Buyer’s Guide: How to Find the Right Tax Provision Software

Navigating the intricate maze of the corporate tax provision process is complicated. With tight timelines and magnified scrutiny, it’s a walk on a tightrope, where every misstep could spell inaccuracies and potential control failures. Many companies kick off their tax provision calculations in Excel. After all, it’s familiar territory. Excel spreadsheets offer flexibility, and building out the basic calculations is easy.

However, that flexibility can create risk in the form of incorrect formulas, version control issues, and other spreadsheet deficiencies. Excel also does not easily adapt to the common factors that complicate the provision process, such as adding new jurisdictions or legal entities, making last-minute changes, or incorporating tax law changes.

It’s often these factors that provoke tax departments to make major changes to their provision process, including making the switch to a new software solution. Or perhaps its new leadership or a new audit team precipitates the need for a better process.

But even in times of relative stability, certain challenges remain – and are only getting worse. Close times are shorter, reporting requirements are increasing, and accuracy remains critical.

Bloomberg Tax surveyed 600 provision professionals and found that companies of all sizes could benefit from rethinking their current process and tools.

When asked about their use of rate reconciliation comparison schedules for review and analytical purposes, only 25% indicated their provision software generates those schedules, indicating the remaining 75% either don’t prepare schedules at all or prepare them manually (likely in Excel).

Yet when we asked which parts of the provision process management cares about the most, the top two responses were:

- The rate reconciliation (31%)

- Accuracy of the process/no control issues (27%)

In other words, the two areas of the provision process management recognize as most important are the exact areas where manual processes fall short.

Consider this: just because something is important, doesn’t mean it has to be difficult and time consuming. In fact, tax provision software can be trusted to make your job easier and reduce the risks keeping you up at night.

If you’re ready to reclaim your time, confidence, and peace of mind with tax provision software, this buyer’s guide will make the process of selecting the right solution easier by:

- Demonstrating why it’s time to rethink your provision process

- Showing a step-by-step process for evaluating tax provision software

- Providing recommendations to help you build the business case

Common provision challenges

Precision, compliance, and efficiency are paramount to completing your tax provision. Any weak spots in the process can lead to expensive financial restatements, scrutiny from auditors and regulators, and reputational damage.

When asked which areas create the most challenges for the provision process, the top two responses in our survey were:

- Data gathering, transformation, and manipulation (32%)

- Tax technical complexity, i.e. applying the tax law to your data (20%)

The four most common challenges that provision professionals say can impede a smooth provision process are:

- Data challenges

- Technical complexity

- Reliance on manual processes

- Lack of flexibility and transparency

If these challenges sound familiar, it’s time to reflect on whether your current approach – be it Excel or another software solution – is truly serving your needs. Embracing a solution specifically designed around the nuances of ASC 740 and the inherent challenges of the tax provision landscape is more than just a good idea – it’s a strategic imperative.

[Ready to start your journey toward selecting and implementing a provision software solution? Download our complete buyer’s guide.]

Evaluating tax provision software: 7 questions to ask

Tax provision software is a specialized digital solution designed to handle complex tax provision calculations and comply with the most up-to-date laws and regulations.

Traditionally, many organizations relied on Excel to carry out complex ASC 740 tax provision calculations. While Excel is a great tool, it has limitations. The slightest data entry error, omission, or inconsistency can result in inaccurate calculations – or hours spent combing through complex spreadsheets to find the problem.

With the right tool, you don’t have to rely on manual methods that become error-prone and inefficient as your business scales and tax scenarios become more complicated. It meets the needs of busy tax professionals by providing a streamlined, accurate, and efficient tool to navigate the journey from tax calculation to compliance.

First, identify your tax provision pain points. Before diving into software evaluations, list your key needs and challenges. What issues do you frequently encounter? What features are absolute must-haves for your organization?

Ask these questions of the software you’re considering

- How does it handle the rate reconciliation?

- How does it support internal controls?

- Does it provide audit-ready support?

- Is it flexible enough to fit your evolving needs?

- Does it offer an intuitive user interface?

- How easily can you roll forward from one period to the next?

- How quickly can you implement it?

