How to Calculate Meals and Entertainment Expense Deductions

Certain business meals expenses paid or incurred in 2018 and later can be deducted – some at 50% and others at 100%. Entertainment expenses, unless included in employee compensation, are generally not deductible.

These business meal and entertainment deduction rules are provisions of the Tax Cuts and Jobs Act (TCJA) that is set to expire Dec. 31, 2025. When the TCJA was passed in 2017 as reconciliation legislation, many provisions were made temporary to keep costs down and comply with the Byrd Rule, which prohibits reconciliation bills from raising the federal deficit beyond a 10-year budget window or making changes to Social Security.

Bloomberg Tax provides tax professionals with all the latest news, analysis, and other resources they need to stay up to date as Congress considers whether to allow the TCJA changes to expire, extend them into 2026 or beyond, or enact other tax law changes.

[Download our exclusive roadmap for a full overview of the 2025 TCJA Expiring or Changing Provisions.]

Why is the meals and entertainment deduction a challenge to calculate?

Recent changes to the meals and entertainment expense deduction present additional challenges when computing the M-1 adjustment. For one, you may have to interrupt your workflow to research the latest rule to determine what’s deductible and what’s not. Secondly, if you use only Excel for your calculations, there are added risks caused by manual data input. And finally, manual data input can also be time consuming when updating year over year or for last-minute changes.

With Bloomberg Tax Workpapers, much of that work is done for you. You don’t have to leave your spreadsheet to research meals and entertainment deductions. With our embedded AI-powered Q&A feature, you can ask questions in plain English and get responses based on the trusted, expert-vetted content from Bloomberg Tax Research.

Additionally, you can automate the data flow from your general ledger or trial balance with a single click – and maintain that data as your single source of truth for all other tax calculations.

How do you calculate the meals and entertainment deduction?

The meals and entertainment calculation is straightforward. You take the amount you’ve recorded to your general ledger or trial balance, and if it’s 100% nondeductible, you add it back for tax purposes. If it’s 50% nondeductible, you take 50% and you add that back for tax purposes. If it’s 100% deductible, then no addback is required.

Many tax professionals use Excel for these tax calculations, but there’s a better way with Bloomberg Tax Workpapers.

