Bloomberg Tax Research

BNA Picks

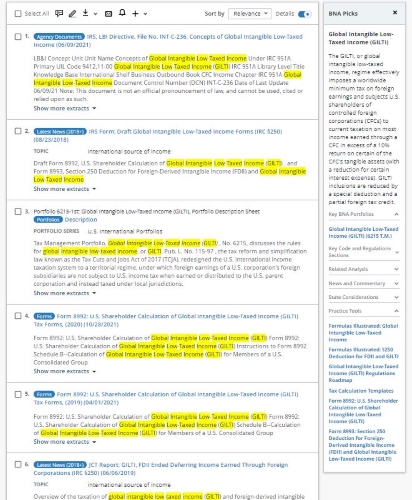

Start your research with BNA Picks and go directly to the related source materials and practice tools quickly and efficiently. Use our navigational tool to access curated recommendations covering critical federal, state, and international tax topics.

BNA Picks offer easier, faster access to the information you need with enhanced functionality and navigational tools covering critical federal, state, and international tax topics in all 50 states and nearly 160 countries.

The BNA Picks frame displays with the search results list and provides a shortcut to related Tax Management Portfolio™ analysis, practice tools, Internal Revenue Code sections, regulations, Fast Answers™, news, and more.

Practice tools from seasoned practitioners

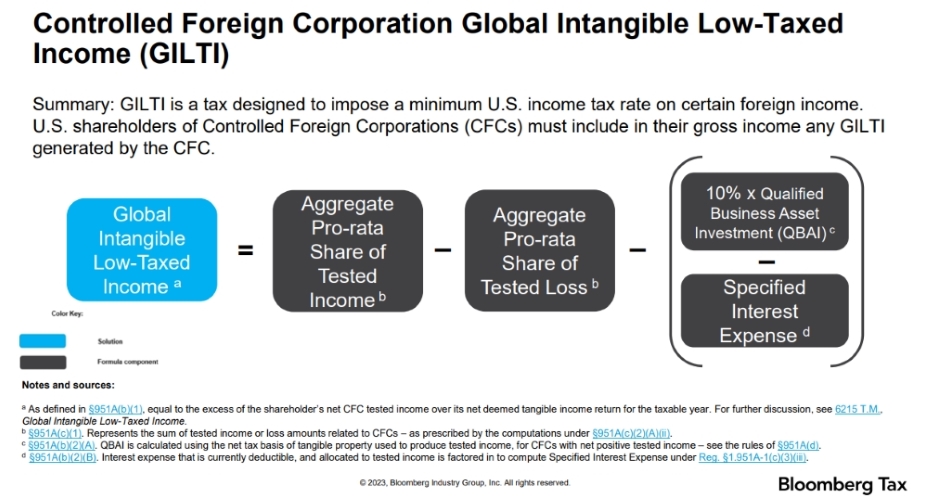

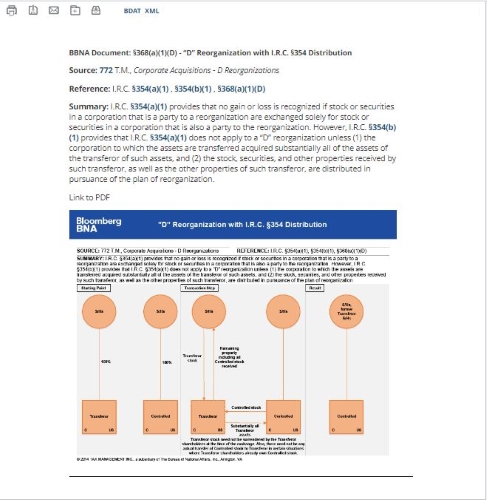

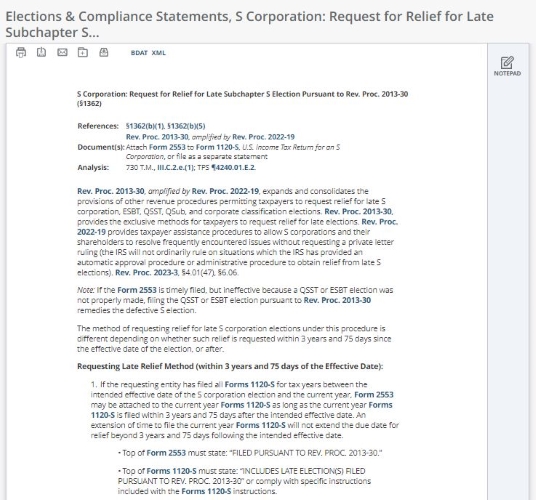

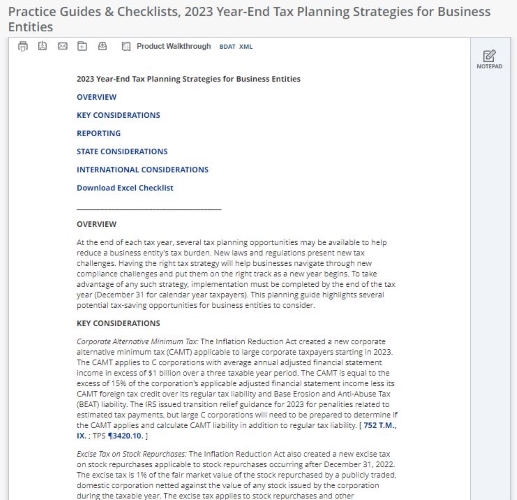

Increase efficiency by using proven, exclusive timesaving practice aids, including Formulas Illustrated, Transactional Diagrams, and Elections & Compliance Statements.

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and we’ll be in touch to schedule a demo so you can see how our solutions transform your work and meet your unique needs.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.