Corporate Tax Analyzer

Remove the risk and chaos from corporate tax management

With Bloomberg Tax’s Corporate Tax Analyzer, you gain the utmost precision, control, and visibility over every aspect of corporate income tax management – giving you newfound confidence and peace of mind.

Increase accuracy and efficiency

Automated calculations, analysis, tax law updates, and reporting removes manual risk and gives you the certainty that spreadsheets never could.

Have more control and visibility

We centralize and automate tax management and planning work in an easy-to-use system so you can view everything you need in one place.

Make a clear impact on the bottom line

Develop strategies that create better business outcomes with software designed to help you identify tax-savings opportunities, plan for tax law changes, and make more informed decisions.

The tools to manage uncertain tax positions

Our corporate tax planning software has time-saving automation tools to analyze the impact of uncertain tax positions so you can plan efficiently and comply with confidence.

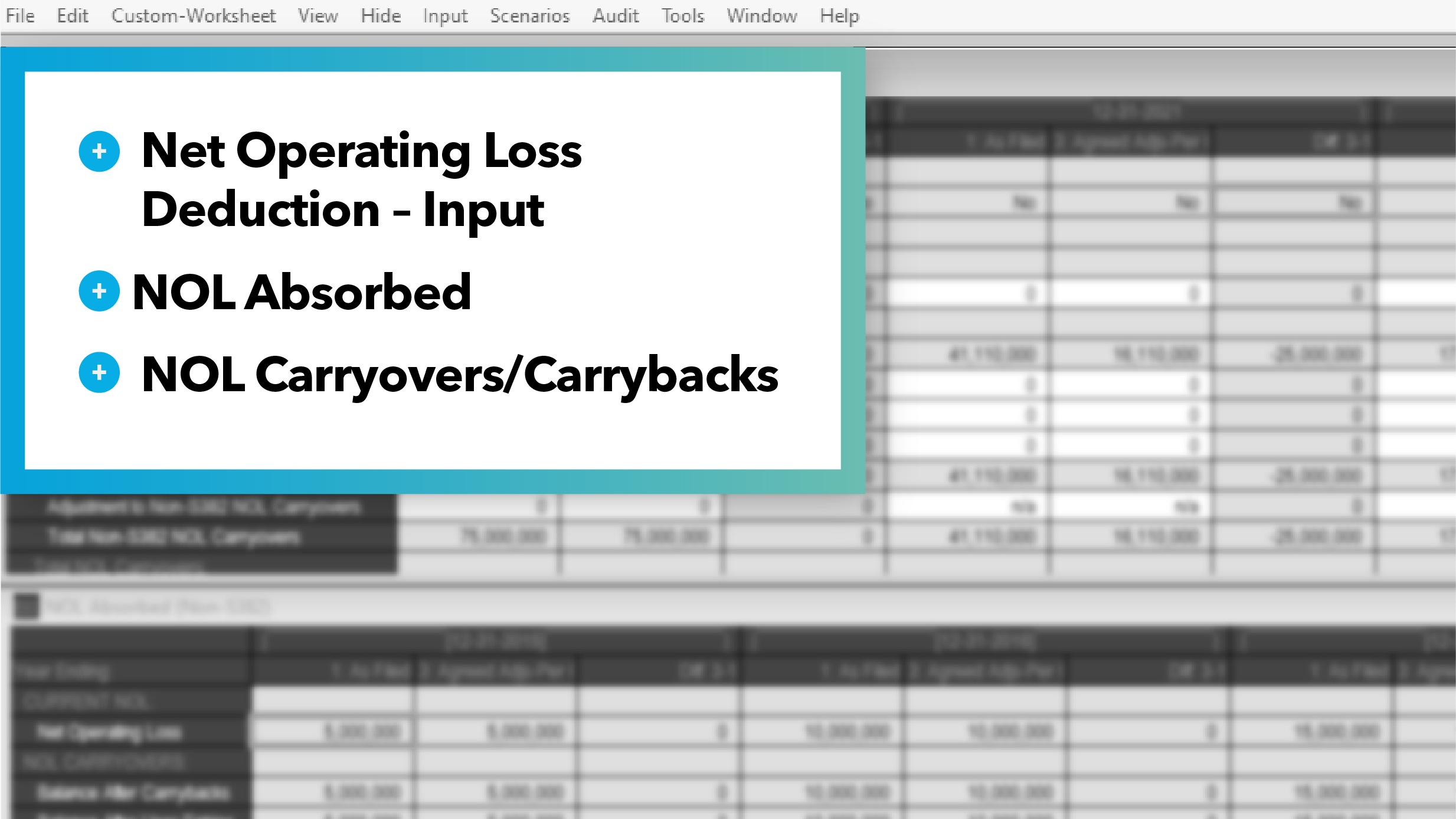

Multiyear calculation automation

No other software automates and manages complex federal corporate income tax attributes over multiple years: NOLs, FTCs, AMT, GBCs, charitable contributions, and more.