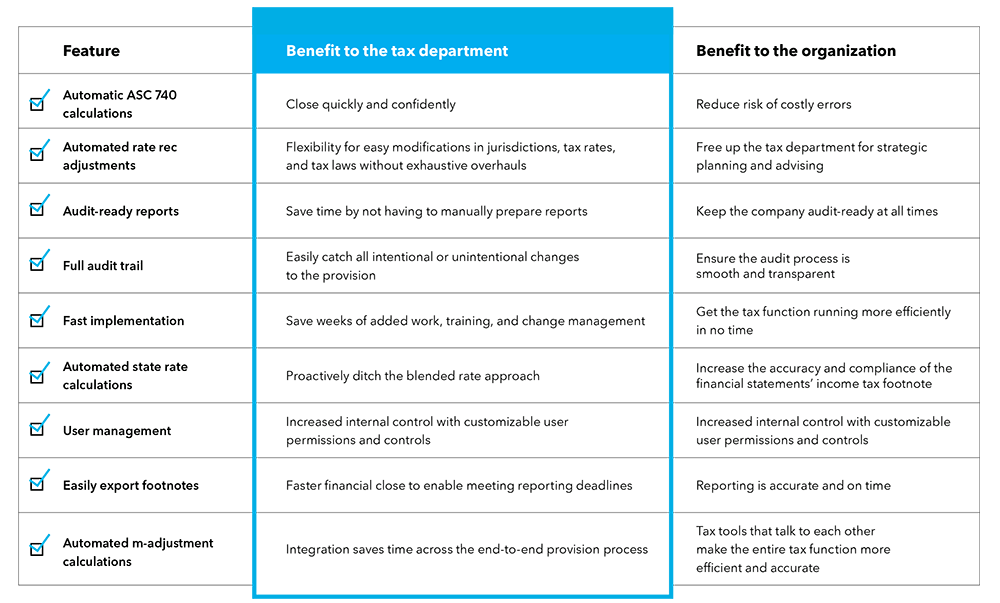

9 must-have features in your provision solution

Build the business case for tax provision software

Once you’ve identified the right solution, you’ll likely have to make the case to your tax department leadership or the C-suite. Build a strong business case for why your organization needs to invest in the tax provision solution by being honest about your pain points and the potential costs of inaction.

In most organizations, the tax provision is the only element of the financial statement that hasn’t seen significant investment. However, continuous changes to the tax laws and regulations affecting your provision indicate that this is an area of external focus – and should be a focus for your organization.

The following checklist can help you create a business case for finally modernizing and automating the provision process.

- Identify and quantify the challenges of current methods.

- Acknowledge the risks of key-person dependency and emphasize the need for a repeatable, automated process that doesn’t rely on a single point of institutional knowledge.

- Highlight the hours spent on manual data entry and verification.

- Put a tangible figure on the cost of these hours – not just in salaries but in the opportunity cost of tasks your team could tackle if freed from laborious spreadsheet management.

- Combine these arguments with the potential financial penalties or reputational damage from incorrect filings, and you present a clear financial and operational case for the shift.

- Address scalability concerns. As the company grows or enters new markets, Excel’s limitations become even more pronounced. Contrast this with the automated, standardized processes in tax provision software, which can seamlessly adapt to more complex tax scenarios.

- Stress the importance of compliance and auditability. Dedicated software provides a built-in audit trail and automatically delivers audit-ready reports.

Making the case for the company to invest in new technology can be an unfamiliar (and often daunting) exercise for the tax department. Set yourself up for success with our complete Buyer’s Guide to Tax Provision Software.

Elevate your ASC 740 process with Bloomberg Tax Provision

Switching to tax provision software understandably gives some companies cold feet, especially since there are a lot of solutions on the market that overpromise and underdeliver. However, Bloomberg Tax Provision isn’t just another software – it’s the tool that automates complex calculations for accurate provisions that always tie out.

What sets Bloomberg Tax Provision apart?

- Precision and peace of mind. Leverage a complete ASC 740 solution, providing strong review and audit support with Excel reports that include formulas – something our competitors don’t do. It’s intuitive and robust, and the rate rec always ties.

- Built by experts, for experts. Who better to craft a tax solution than seasoned tax professionals? Our software echoes their insight and experience.

- Evolving as you grow. Whether you have existing reporting needs or are facing new calculations due to business changes or expansions, Bloomberg Tax’s software has you covered.

- Swift and smooth integration. Bid farewell to the steep learning curves. Embrace a solution that’s extremely fast to implement, learn and use.

Request a demo to see how Bloomberg Tax Provision software automates calculations across the entire tax provision lifecycle and applies adjustments so they’re guaranteed to tie out – all within a clean design that feels intuitive to use.