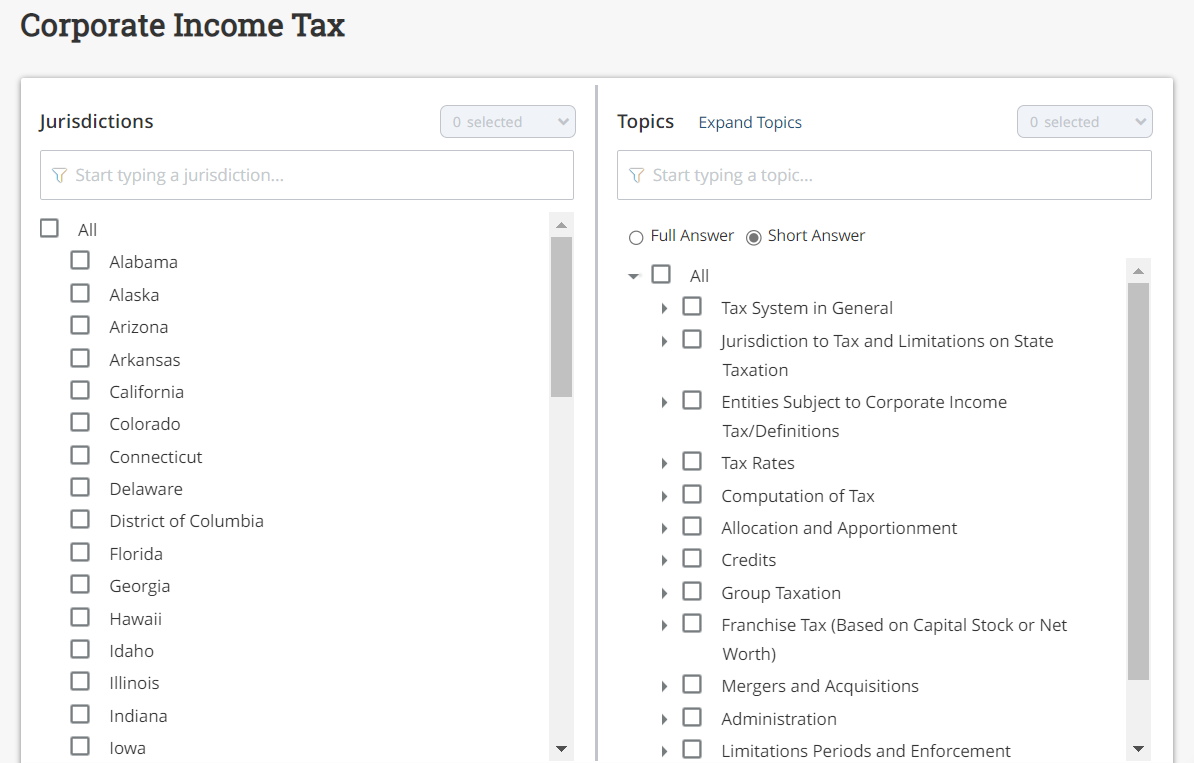

Chart builders

Authored by tax experts, chart builders offer an at-a-glance perspective on key state and international tax topics. Using primary and secondary sources, our analysts cover all 50 state tax jurisdictions, Washington, D.C., New York City, and 223 jurisdictions worldwide, offering insights on VAT, corporate income tax, sales and use tax, pass-through entities, excise tax, credits and incentives, and withholding tax.

Practice guides and checklists

Practice guides and checklists offer time-pressed tax professionals quick, accurate information on a variety of tax areas: pass-through entities, compensation, charitable giving, business transactions, and more.

Each practice guide provides a concise overview of a tax topic, key considerations, applicable code and regulations, key portfolios and other resources, and a downloadable Excel checklist. Each checklist lays out a table of questions to consider when dealing with a particular tax issue to ensure requirements are upheld.