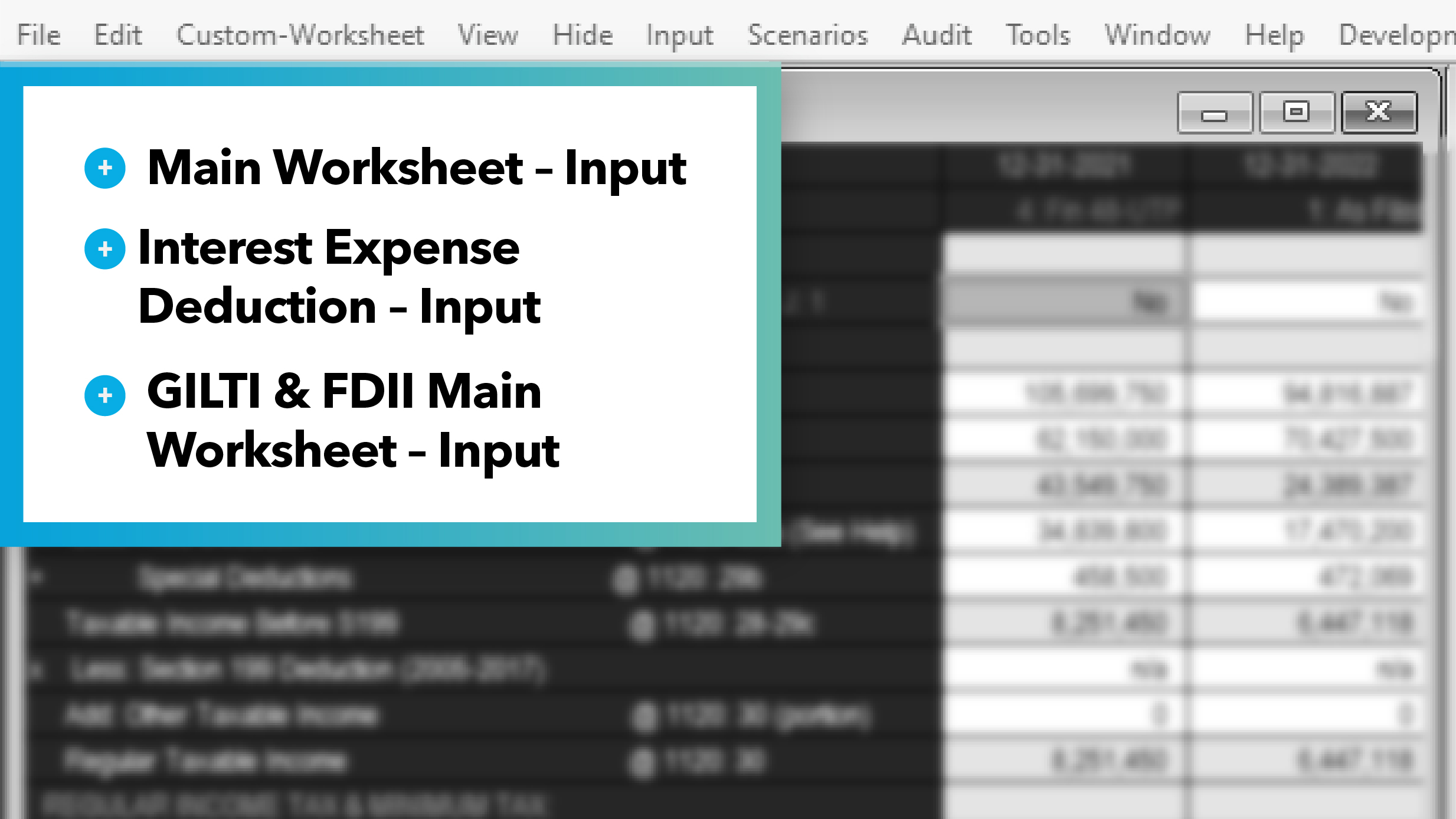

Side-by-side scenarios

Save time using multiple side-by-side scenarios to analyze the impact of tax law changes, uncertain tax positions, and implications of business decisions such as mergers, acquisitions, spin-offs, and sales entities.