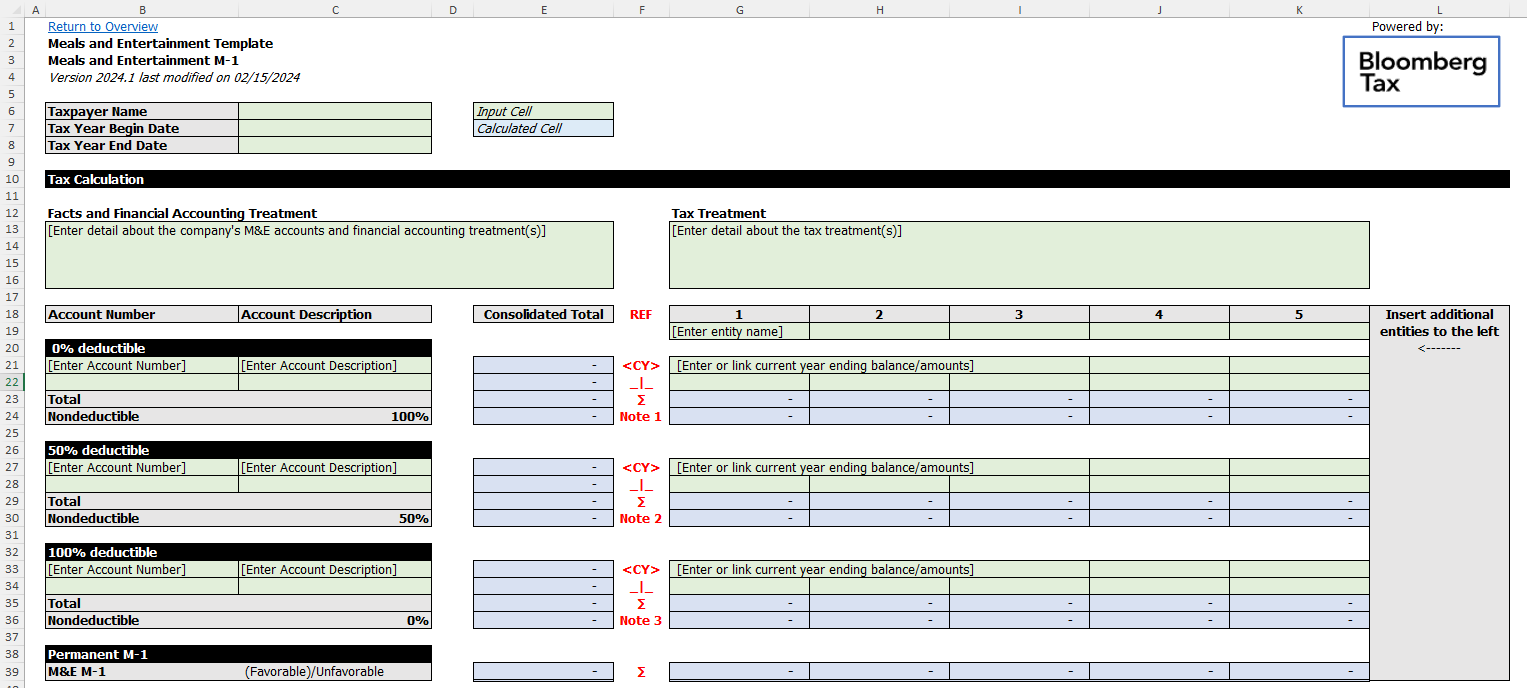

You can use the premade template designed specifically for the meals and entertainment M-1 adjustment. The Excel-friendly template includes several features, including:

- A standardized calculation supporting multiple entities and accounts

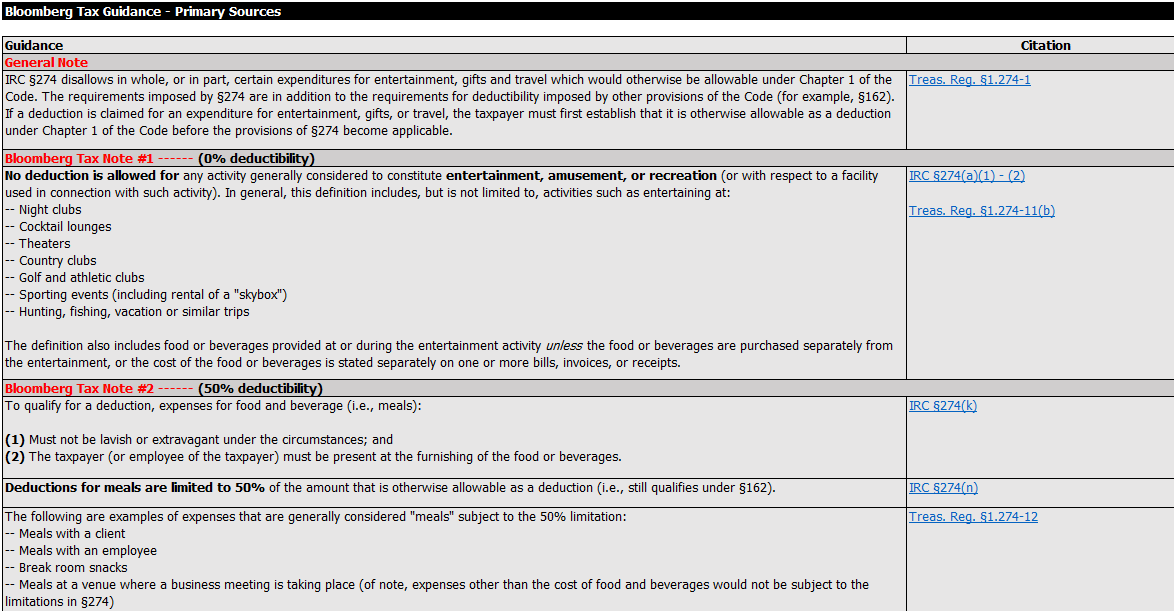

- Tax guidance on deductibility

- Space to document your facts and circumstances

The built-in tax guidance on deductibility offers a chart view of the different categories of meals and entertainment expenses to help you determine what portion of the amounts you’ve recorded in your financials becomes an adjustment.

Having all of this tax research contained within the template will help streamline the research and calculation processes for users. Links and citations are included so users can quickly access primary and secondary sources for additional research or verification.

Then, the standardized calculation built into the template allows you to immediately start entering your account details.

How can automation help me calculate the meals and entertainment deduction?

One portion of preparing the M-1 is doing the calculation itself and putting it into a spreadsheet format. This can be done manually by inputting the GL account balances into an Excel spreadsheet and linking it to the trial balance. However, this manual data input is time consuming, introduces the potential for error, and needs to be updated line by line each year.

With Bloomberg Tax Workpapers, the data transformation engine can save time and ensure you’re using the same data for all your calculations.

See how to calculate meals and entertainment deductions with an easy-to-use template from Bloomberg Tax Workpapers (2:16).

Expedite your workpapers process with automated data transformation and easy-to-use templates

Preparing workpapers in Excel leaves you decoding calculations, manually gathering data, and worried you’re not in line with the latest tax laws. Request a demo of Bloomberg Tax Workpapers to see how it combines the flexibility of spreadsheets with automatic data transformation and time-saving tax-specific functions, all in one solution.