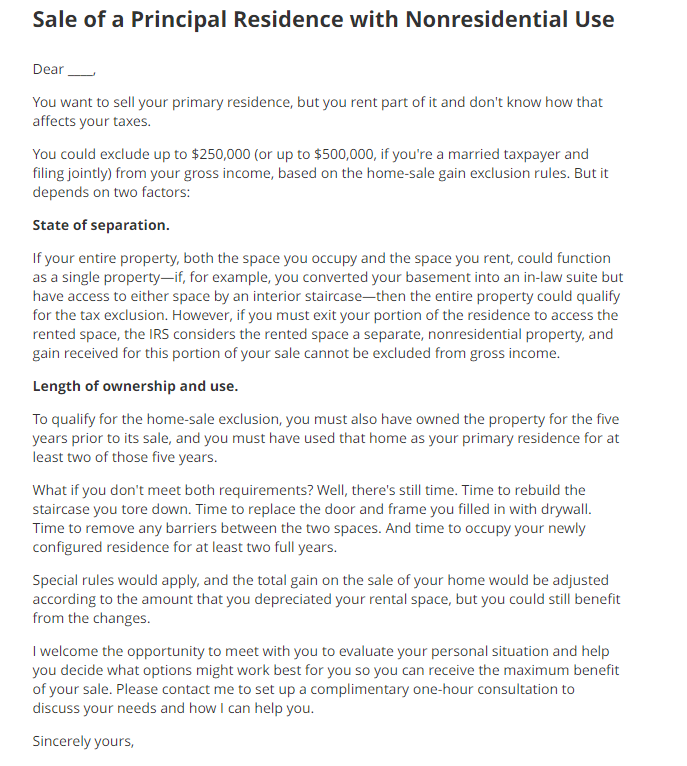

Sample documents

Crafting letters to clients or the IRS requires time, attention, and finesse to ensure communication is accurate and clear. Bloomberg Tax alleviates that pressure by offering sample forms for a variety of use cases, such as client development, engagement, and explanation. Letters can be easily adapted and tailored for a client’s individual needs.

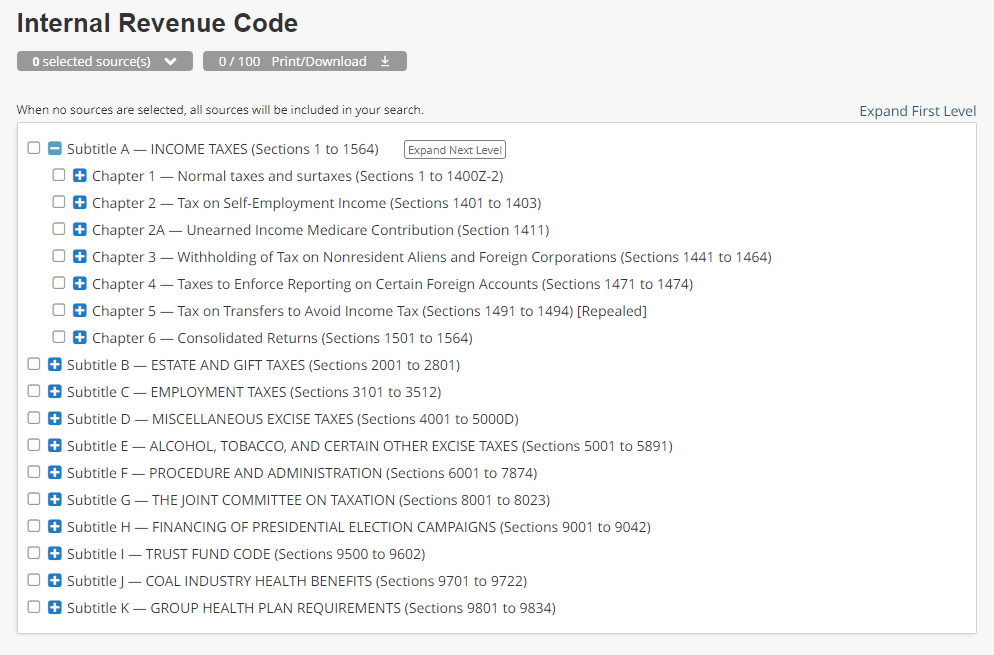

Primary sources

Building a strong tax foundation starts at the source. Bloomberg Tax offers an extensive collection of primary sources, including the Internal Revenue Code dating back to 1931 and a case law citator, BCite, which provides detailed analysis and updated information on tax cases, relevant court opinions, strength of authority, and the judicial history of a case to ensure it remains good law.

News and analysis to keep you in the know

Stay informed with concise coverage of tax news and developments with our flagship Daily Tax Report and our wide offering of specialty tax publications. Tap into our network of seasoned tax and accounting reporters for the latest news, trends, and issues shaping your field.

Daily Tax Report

Daily Tax Report offers comprehensive news coverage and analysis of federal, state, and international tax issues, ranging from M&A and corporate tax income to exempt organizations and tax legislation.

Our team of 200+ tax reporters publish articles in real-time, so that you can stay abreast of new regulatory and policy developments as they happen. To ensure you never miss a beat, you can also customize your news feed by setting up email alerts on specific tax topics or jurisdictions.

Why choose Bloomberg Tax?

Bloomberg Tax is a leading research platform for tax professionals providing expert analysis, timesaving practice tools, primary resources, and comprehensive news coverage. From our Tax Management Portfolios and chart builders to BCite and Daily Tax Report, each product feature can help you stay in compliance, and spend less time on research tasks and more time on tax strategy. Request a demo today.