Fast and accurate NOL calculations

Automatically calculate NOL carryback and carryforward to easily compare the impact of each, so you can better navigate an audit.

Precise 1120 returns

Corporate Tax Analyzer ensures your current and previous form 1120 returns are correct and optimized, using an independent and reliable source of calculations to identify errors.

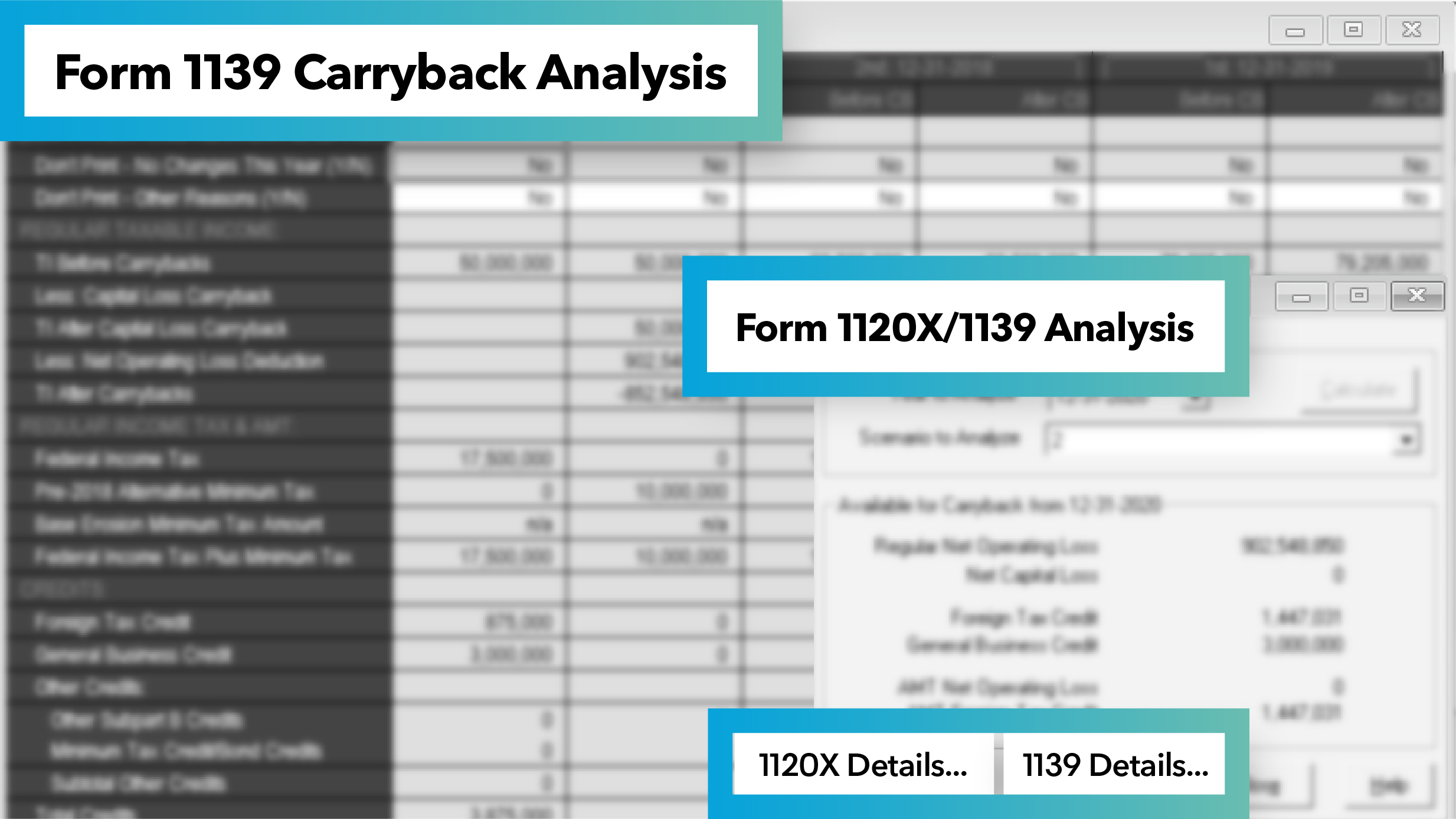

Model 1139 and 1120X claims

Model multiple scenarios to quickly calculate the impact of carrying back versus electing out and carrying forward NOLs for filing 1139 claims – giving you critical insights to navigate an audit.

Request a demo

Bloomberg Tax simplifies the entire tax process with intelligence and technology that accelerates tedious work, minimizes risk, and puts you in the best tax position possible.

Complete the form, and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into the tools.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.